Zype is a new platform that provides personal loan facility to the needy. Loans are available from Zype at interest rate of 18% to 39% per annum. For best service, the loan application process here is 100% paperless and online. For complete information related to Zype Personal Loan, read the blog till the end.

Benefits of Zype Personal Loan

Zype Personal Loan offers a range of benefits, including quick online application with minimal documentation, competitive interest rates, and flexible repayment options. Enjoy fast disbursal of funds directly to your bank account and a secure, reliable borrowing experience backed by compliance with RBI regulations for financial safety and transparency.

| Loan Amount | Credit line up to ₹5 lakhs |

| Tenure | 3 months to 12 months |

| Interest Rates | 18% to 39% |

| Application Process | No paperwork Fast & easy process |

Other Benefits

- Multiple loans

- Instant processing & disbursal

- Rewarding payments

- No document uploads

- Seamless experience

- Check your credit score for free Instant loan approval

- Make utility bill payments

- Track money effortlessly

- Flexible EMIs

- Low processing fee

Eligibility Criteria Salaried

- Age Group: 18 – 55 years

- Income Range: ₹15,000+

Documents Required:

- Identity proof: Any one of the documents – PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Salary certificate, Recent salary slip, Employment letter

You must be a resident of India

How to Apply For Personal Loan On Zype App

Application Process : Please keep the following documents and details handy to start the process:

- Your Aadhaar card and

- PAN card So, let’s start!

- Visit the Zype Personal Loan website by clicking on the link shared by your advisor and start the application journey.

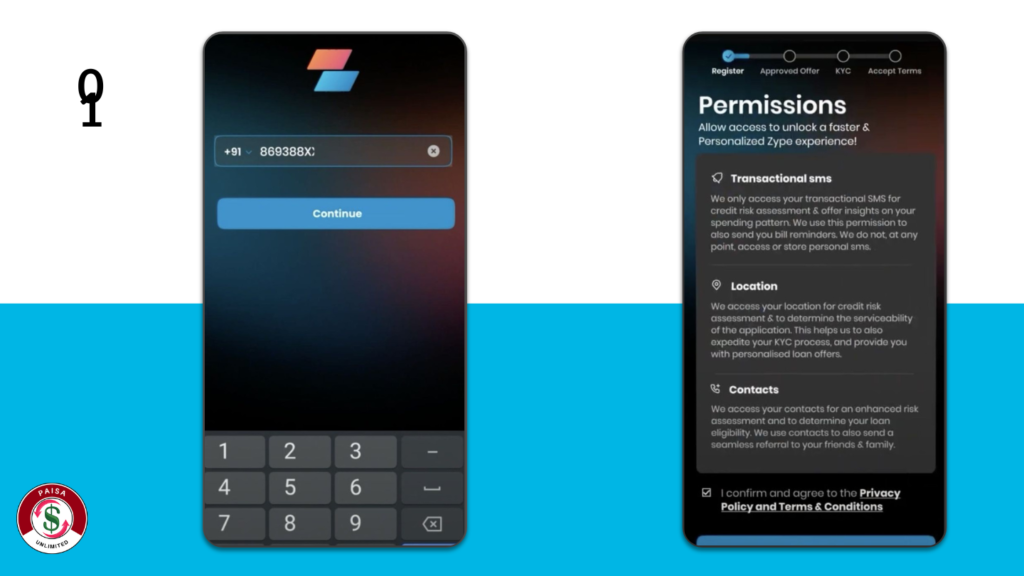

01: Follow the steps

- Enter your phone number and click on ‘Continue’

- Enter the OTP sent to your mobile number and verify (image -1)

- Allow all mandatory permissions (image-2)

