mPokket Instant Loan is especially famous for giving instant loans to students. Every year lakhs of students come out of their financial problems by taking emergency loan from mPokket. With mPokket you can easily get instant loan at low interest rates. How to take Instant Loan from mPokket and complete information related to it is given step by step below.

Benefits of mPokket Instant Loan

| Loan Amount | 500 to ₹30000 |

| Application Process | 100% Online No paperwork is required |

| Tenure | Up to 4 months |

| Interest Rates | 24% to 48% p.a. |

| Disbursal | Get disbursed in minutes |

| Others | Instant personal loans for students No collaterals needed |

mPokket Eligibility Criteria For Salaried

- Age Group: 18+ years

- Income Range: ₹9,000+

Documents Required:

- Identity proof: Any one of the documents – PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Aadhaar card, passport, Voter ID Card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

- For Students: Valid College ID Card, PAN Card , Address Proof like: Voter card, Aadhaar,PAN, Driving licence & Passport.

Other Eligibility Criteria

Customer must be an Indian resident

How to Apply For mPokket instant loan approval

Application Process Please keep the following documents and details handy to start the process

- Your PAN card

- Aadhaar card and

- Bank account details

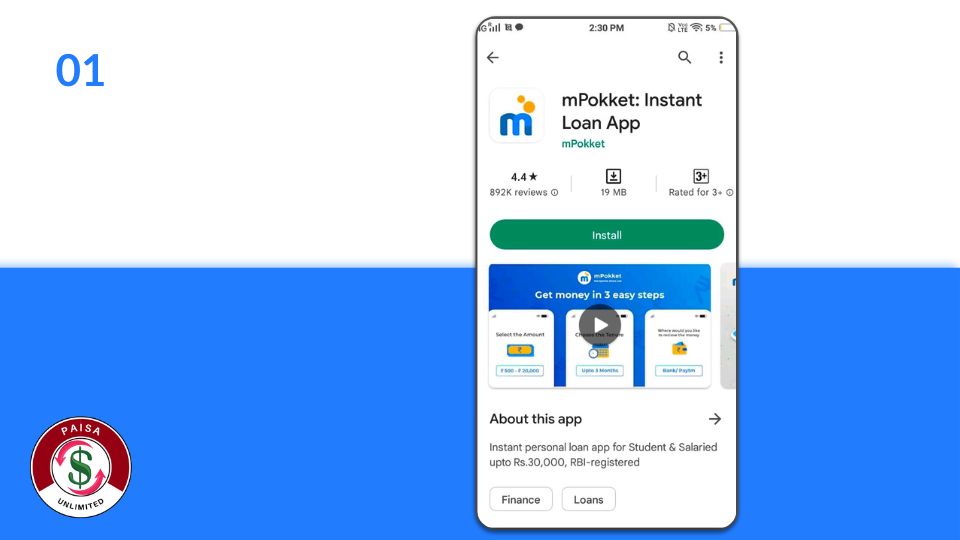

01: Install the mPokket app from the Google Play Store by clicking on the link and start the application journey

- Open the app and click on “Get Started”

- Give all the permissions to the app by ticking on “I Accept Permissions, Terms & Conditions” and click on “Continue”

- Now enter your mobile number and click on “Send OTP”

- Enter the OTP received on your number and click on “Verify”

