SmartCoin Personal Loan is one such loan platform. Where the needy are given loans with 20-36% annual interest rate. If you fulfill all the required criteria then your loan is approved immediately. Complete information related to SmartCoin Personal Loan will be given to you in detail in this blog. So read the blog till the end.

Benefits of SmartCoin Personal Loan

| Loan Amount | From ₹4000 to ₹1 lakh |

| Tenure | 2 to 9 months |

| Application Process | 100% digital process & Minimum paperwork |

| Disbursal | Quick loan disbursal |

| Interest Rates | 20% to 36% p.a. |

| Others | No collateral/ guarantee required No pre-closure charges Easy repayment options Low processing fee 100% secure process |

Eligibility Criteria Salaried

- Age Group: 24-45 years

- Income Range: ₹20,000+

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Salary certificate, Recent salary slip, Employment letter, etc.

Eligibility Criteria Self-employed

- Age Group: 24-45 years

- Income Range: You must have a regular source of income

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc.

Note : You must be an Indian resident & CIBIL score must be 650+

Application process

Download the SmartCoin Personal Loan app from the Google Play Store by clicking on the link and start the application journey.

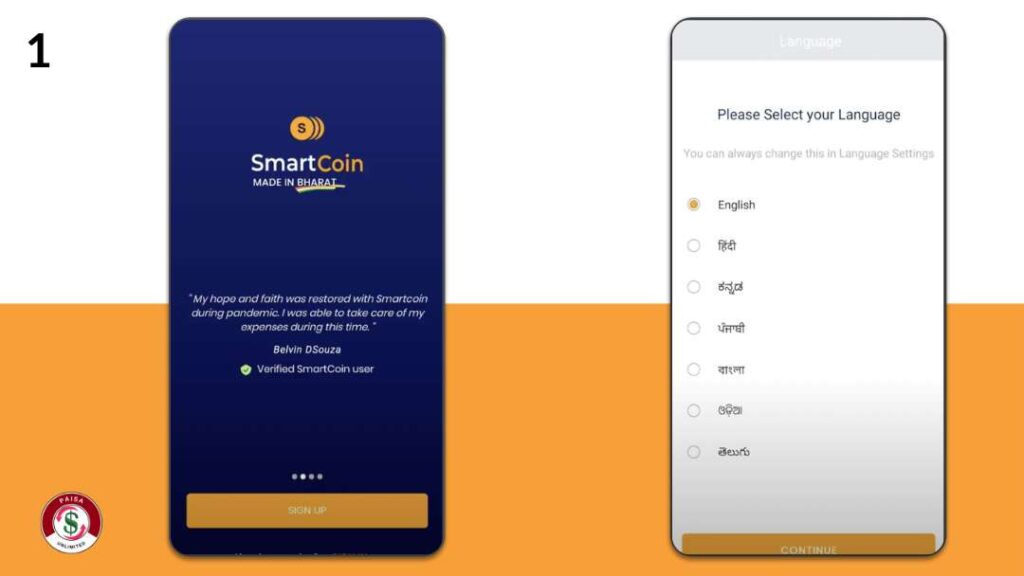

01: Sign-up process:

Open the app, click on ‘Sign Up’ and select your preferred language

02: Enter your full name(as per the PAN card) and mobile number. Skip the referral code section and continue (image 1)

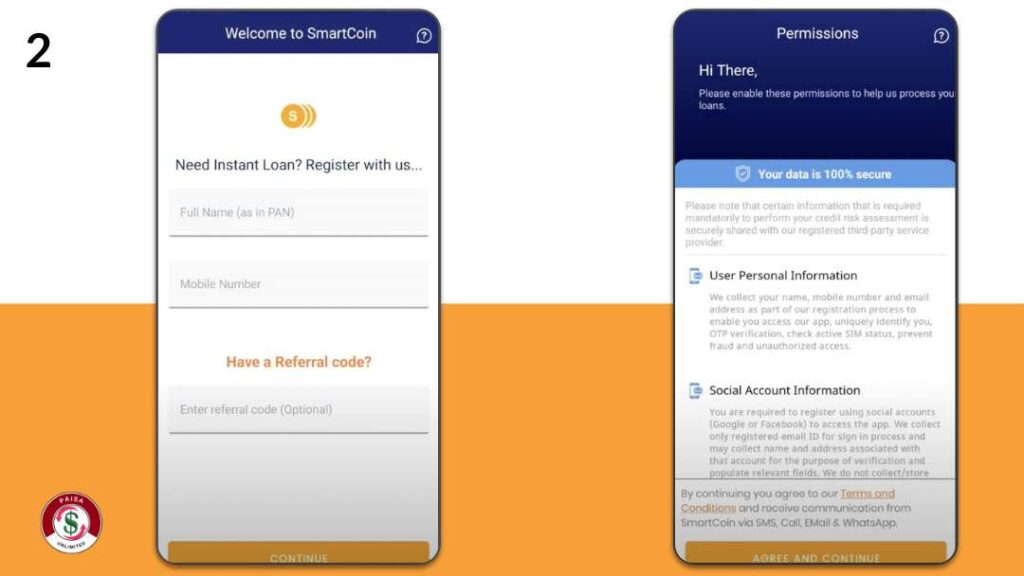

Allow all mandatory permissions to the app and accept the terms & conditions (image 2)