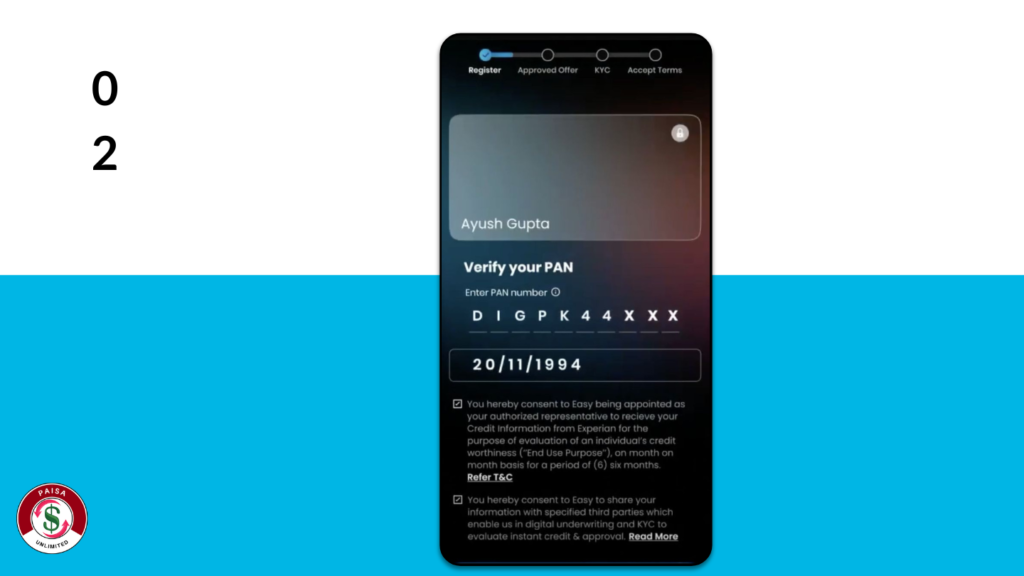

02: Enter your personal details such as full name, PAN number, date of birth, email and proceed

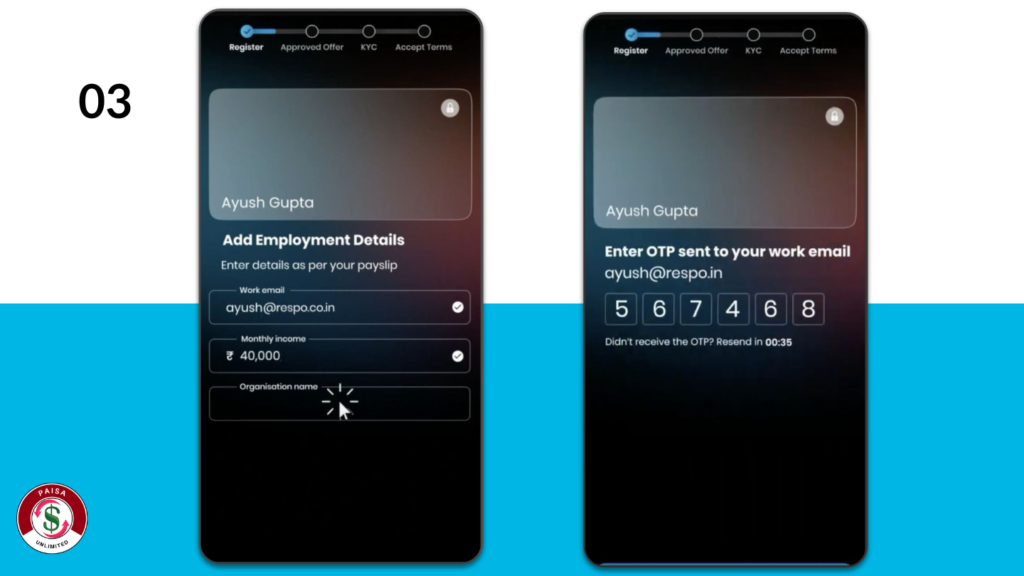

03: Enter your work details such as employment type, office email, monthly salary and organisation name (image 1)

Enter the OTP sent to your work email and verify (image 2)

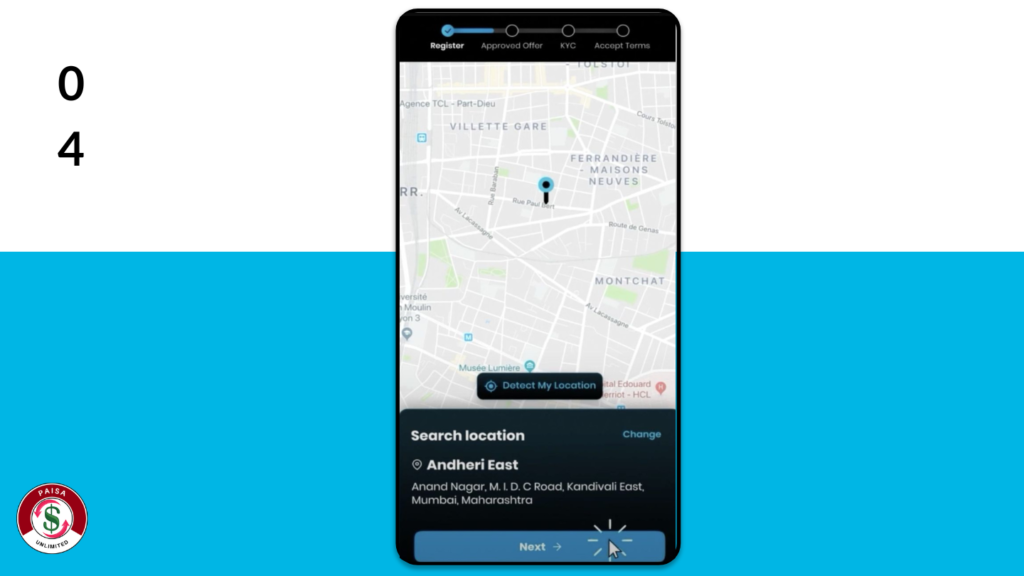

04: Add your full address and click on ‘Save and Confirm’

