KreditBee Instant Personal Loan provides a seamless and flexible financial solution, offering loan amounts from ₹1,000 to ₹4 lakh. Borrowers can enjoy tenures ranging from 64 days to 24 months, allowing for customized repayment plans. The 100% online application process is hassle-free, requiring minimal documentation and no paperwork.

With rapid 10-minute disbursal, funds are swiftly transferred directly to your bank account. Interest rates are competitive, ranging from 15% to 29.95% per annum. KreditBee stands out with easy repayment options, no collateral requirements, and the convenience of EMI purchases. This user-friendly service is perfect for anyone seeking quick and efficient financial assistance.

Benefits of KreditBee Instant Loan

| 1. | Loan Amount | ₹1000 to ₹4 lakh |

| 2. | Tenure | From 64 days to 24 months |

| 3. | Application Process | 100% Online No paperwork is required Minimal Documentation |

| 4. | Disbursal | 10 Minute Disbursal Get the loan amount directly into bank account |

| 5. | Interest Rates | 15% to 29.95% per annum |

| 6. | Others | Easy repayment options No collateral required Purchase on EMI |

Eligibility Criteria For Salaried

- Age Group: 21 – 55 years

- Income Range: ₹8,000+

Documents Required:

- Identity proof: Any one of the documents – PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Aadhaar card, passport, Voter ID Card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

Eligibility Criteria Self-employed

- Age Group: 21 – 55 years

- Income Range: You must have a regular source of income

Documents Required:

- Identity proof: Any one of the documents – PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Aadhaar card, passport, Voter ID Card

- Business Proof: Proof of Business Existence, Certificate of Incorporation, Certificate of Registration with Appropriate Registration Body

- Income Proof: ITR of Past 2 years, Certified Profit and Loss Statement.