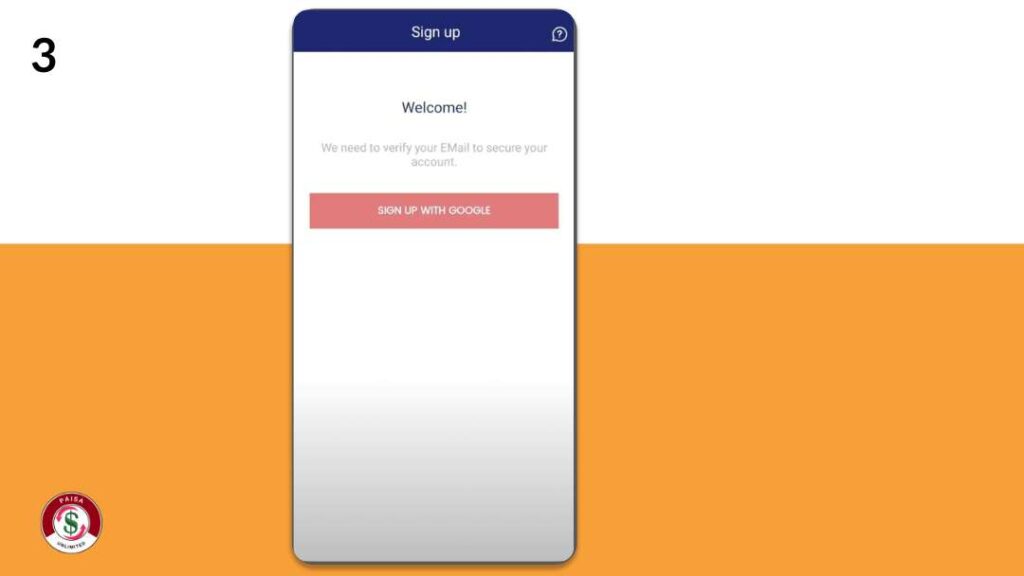

03: Click on ‘Sign Up with Google’ to verify your email

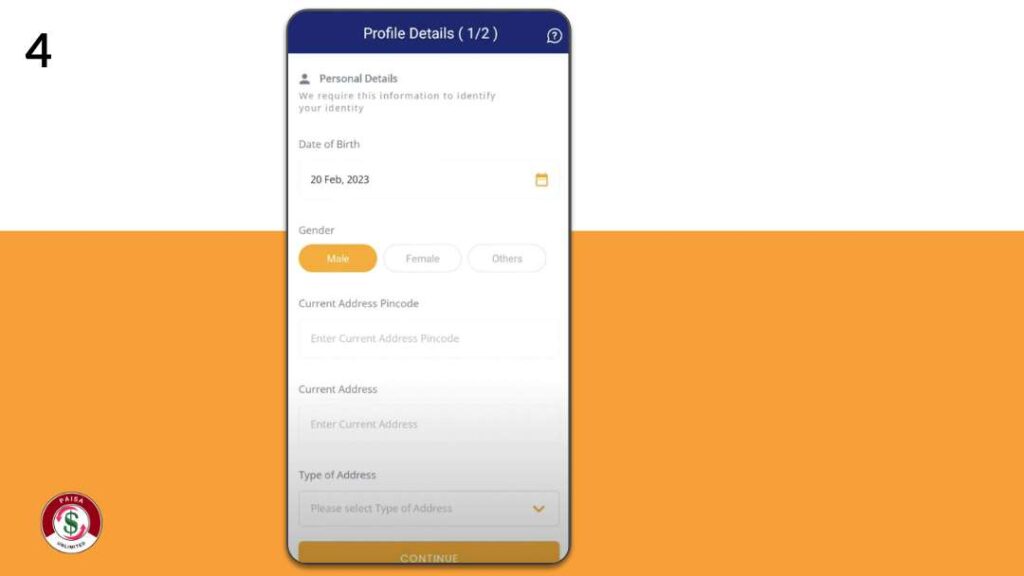

04: Add your profile details & check eligibility

Enter your personal details such as date of birth, gender, current address details, etc.