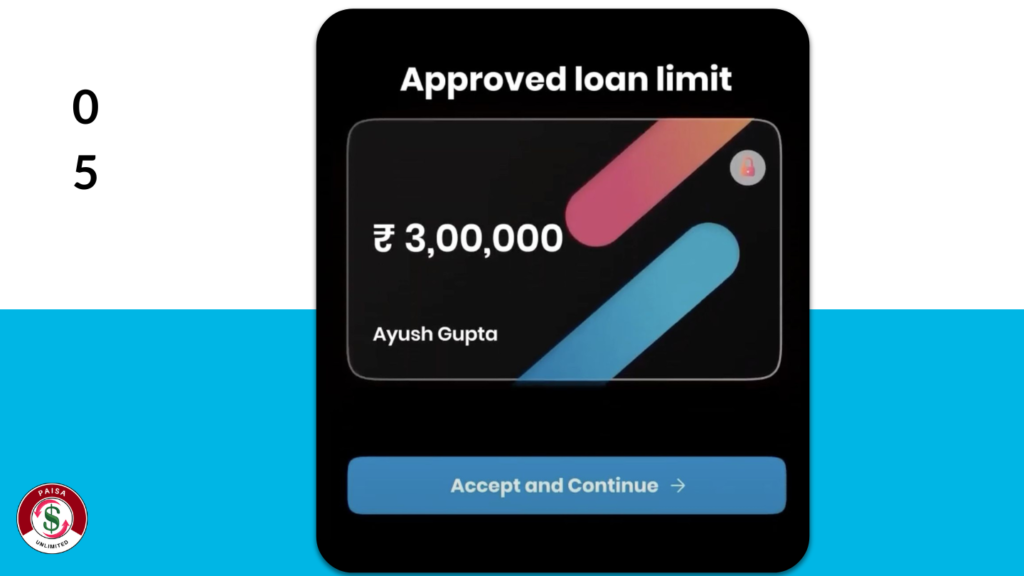

05: A personalized credit offer is generated after evaluating your profile, click on ‘Accept & Continue’

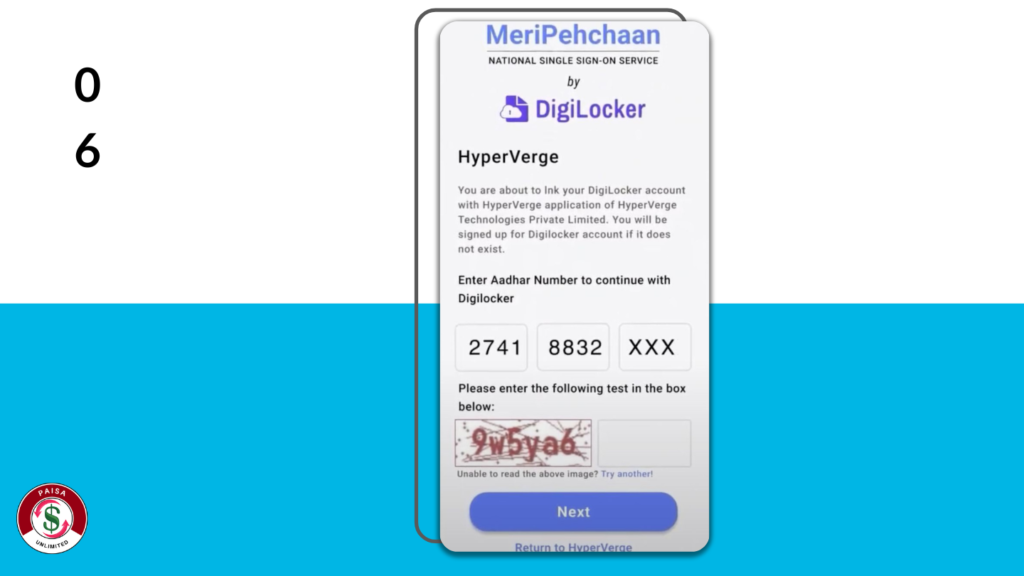

06: Next Step

- To activate your Zype credit line, enter your Aadhaar number, security code and click on ‘Next’

