Standard Chartered Bank Credit Card is a very popular credit card in the country. Which provides rewards to its customers on the basis of spending. Its joining and annual fee is only Rs 250. If you want to apply for Standard Chartered Bank Credit Card, then its step by step process is given below.

Standard Chartered Bank Credit Card

| Joining fee | ₹250 Onwards |

| Annual fee | ₹250 Onwards |

Benefits of Standard Chartered Bank Credit Card

Cashbacks

- 2% Cashback on all online spends & Flat 1% Cashback on all other spends

- 5% Cashback on fuel, phone bills & utility bills

- 5% Cashback at supermarkets & duty free spends

Rewards

- 5x Reward points for every INR 150 spent at fine-dining outlets, spent on fuel

- 1x Reward points for every INR 150 spent on other categories

Travel

- 20% instant discount on hotel bookings with EaseMyTrip variant

- 10% discount on flight tickets with EaseMy Trip variant

- Free lounge access for 1 domestic per calendar quarter & 2 international per year

Others

- 20% off at Myntra with no minimum spends

- 10% off at Grofers with no minimum spends

- 10% off at Zomato with no minimum spends

Eligibility Criteria Salaried

- Age Group: 21 to 65 years

- Income Range: ₹20,000+

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

You must be a resident of India Credit Score should be 730+

Application Process For Standard Chartered Bank Credit Card

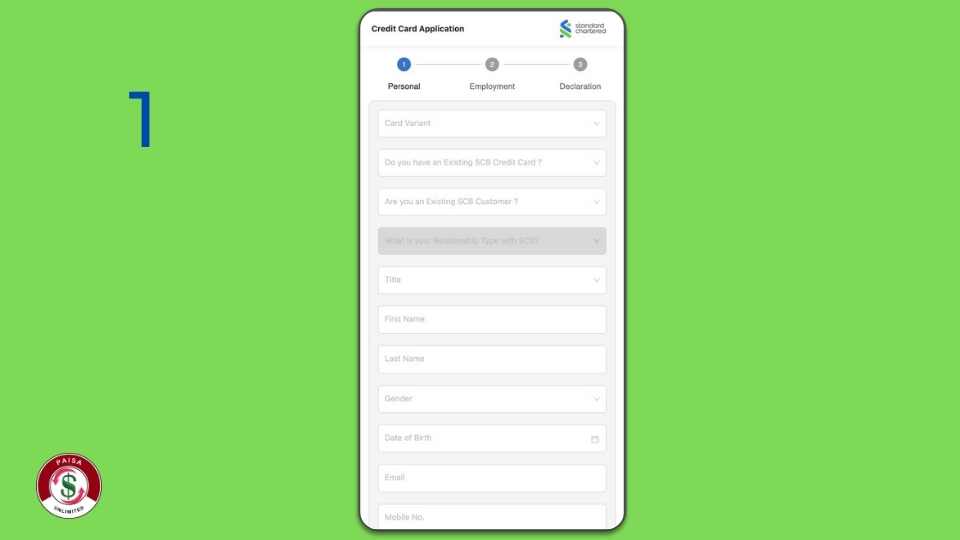

Visit the Standard Chartered Bank Credit Card web page by clicking on the link and start the application journey