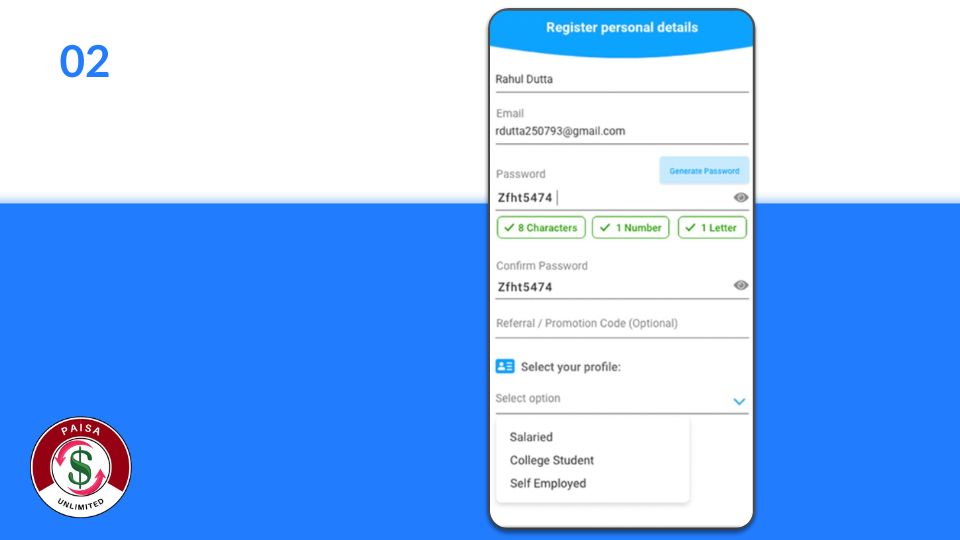

02: Creating Your Profile

- Select your current status such as Student, Salaried and Self-Employed and click on “Continue” To demonstrate, we are selecting current status as salaried, but you can choose your status accordingly, the process will be almost similar.

- Skip the referral code by clicking on “I don’t have a referral code”

- Now select your second preferred language other than English, like Hindi or any other language of your choice, and click on “Continue”

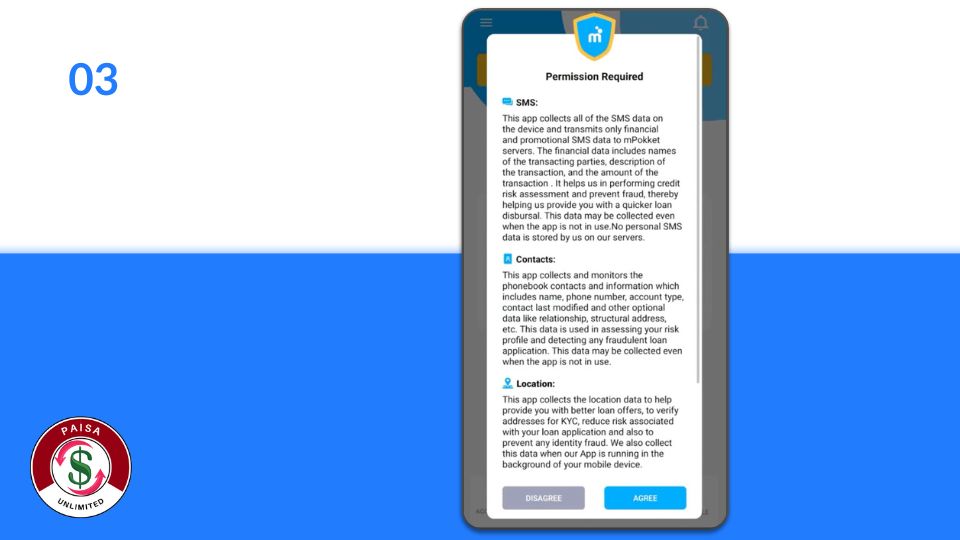

03: Next Step For Creating Your Profile

- Click on “Agree” to give all the required permissions to the app and click on “allow” to all the permission requests You will be redirected to the home page of the mPokket app.

- Click on the profile tab to complete your profile before applying for the loan In your profile you will have to provide your KYC details, Basic Information, Employment details and Selfie Video.

