Nira Finance offers instant loans with an easy online application process in 2024. Borrowers can apply for loans conveniently through their website or mobile app. Enjoy quick approval and disbursal of funds directly into your bank account. With flexible repayment options and competitive interest rates, Nira Finance provides a reliable solution for immediate financial needs.

Benefits of NIRA Finance Instant Loan

- Loan Amount : From ₹5000 to ₹1 lakh

- Application Process : 100% Online & Paperless process

- Tenure : From 3 to 12 months

- Disbursal : 3 minute approval & disbursal

- Interest Rates: 24% – 36% p.a

Nira Eligibility Criteria For Salaried Persoan

- Age Group: 25 to 60 Years

- Income Range: ₹25,000+

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

Other Eligibility Criteria

- You must be a resident of India

- CIBIL score must be 660+

NIRA Finance Instant Loan Process 2024

Step : 01 Download the app from play store and Open the app and select the preferred language

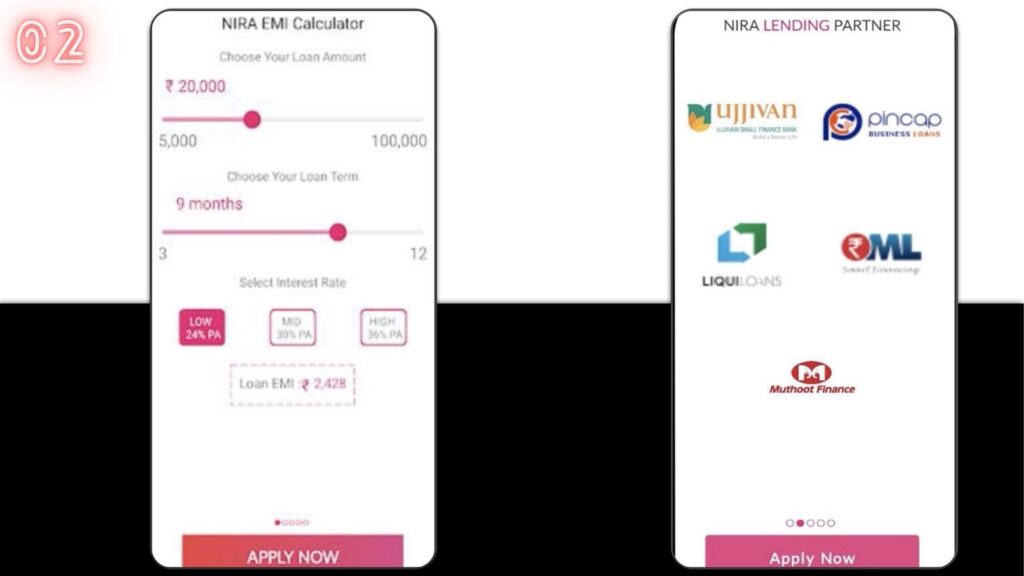

Step : 02 Select the loan amount, loan term and click on ‘Apply now’ (image 1)

On the next screen, you can see NIRA Lending Partners and click ‘Apply Now’ (image 2)

Step : 03 Accept the Terms & conditions, click ‘I Agree’ and allow all mandatory permissions (image 1)

Enter your mobile number and an OTP will be sent to it, enter the OTP and click on ‘Register’ (image 2 )

