Many times we need money immediately in case of emergency. But since we do not have money, we take a loan from a bank at a higher interest rate. Which also leads to regret later on.

In such times, Privo Instant Loan can help you. Privo Instant Loan is a new loan application for instant loan approval with an easy process. From where you do not need to visit any bank to take a loan. Because Privo promises to provide loans with 100% paperless process.

Benefits of Privo Instant Loan

| Loan Amount | 20,000 to ₹2 lakh |

| Tenure | 3 to 60 months |

| Application Process | 100% Online Minimal documentation |

| Disbursal | Instant approval & quick disbursal |

| Interest Rates | 13.49% to 29.99% p.a |

| Others | No Processing fees No Pre Closure fees Forever exclusive access to all features Personalized Welcome Kit 500 Amazon voucher |

You must be a resident of India CIBIL score must be 650+

Eligibility Criteria Salaried

- Age Group: 21 – 57 years

- Income Range: ₹18,000+

Documents Required:

- Identity proof: Any one of the documents – PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Aadhaar card, passport, Voter ID Card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

Application Process For Privo Instant Loan 2024

Please keep the following documents and details handy to start the process

- Your PAN card

- Aadhaar card

- Bank account details and

- A Mobile number linked with Aadhaar card

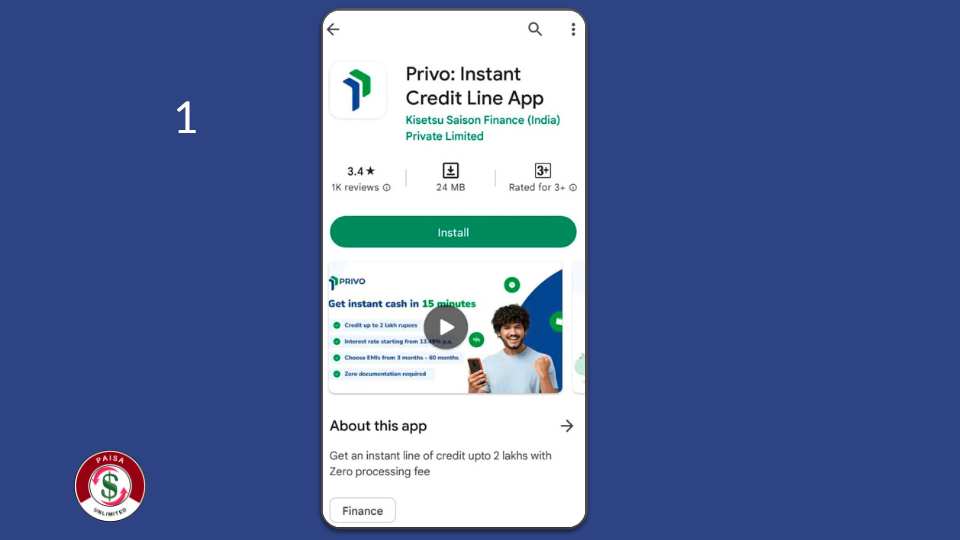

01: Let’s start!

Install the Privo app from the Google Play Store by clicking on the link and start the application journey

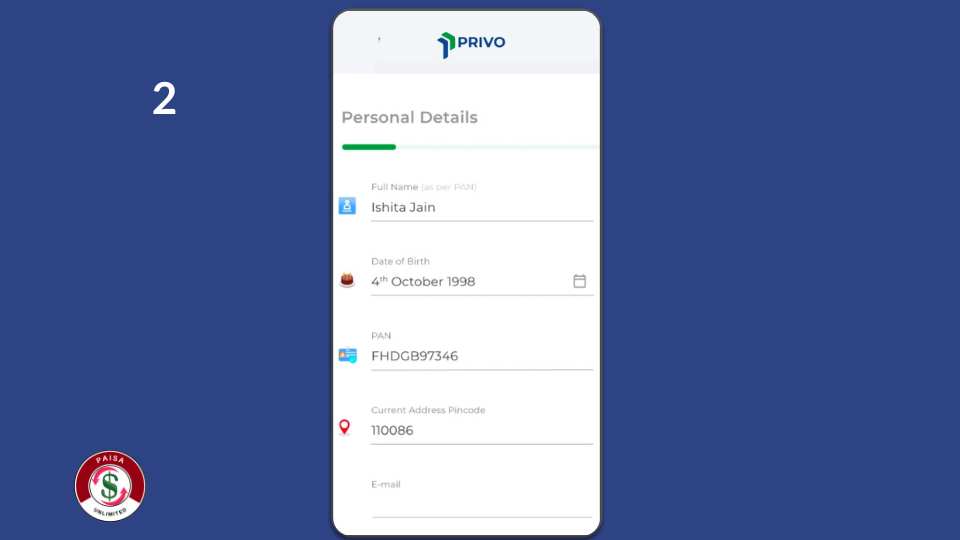

02: Set up your profile

- Open the app, log in with your mobile number and click ‘Continue’