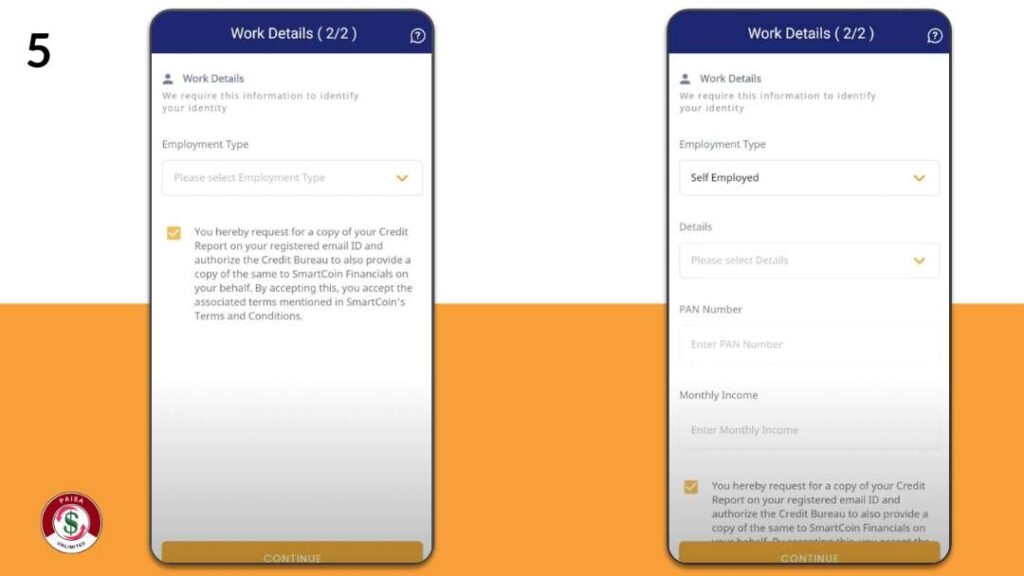

05: Enter your work details such as employment type, PAN number, monthly income, etc., and continue

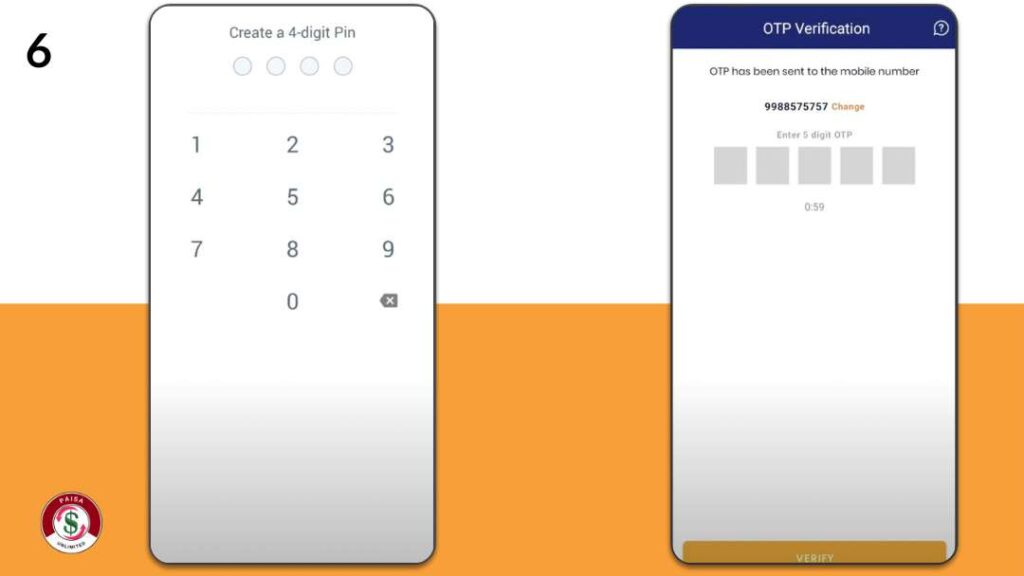

06: Now set up a 4-digit pin and confirm (image 1)

Enter the OTP sent to your mobile number and verify (image 2)