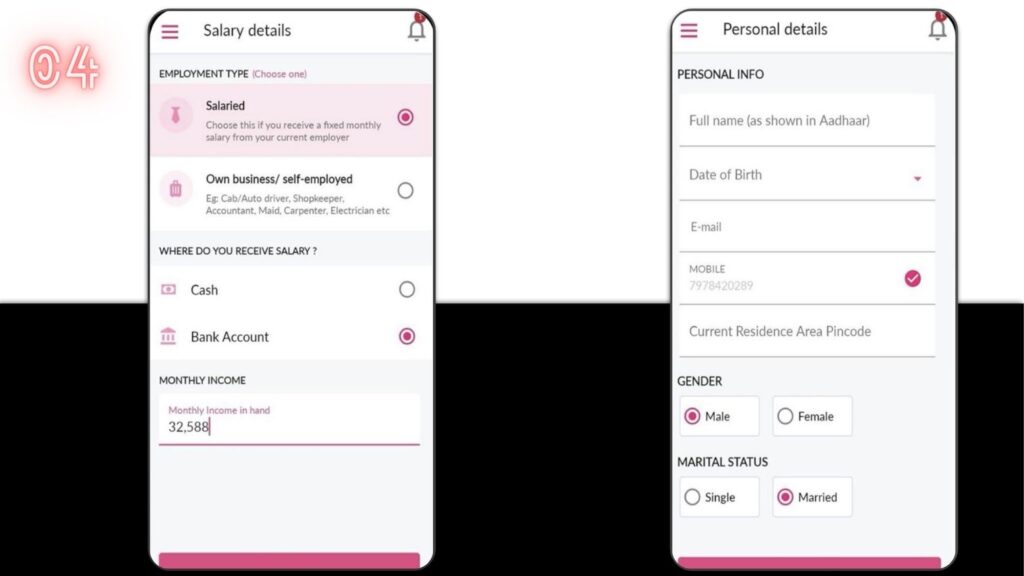

Step : 04 Enter your salary details such as employment type, monthly income, etc., and click on ‘Proceed’ (image 1)

Also, enter the information such as loan purpose, total work experience, etc., and click on ‘Proceed’ (image 2)

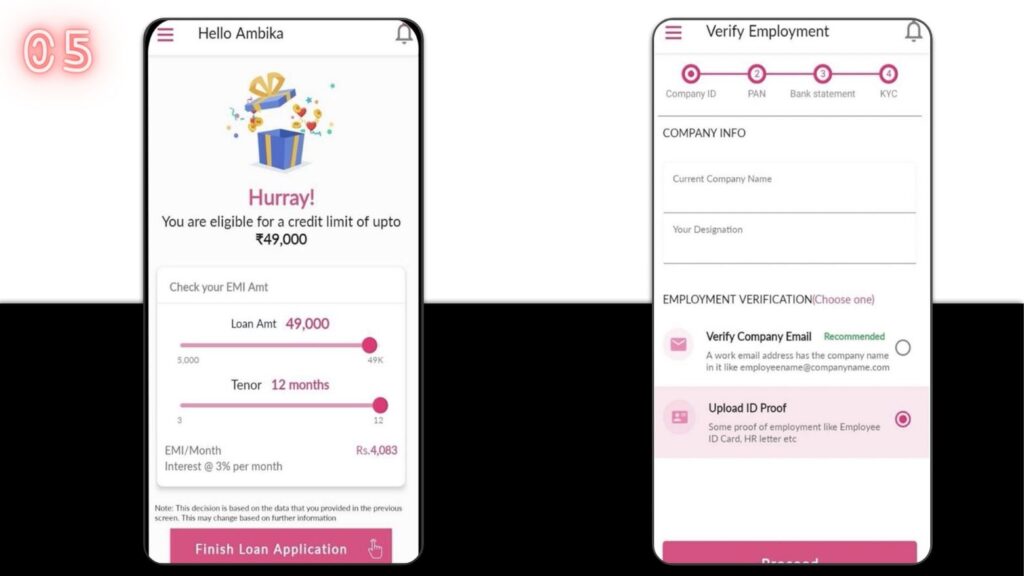

Step : 05 If you are eligible, you will be shown the credit limit, check the EMI amount and complete the loan application (image 1)

Enter your employment details such as current company name, designation and complete employment verification via company email or by uploading ID proof (image 2)