- Enter the OTP sent to your mobile number and verify

- Allow all mandatory permissions to the app and continue

03: Next step

Enter your personal details such as full name(as per PAN), date of birth, PAN number, etc., and click on ‘Continue’

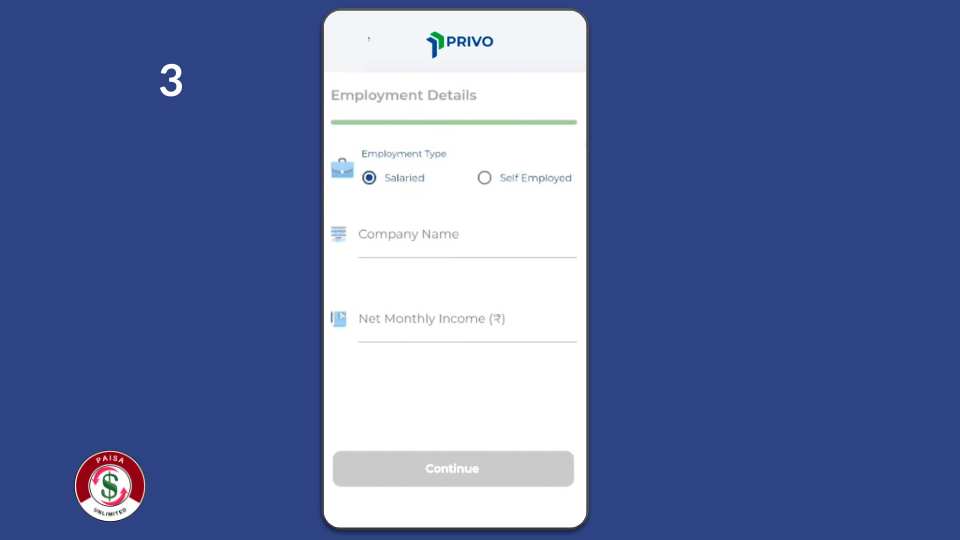

Add your employment details such as employment type, company name, etc., and continue

The best loan offer will be shown to you according to your profile

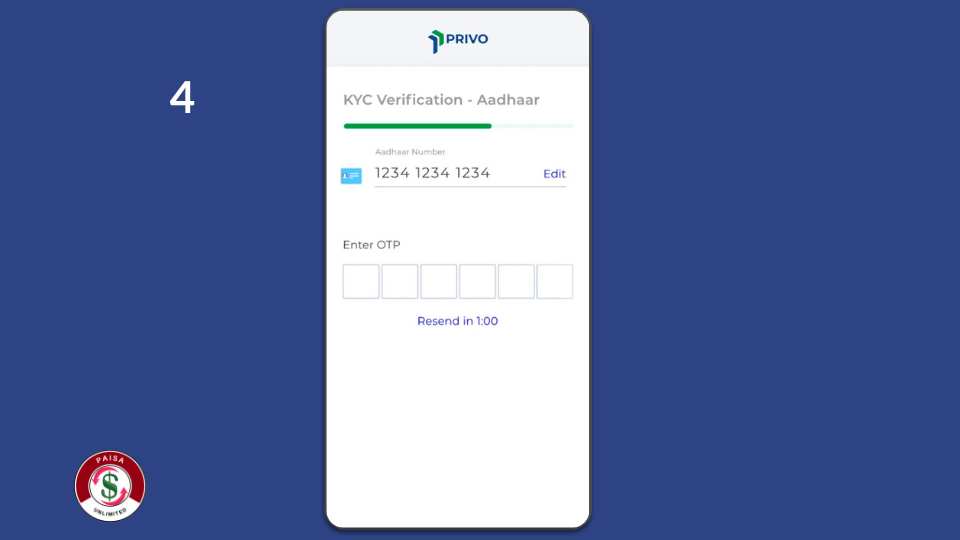

04: Complete your KYC

- Click on ‘Proceed to KYC’

- Enter your Aadhaar number for KYC verification and click on ‘Submit’