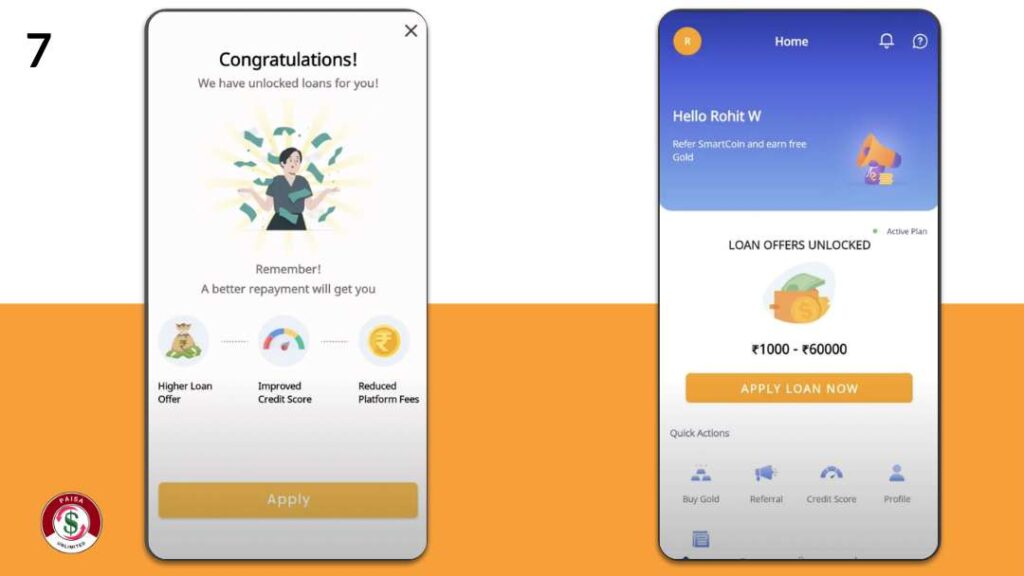

07: The best loan offer will be shown to you according to your profile. Click on ‘Apply’ (image 1)

Now the app will show you the loan amount you are eligible for, click on ‘Apply Loan Now’ (image 2)

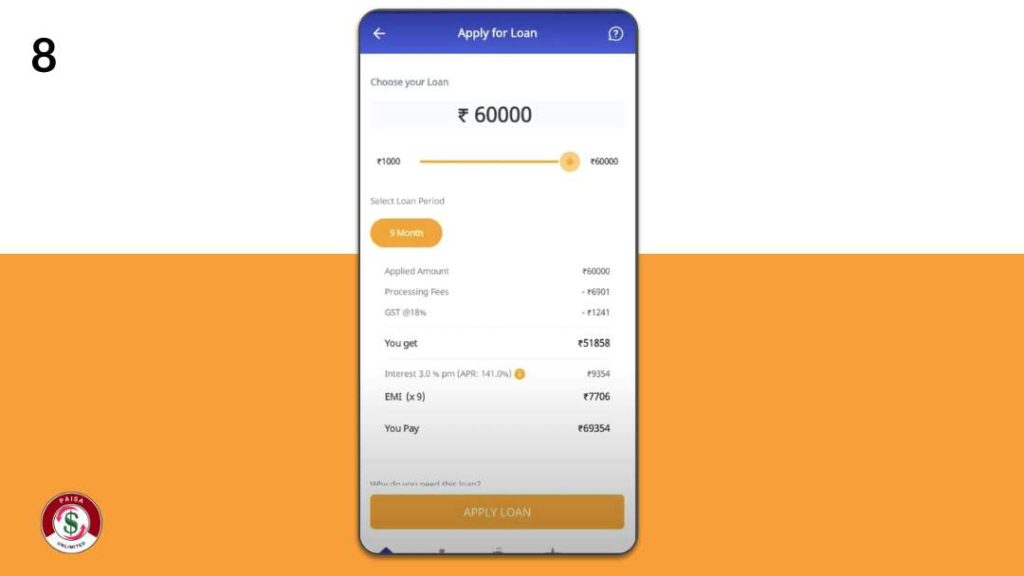

08: Choose your loan offer:

Choose your preferred loan amount from the maximum loan offer, select loan period, loan purpose and click on ‘Apply Loan’