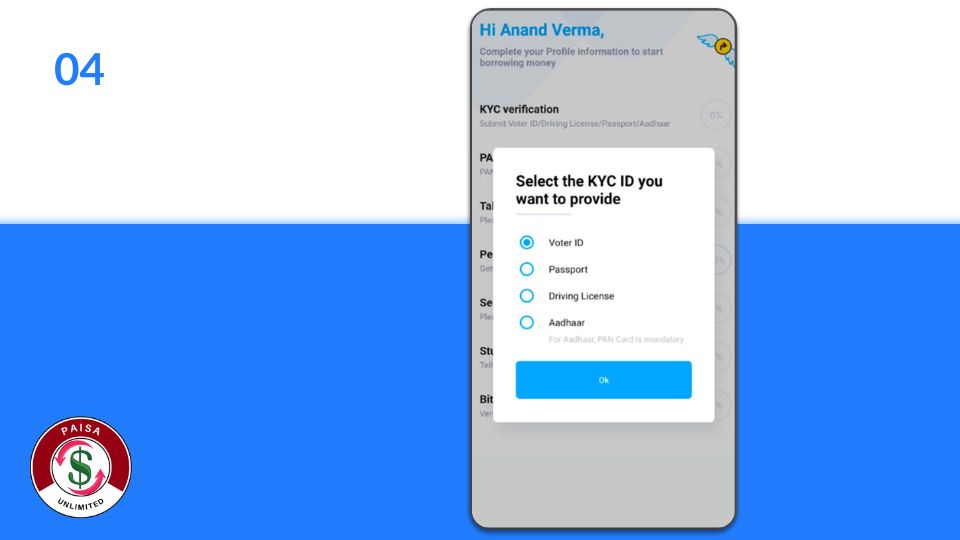

04: Providing your KYC details

- Click on the KYC verification option, upload your selfie photo, and enter your PAN number Select KYC document type like Aadhaar Card and enter your Aadhaar number and click on “Send OTP”

- Now you will receive an OTP on your mobile number linked to your Aadhaar card.

- Enter the OTP and proceed

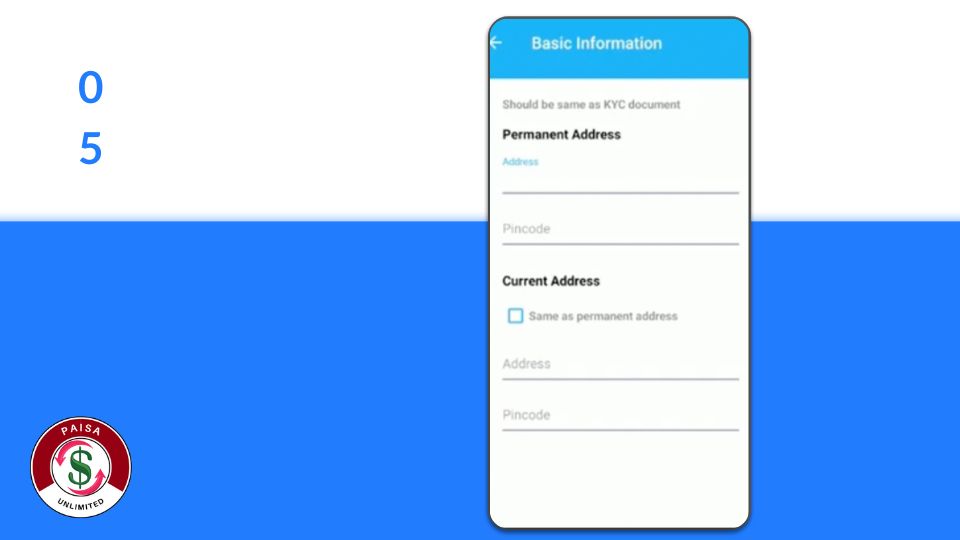

05: Next Step For Providing your KYC details

- Now you will have to provide your basic information like name, gender, date of birth, marital status, highest qualification, parent’s name and click on “Next”

- Enter your permanent and current address details and click on “Next”

- Now inform if this number is available on WhatsApp or not and also enter an alternate number and click on “Next”