- Enter the OTP sent to your Aadhaar registered mobile number and continue

- Upload a selfie to verify your identity

- Read and accept the loan agreement of Privo

- Now your Credit Line is ready to use

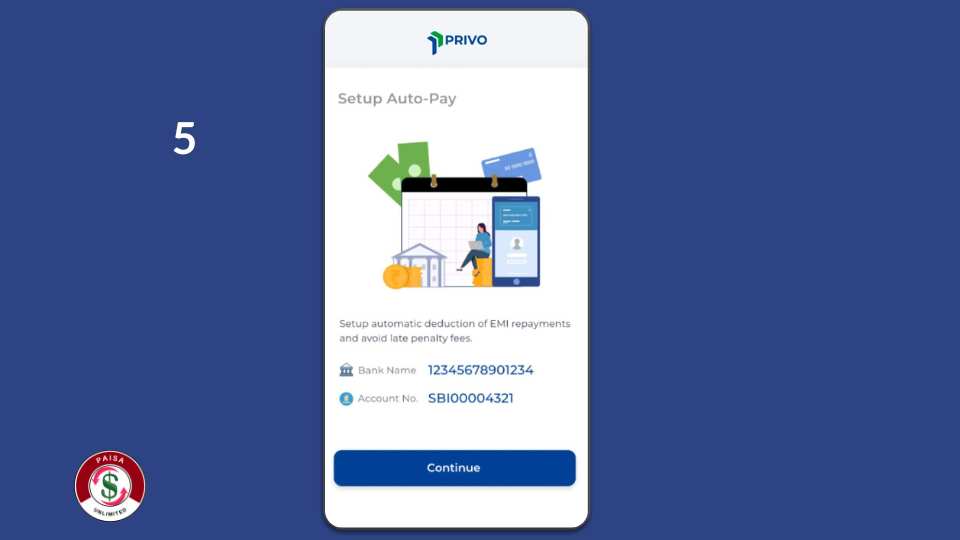

05: Add your bank account details and set up auto-pay

- Click on ‘Proceed to withdraw’ and select your primary bank, enter your account number, IFSC code and click ‘Continue’

- Privo will transfer ₹1 to your bank account for account verification

- Now setup your monthly EMI auto debit repayment and click on ‘Continue’

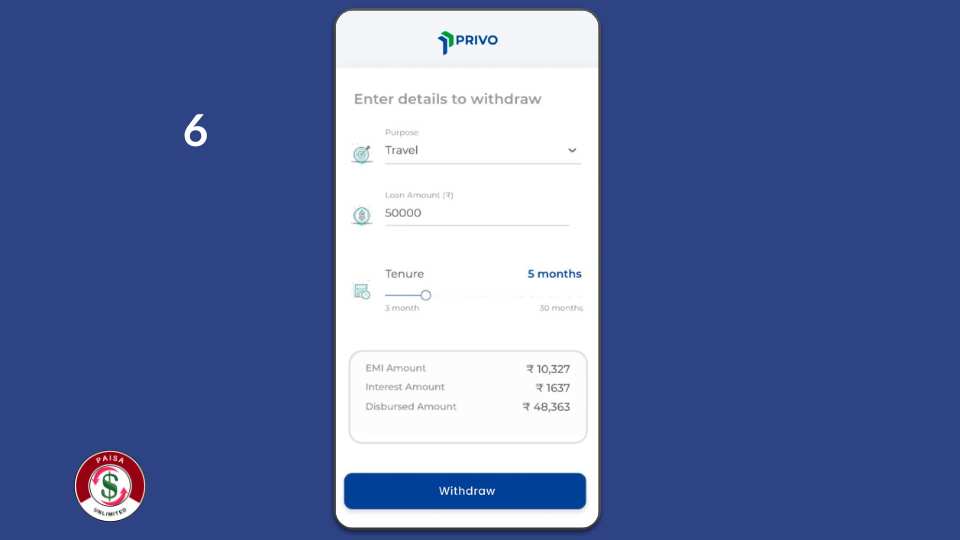

06: Choose an amount to withdraw

- Add details such as loan purpose, loan amount, tenure and click on ‘Withdraw’

- Enter your current residential address and confirm

- After the verification, the cash will be transferred to your bank account within 24 hours

Privo Instant Loan App Overview 2024

| Apply Link | Apply Here |

| Privo Helpline Number | 1800-1038-961 |

| Email Support | support@privo.com. |

| Official Website | Visit |

Privo’s competitive interest rates and flexible repayment options make it a convenient choice for meeting short-term financial needs without unnecessary hassle. Overall, Privo Instant Loan ensures a straightforward and reliable borrowing experience, catering to the diverse financial requirements of individuals in a timely and efficient manner.

Related Posts –

- SmartCoin Personal Loan Application Process 2024

- How to Apply For Standard Chartered Bank Credit Card In 2024

- Bajaj Finserv RBL Bank SuperCard Application Process 2024

FAQ-

What documents are required to apply for a loan?

Aadhaar Number and PAN are mandatory to apply for a loan

How much is the processing fee?

Processing fee for this loan is 1% to 3% of the loan amount + GST

What is Privo?

Privo is a digital lending app of Credit Saison India – the Neo-lending subsidiary of Credit Saison. Credit Saison India is a technology-led neo-lending conglomerate with a Global MNC Parent. We offer bespoke solutions to cater to the different financial needs of Individuals, SMEs, Fintechs and NBFCs