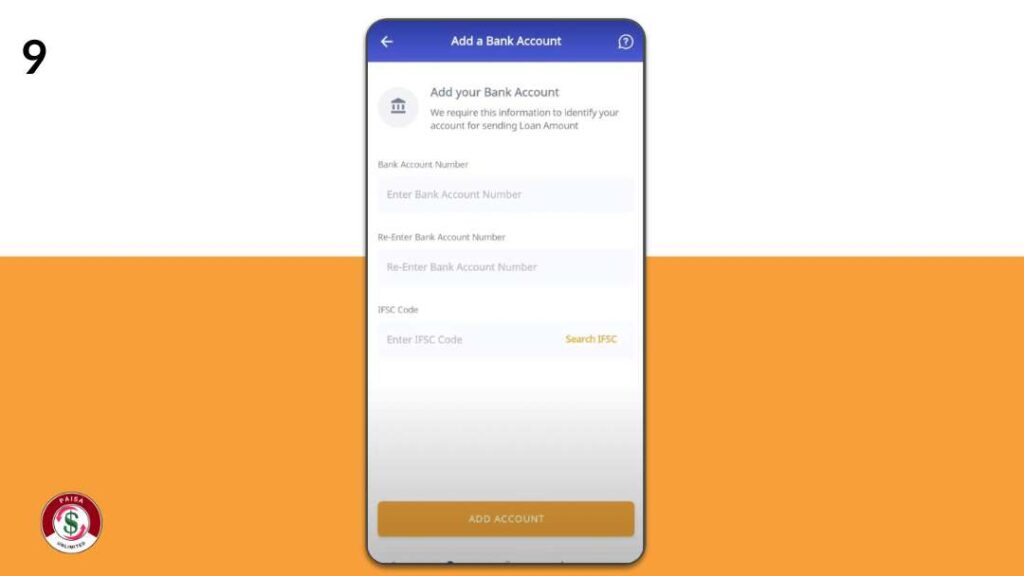

09: Add your bank account details:

Enter your details such as bank account number, IFSC code, etc., and click on ‘Add Account’

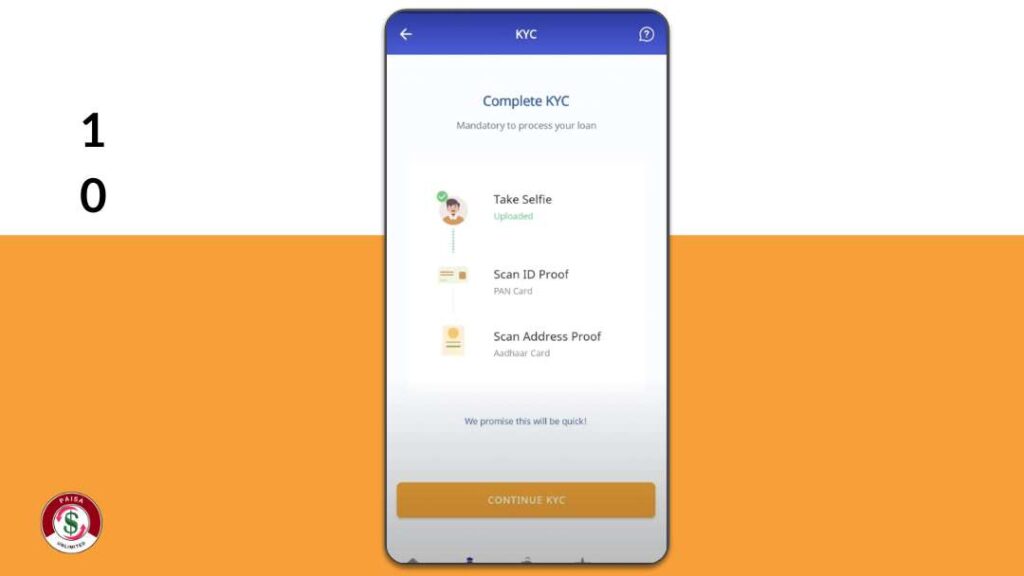

10: Complete your KYC

Upload the required documents and continue

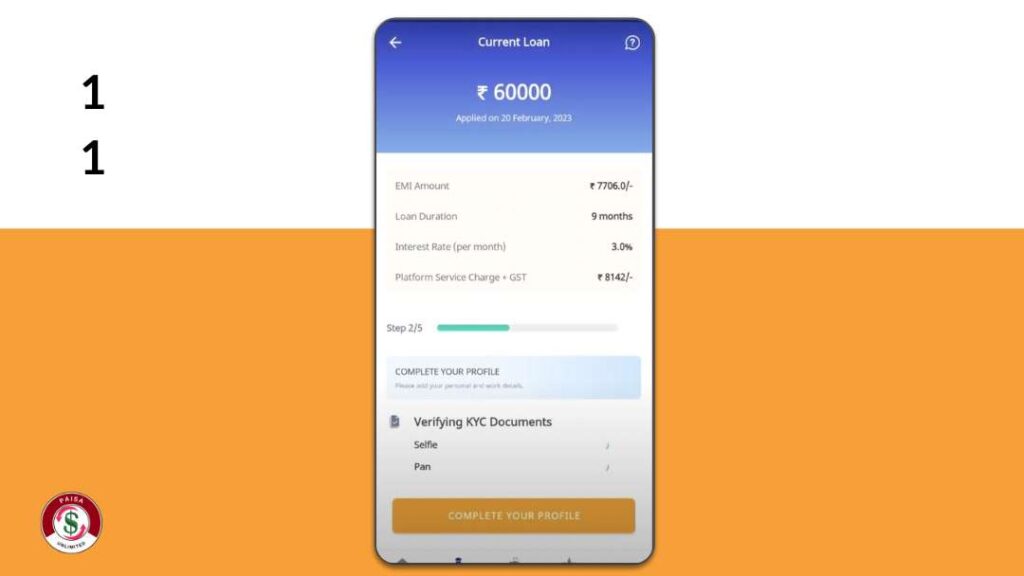

11: Click on ‘Complete your Profile’