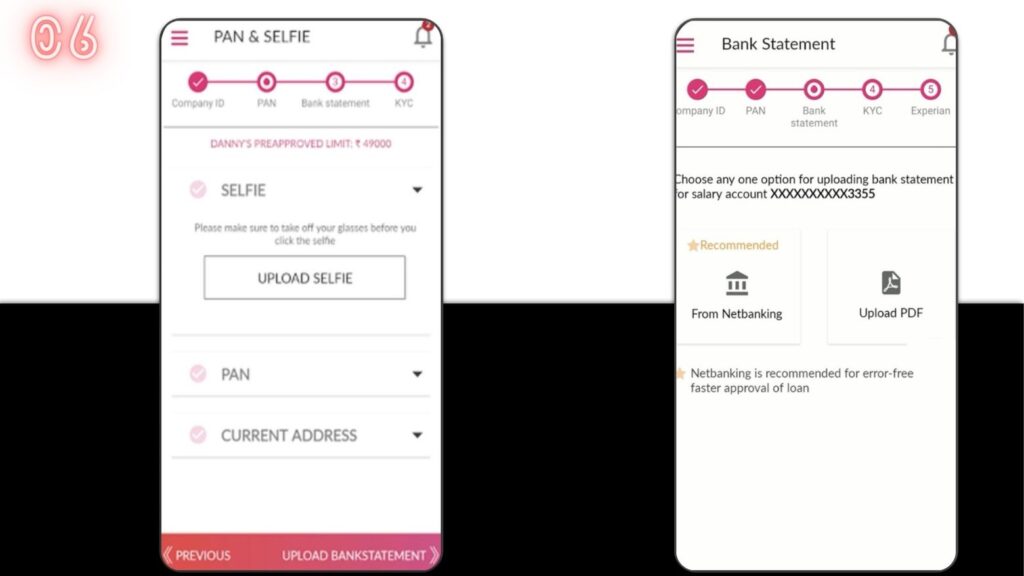

Step : 06 Upload your selfie, PAN and enter current address details such as pin code, city, state, etc., and proceed to upload the bank statement (image1)

Proceed with Net Banking or upload a PDF to upload the bank statement (image 2)

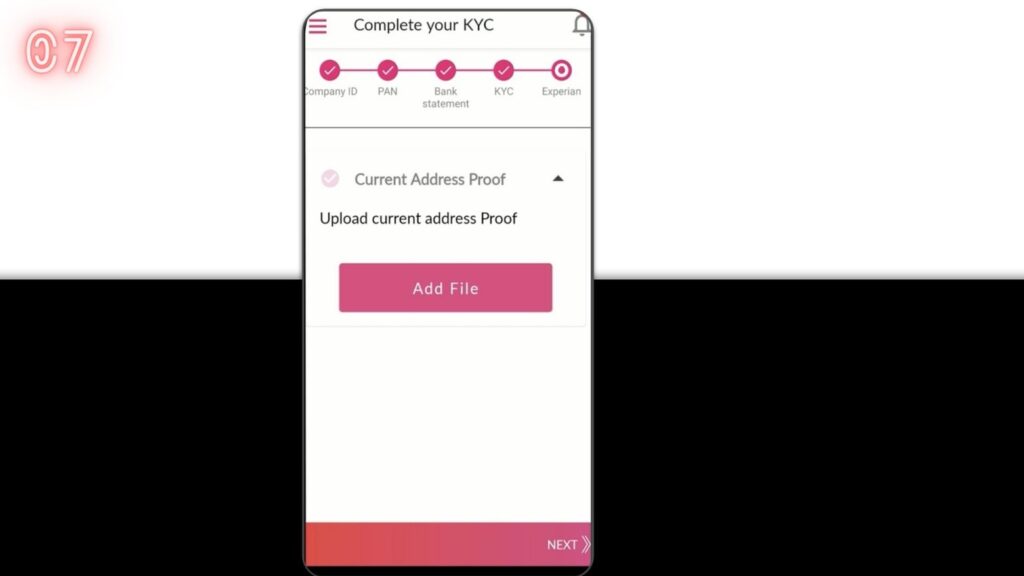

Step : 07 To complete the KYC, upload current address proof, Identity proof, etc., and click on ‘Next’