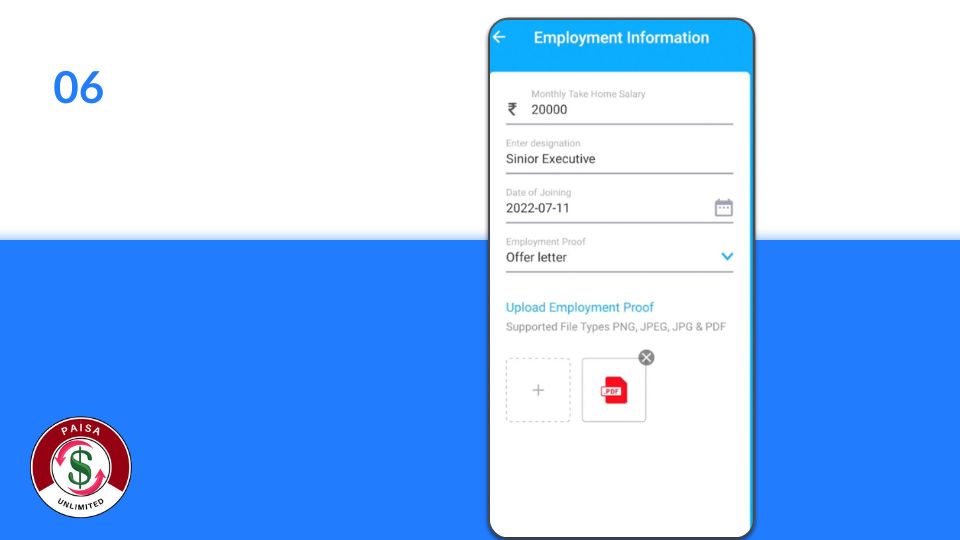

06: Providing your employment details

- Provide your employment details like Company name, Office Address, Office Pin Code and click on “Next”

- Enter your monthly in-hand salary, designation, date of joining

- Upload an employment proof such as Payslip, Offer letter, Joining letter, Permanent ID or Appraisal letter and click on “Next”

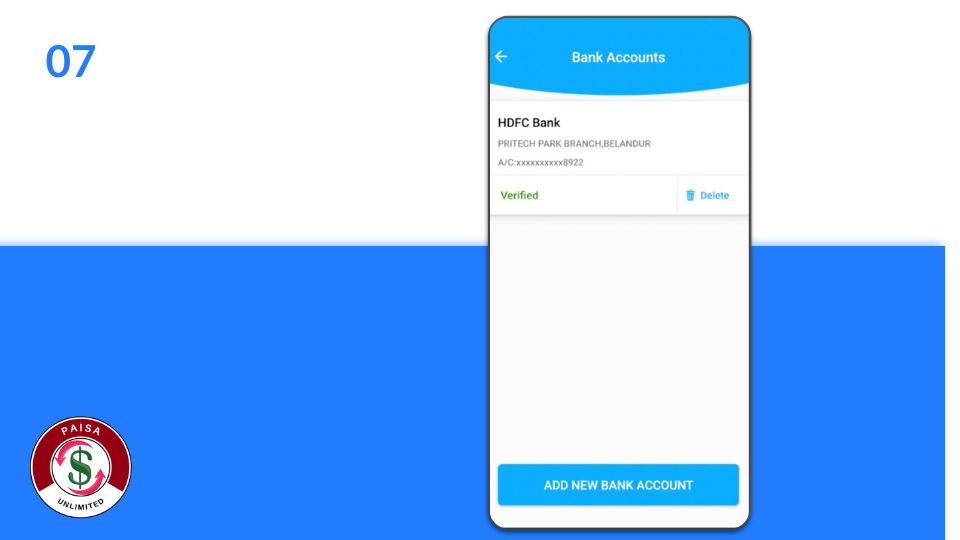

07: Providing your bank account details

- Enter the IFSC Code of your bank and click on “Next”

- Now if you provide bank details of your salary account like IFSC code, Account holder name, Account number

- Upload 3 months bank statement and click on “Next”