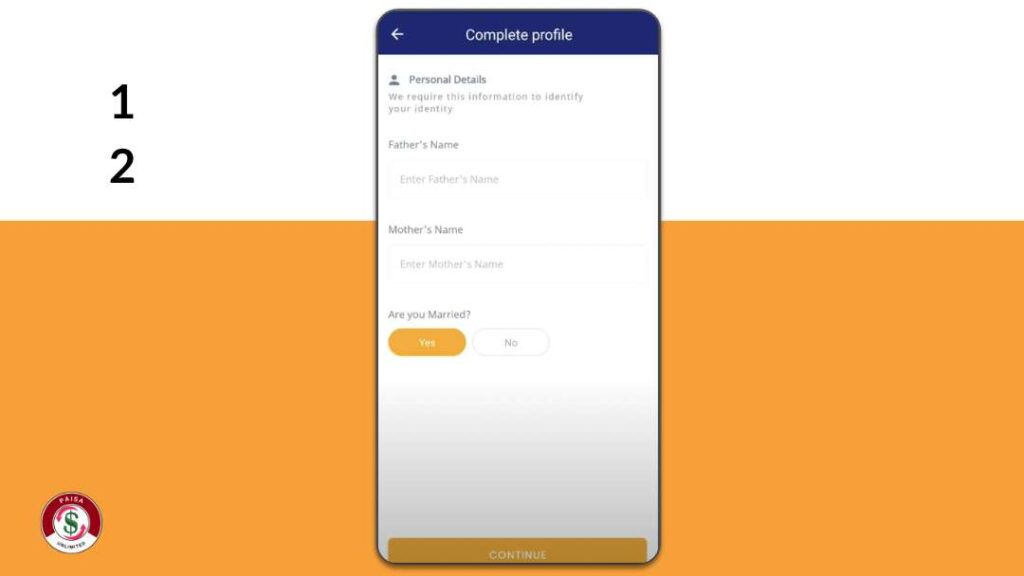

12: Enter your personal details such as your father’s name, mother’s name, marital status and click ‘Continue’

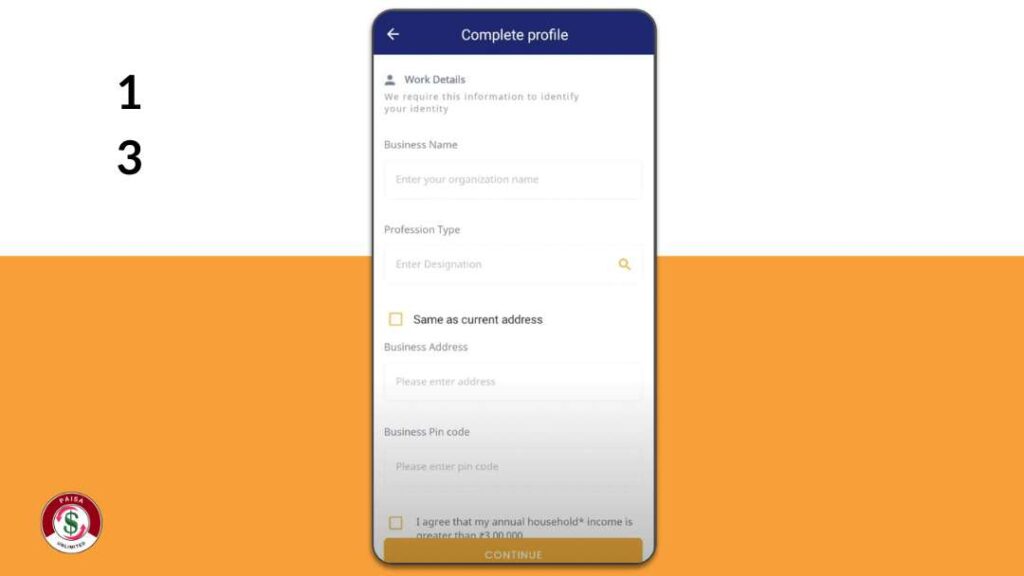

13: Add your work details such as business name, profession type, business address, etc.