- Enter the OTP sent to your

- Aadhaar linked mobile number and click ‘Continue’

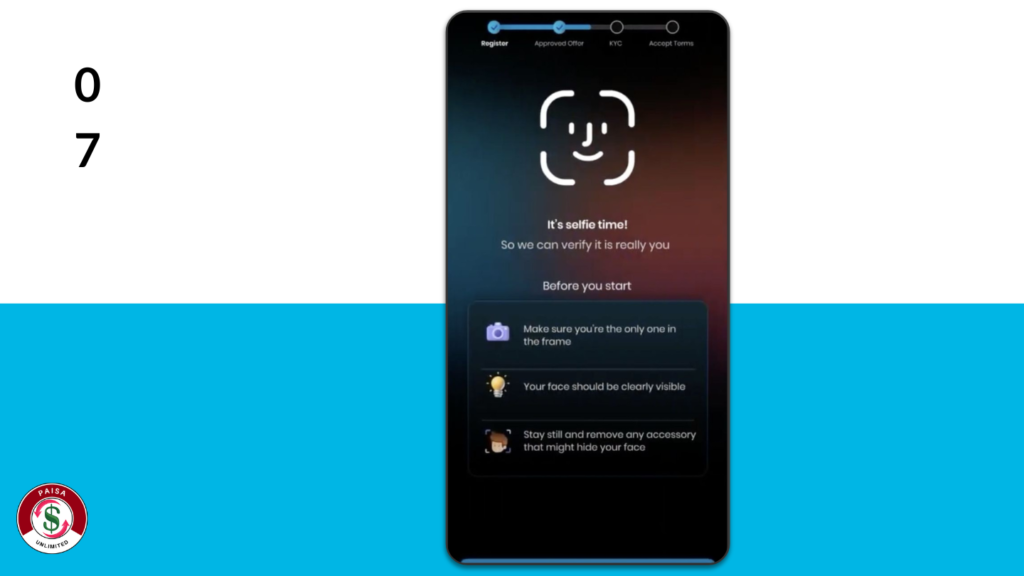

07: Once your Aadhaar is verified, take a selfie to complete your KYC and confirm your identity

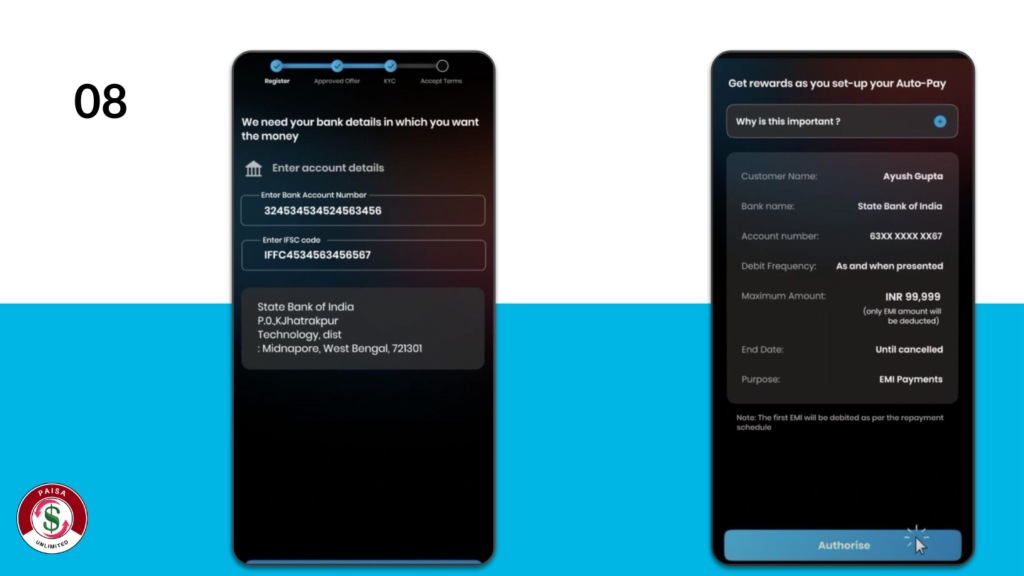

08: Add your bank account details and confirm (image 1) And Set up autopay (image 2)