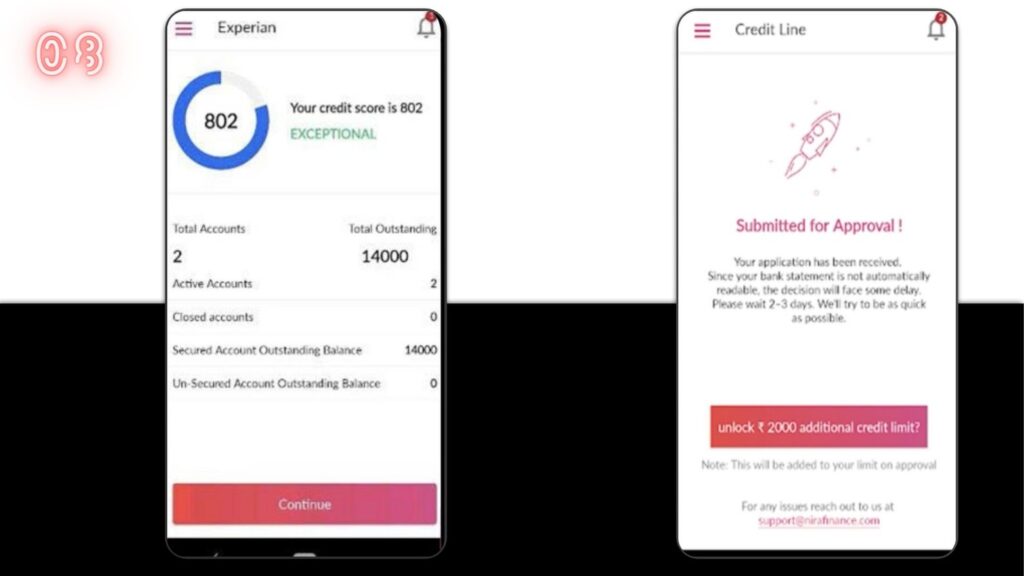

Step : 08 Now you can see your experian score on the screen and click on ‘Continue’ (image 1)

Your application will be submitted and it will be reviewed by the NIRA Finance verification team (image 2)

NIRA Finance Instant Loan Process 2024 Overview

| Apply Link | Apply Here |

| Nira Loan App Helpline Number | +91 95136 22391 |

| Suport Email | support@nirafinance.com |

| Official Website | nirafinance.com |

Conclusion : In conclusion, Nira Finance stands out as a convenient and reliable option for instant loans in 2024. With its seamless online application process, quick approval, and direct disbursal of funds, it caters to urgent financial needs effectively.

The flexibility in repayment options and competitive interest rates add to its appeal, ensuring borrowers can manage their finances conveniently. Whether for unexpected expenses or planned investments, Nira Finance provides a user-friendly and efficient borrowing experience.

You May Interested

Help & Support FAQs

- KreditBee Instant Personal Loan Apply Online 2024

- How Do I Apply For an IndusInd Bank Credit Card

- Money View Personal Loan Apply Online 2024

What does NIRA offer?

NIRA offers line of credit of upto ₹1 lakh. Avail credit whenever you want, wherever you want.

What are the required documents to apply?

List of Documents

1.Proof of Identity:- Passport / Driving Licence / Voter ID / PAN Card / Aadhaar Card (any one)

2.Proof of Residence:- Leave and Licence Agreement / Utility Bill (not more than 3 months old) / Passport (any one)

3.Latest 3 months Bank Statement (where salary/ income is credited)

4.Salary slips for last 3 months

What is a processing fee and why is it charged?

There will be a processing fee of a minimum of ₹350 + GST and a maximum of 2% of loan amount on your first loan. This is to cover the costs of on-boarding including document collections, verifications and payment setup.

Nira Finance Loan Instrest Rate ?

24% to 36% per annum

Nira Finance Loan Foreclosure Charges in 2024

“If you make your prepayment within seven days of receiving the loan, there will be no additional charges.”