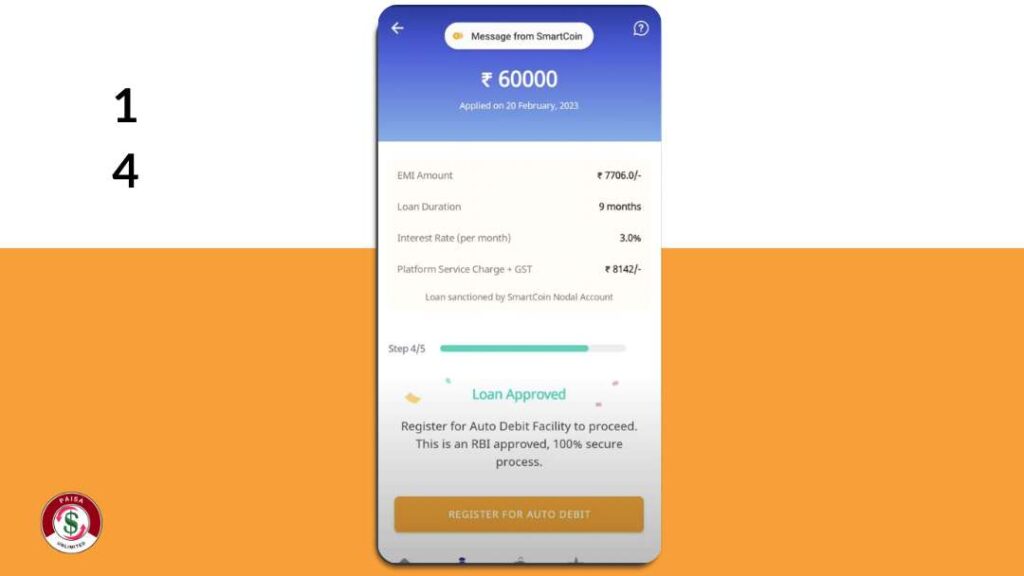

14: After verification, the app will show that your loan has been approved. Click on ‘Register For Auto Debit’