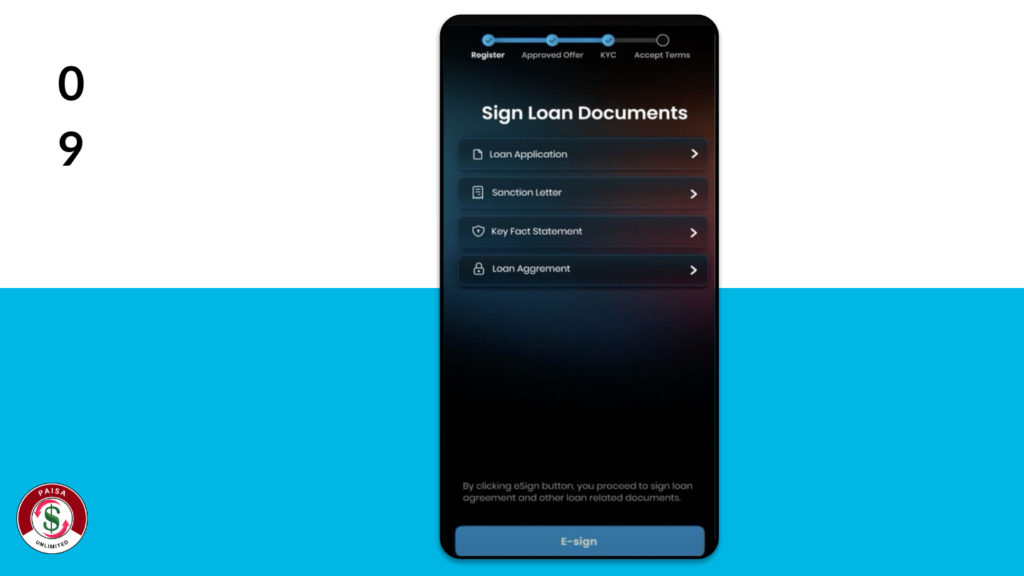

09: Sign the loan documents & Now you are ready to use Zype credit line

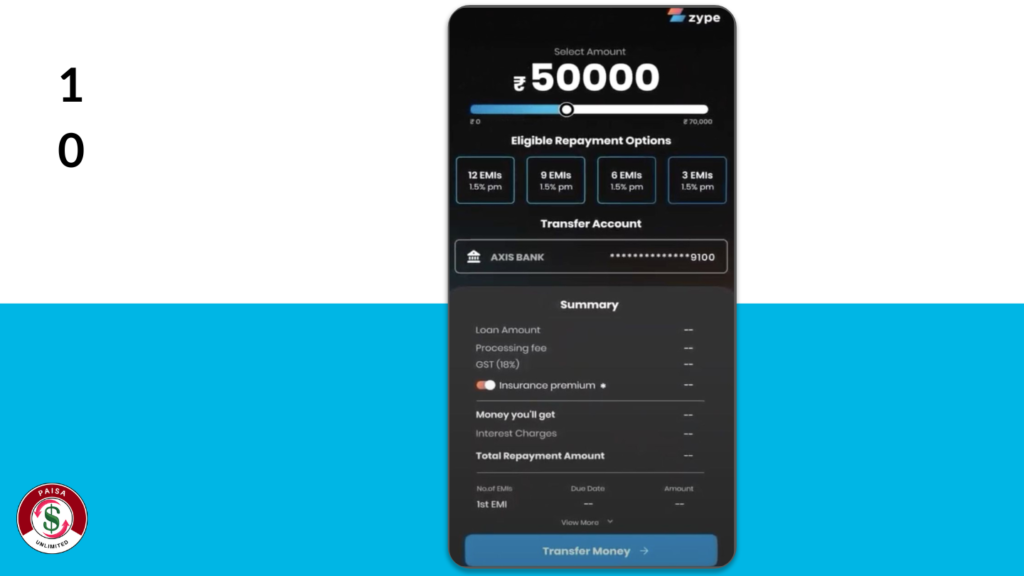

10: To transfer money from Zype Credit Line to your bank account, select your loan amount, EMI plan & click on ‘Transfer Money’

The money will be transferred to your account instantly

Zype Loan Application Overview 2024

| Apply Link | Apply Here |

| Zype Loan App Helpline Number | 08035018179 |

| Email Support | connect@zype.co.in |

| Official Website | Visit |

Related Posts –

- How to Apply For Loan On Prefr App in 2024

- mPokket Instant Loan – Best Loan App For Students in 2024

- Low Interest Rate Personal Loan in India 204 – Kissht Personal Loan

- CASHe Instant Loan Application in 2024

FAQ-

How long does it take to disburse the personal loan?

After activating your credit line, you can simply transfer your desired loan amount to your bank account in less than 5 minutes.

Will Zype Personal Loan affect my credit score?

Repaying your Zype personal loan on time will help you to improve your credit score, which lets you avail higher loans at lower interest rates.

Zype Personal Loan App is RBI Approved ?

Zype loan app India follows the RBI fair practice code required for loans, making it a 100% safe personal loan experience.