Best Digital Gold App : अब घर बैठे खरीदों डिजिटल गोल्ड

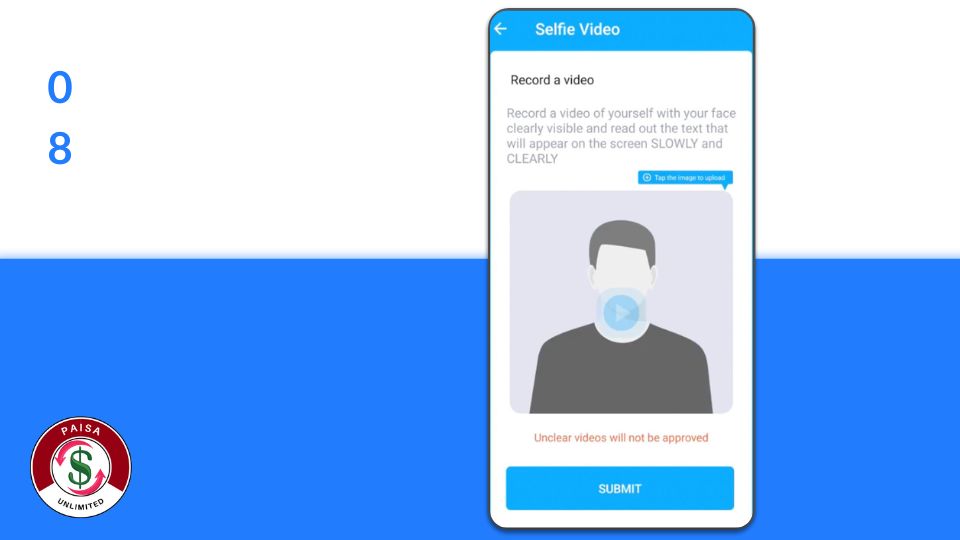

08: Recording a video

Now you will have to record a video of yourself in which you will have to read out a text displayed in the app and submit the video

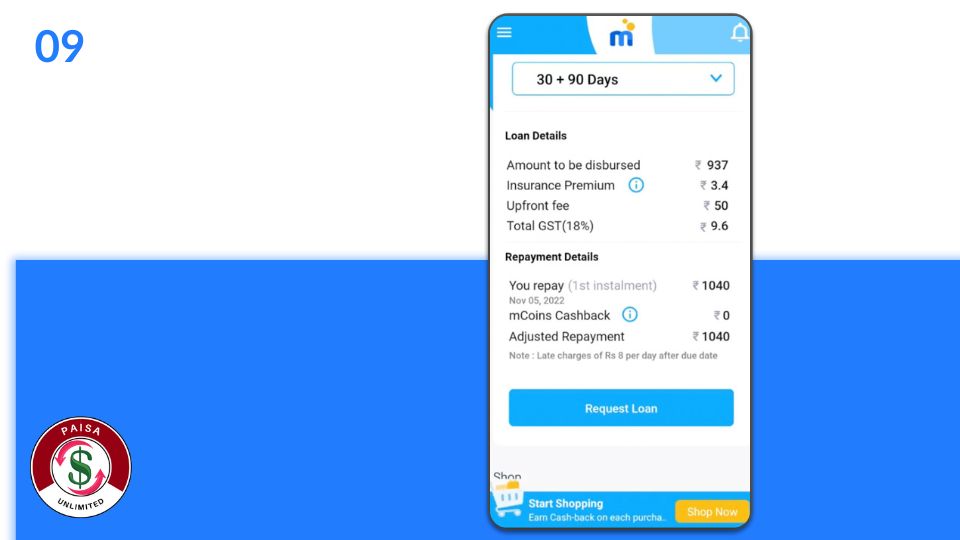

09: Taking the loan amount in your account

- After submitting all your details, go to the homepage of the app.

- You can see your credit limit at the top of the screen

- Choose the loan amount and tenure, click on “Request Loan

- The app will now show you loan and repayment details, after checking the details click on “Request loan”