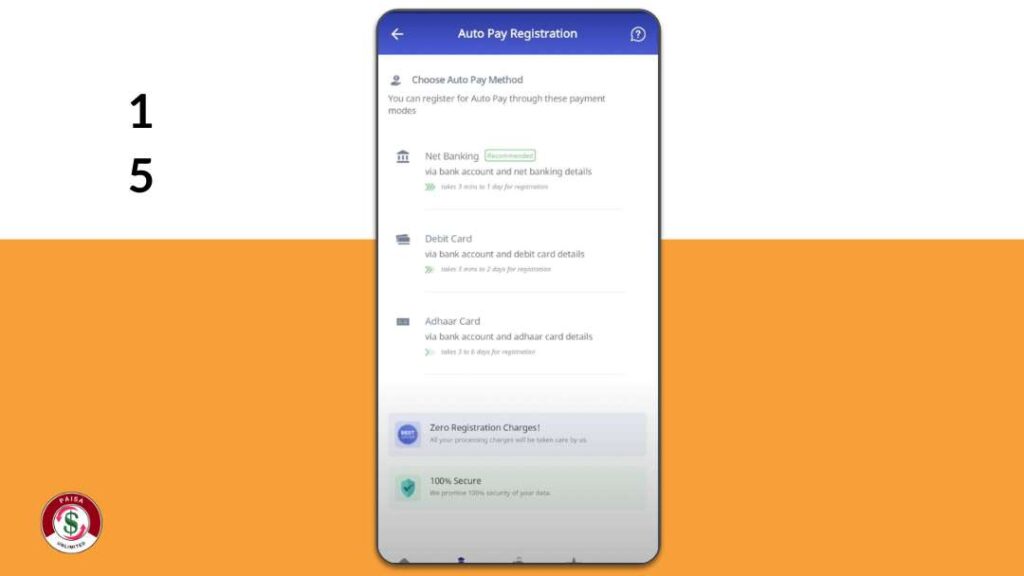

15: Set up auto EMI repayment

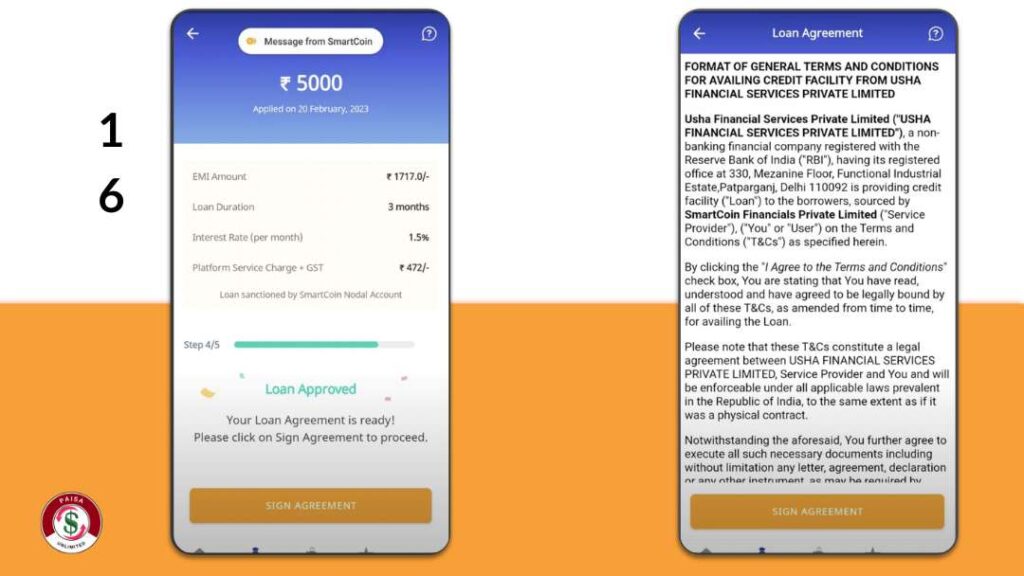

16: Click on ‘Sign Agreement’ and e-Sign the loan agreement

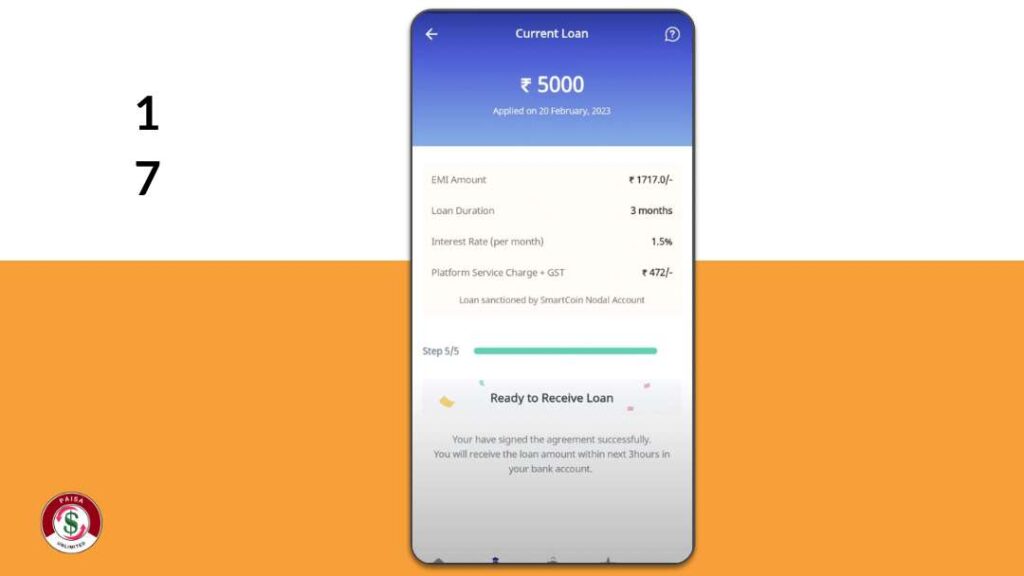

17: After the verification, the cash will be transferred to your bank account within 3 hours

SmartCoin Personal Loan Overview 2024

| Apply Link | Apply Here |

| SmartCoin Loan Helpline Number | +91-9148380504 |

| Email Support | help@smartcoin.co.in |

| Official Website | Visit |

Conclusion : In 2024, SmartCoin offers a simple and efficient personal loan application process. Users can apply directly through the SmartCoin app, with minimal documentation required. The platform provides quick approval and disbursal of funds, making it convenient for borrowers.

SmartCoin’s focus on digital accessibility and user-friendly interface ensures a hassle-free experience, catering to the financial needs of a diverse range of users.

Related Posts –

- Bajaj Finserv RBL Bank SuperCard Application Process 2024

- i2iFunding Personal Loan Application Process 2024

- Zype Personal Loan Application Process In 2024

FAQ-

For what purposes can I take a SmartCoin personal loan?

You can take a SmartCoin personal loan for domestic or international vacations, weddings, higher education, car purchase or home repairs. You can spend this money for any purpose.

Can I repay my SmartCoin personal loan early?

Yes, you can repay your SmartCoin personal loan early without any penalty or additional charges.

How can I contact SmartCoin Personal Loan customer

care?

– You can call on +91-9148380504

– You can also send an email to help@smartcoin.co.in