01: Enter your personal details

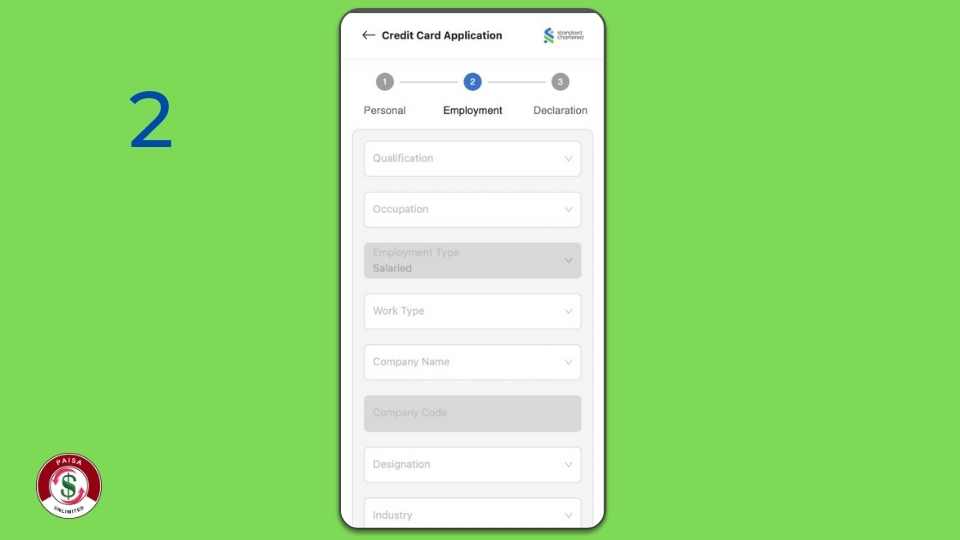

02: Complete the application form by submitting your employment details

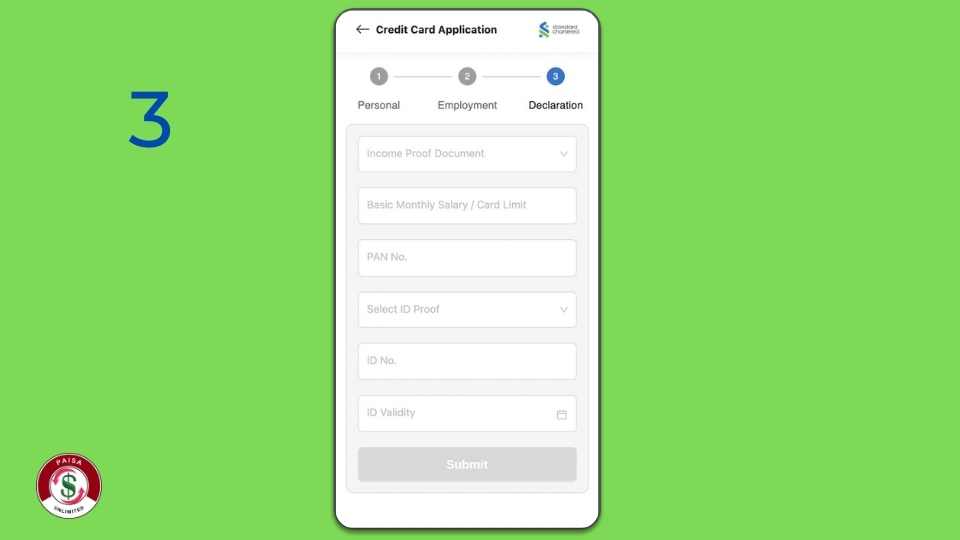

03: Check all the information you have provided before submitting the application

Note –

- After submitting the form, you will receive an instant AIP response (approval or rejection) for card application

- If the application is approved, the Bank executive will contact in next 48 hours for verification and completion of KYC (and collection of documents wherever required)

- On completion of the due process, the Bank will take a final decision on card approval

- If approved, you will get the credit card within 7 to 15 days of final decision

Standard Chartered Bank Credit Card Overview

| Apply Link | Apply Here |

| Standard Chartered Bank Credit Card Helpline Number | 011-66011500 / 011-39401500 |

| Email Support | customer.care@sc.com |

| Official Website | Visit |

Important Terms & Conditions

- Benefits, Rewards & Offers may differ as per the card type/variant

- Credit limit varies as per your credit score

- (Please note: The ‘Manhattan’ Credit Card variant has been discontinued)

Conclusion :

Applying for a Standard Chartered Bank credit card in 2024 is a straightforward process that offers convenience and flexibility to potential cardholders. The application can be completed online through the bank’s website or mobile app, making it accessible from anywhere at any time. Applicants need to provide essential documents such as identity proof, address proof, and income proof.

Standard Chartered Bank provides a variety of credit cards tailored to different needs, including cashback, rewards, and travel benefits. The bank offers competitive interest rates and flexible repayment options, enhancing its appeal among consumers.

With quick approval and seamless customer service, Standard Chartered Bank ensures a reliable and efficient application experience. Overall, obtaining a Standard Chartered credit card in 2024 provides cardholders with valuable financial tools and benefits to manage their expenses effectively.

Related Posts –

- Bajaj Finserv RBL Bank SuperCard Application Process 2024

- Get AU Small Finance Bank Credit Card In 2024

- CASHe Instant Loan Application in 2024

FAQ-

What are different types of Credit Cards offered by Standard Chartered in India?

Standard Chartered Bank Credit Cards are offered in 4 different variants- Smart Credit Card, Digismart Credit Card, EaseMyTrip Credit Card and Platinum Rewards Credit Card. Each of them provide benefits focused on one or more credit card categories which include cashback, fuel, travel, shopping and lifestyle.

How can I check my credit limit on Standard Chartered Credit Card?

You can check the credit limit via Online Banking:

Step 1: Log in to Online Banking.

Step 2: From the left-hand side menu, click on “Cards” and select “Card Summary”

Step 3: Select “Card Details” to view the credit limit under the “Available Credit Limit”

How do I know my billing cycle of Standard Chartered Credit Card?

Your Standard Chartered Credit Card billing cycle is mentioned on your credit card statement. The bill for a particular cycle will be generated on the last day of the specified billing cycle and shared with you via SMS and email.