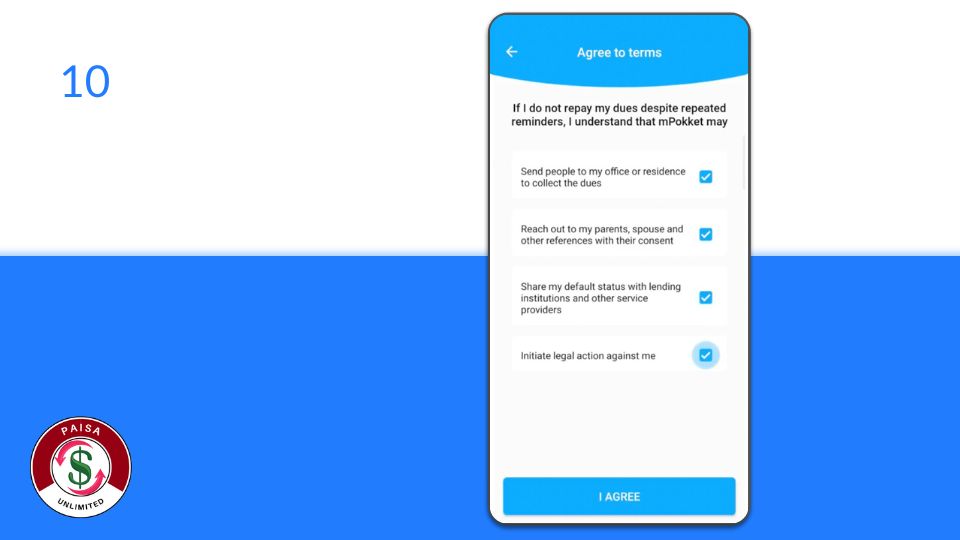

10: Taking the loan amount in your account

- Now choose bank account option and it will show you your verified bank details

- Tap on your bank details to proceed further

- Accept the Terms & Condition and click on “Confirm”

- Now select the purpose of your loan and click on “Continue”

- Tick on all the terms and conditions and click on “Agree”

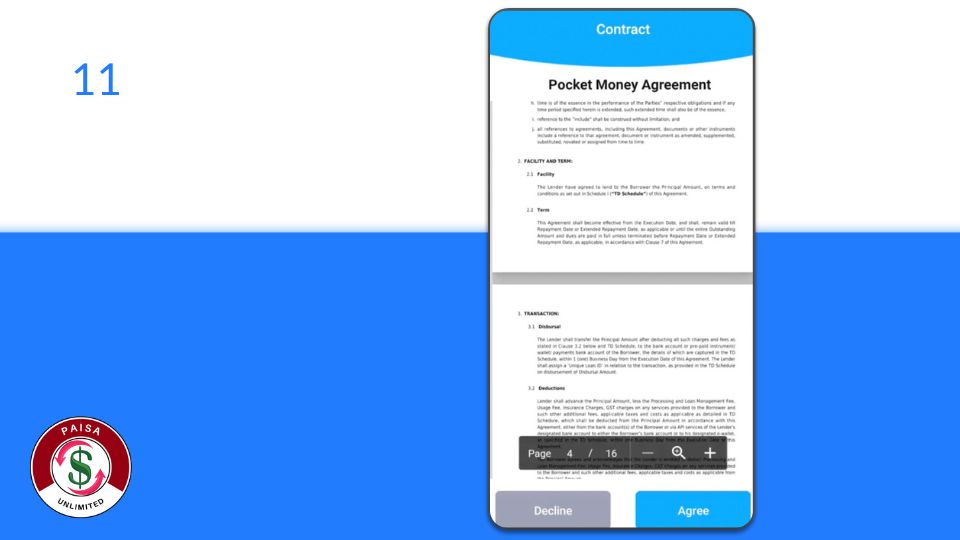

11: Taking the loan amount in your account

- Click on “View Contract” read the loan agreement and click on “ Agree”

- Now enter the OTP and click on “Confirm Transfer”

- Congratulations! Within 30 minutes, you will receive the loan amount in your bank account.

mPokket Instant Loan Overview 2024

| Apply Link | Apply Here |

| Helpline Number | 033- 6645 2400 |

| Support Email | support@mpokket.com |

| Official Website | Visit Website |

you may interested

- Low Interest Rate Personal Loan in India 204 – Kissht Personal Loan

- CASHe Instant Loan Application in 2024

- Nira Finance Instant Loan Apply Online 2024

- Fibe Loan App – Instant Loan Application in 2024

FAQ-

How much is the processing fee?

Processing fee for this loan is ₹50 to ₹200 + 18% GST of the loan amount

How do I check my loan status?

Under the activity section in the mPokket app, you will be able to check the status of all your open loans

mPokket Interest Rate ?

2% to 4% per month.

mPokket Loan RBI Approved or Not ?

YES