Other Eligibility Criteria

You must be a resident of India and Credit score should be 680+

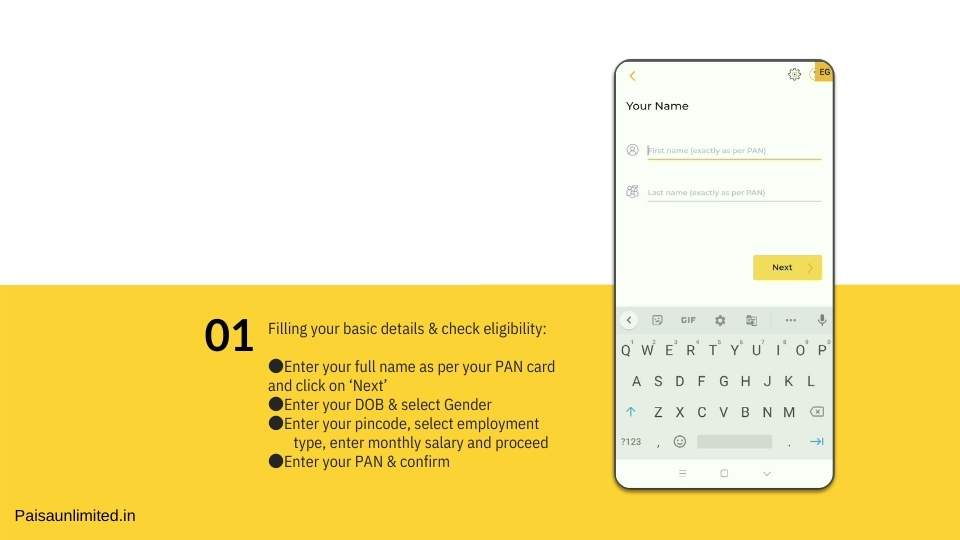

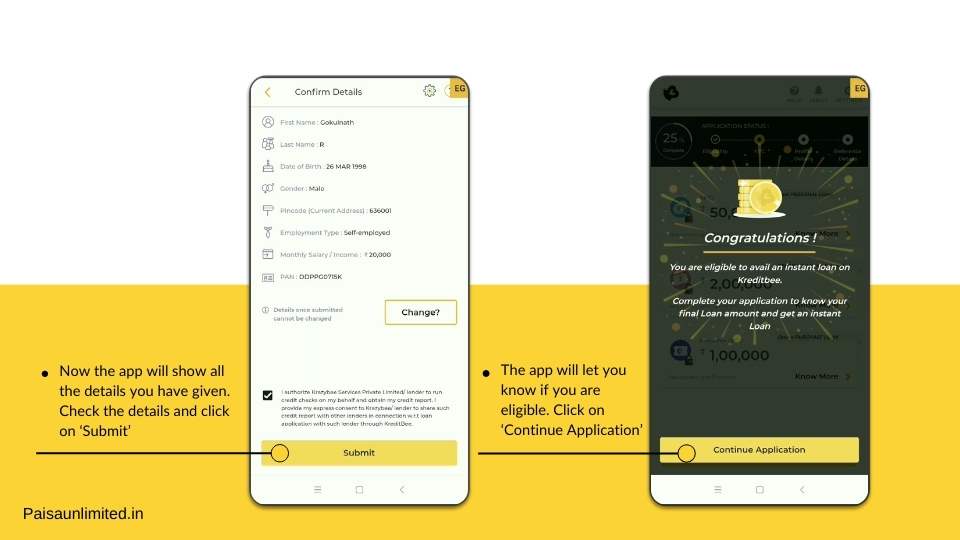

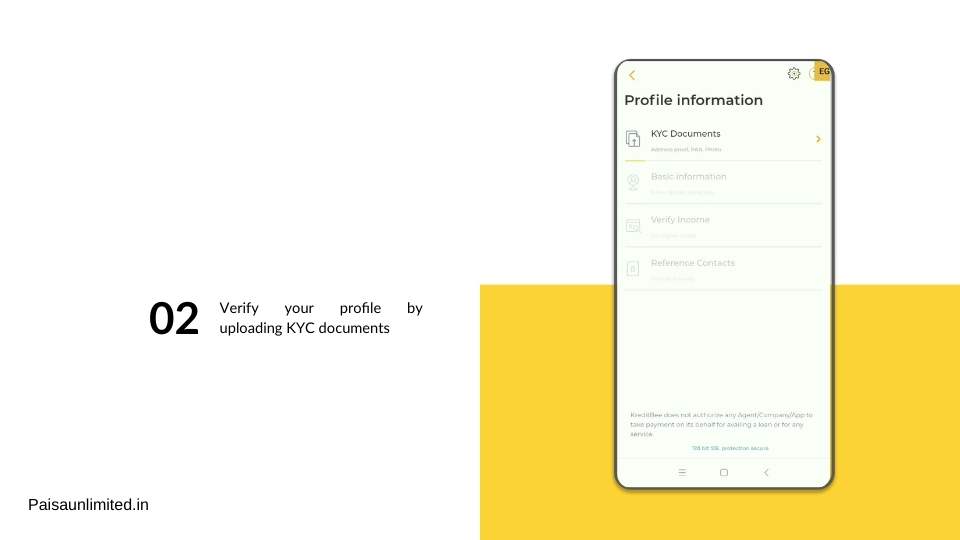

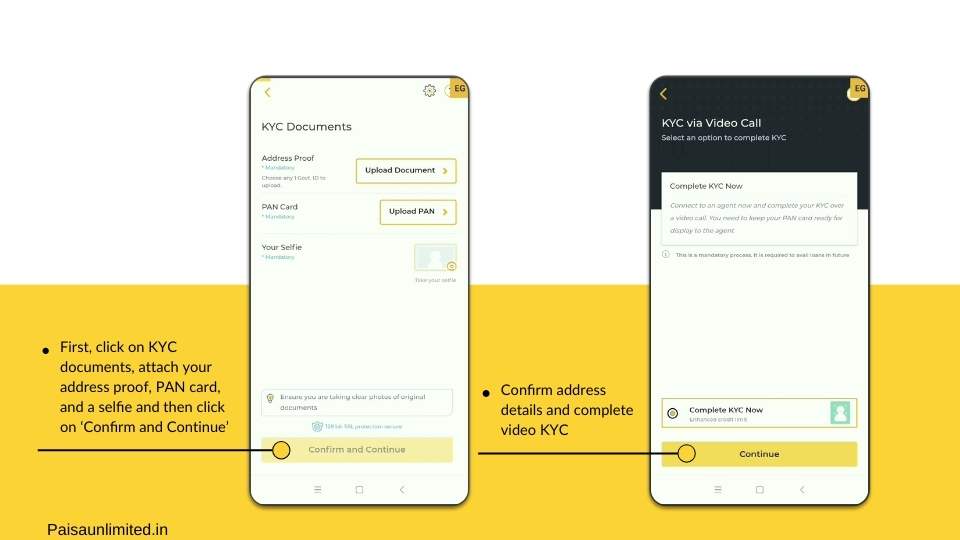

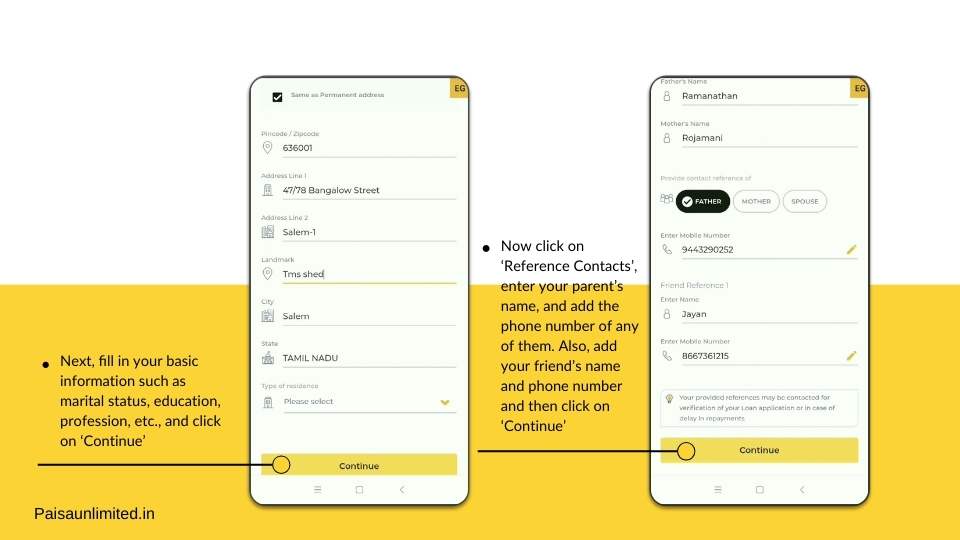

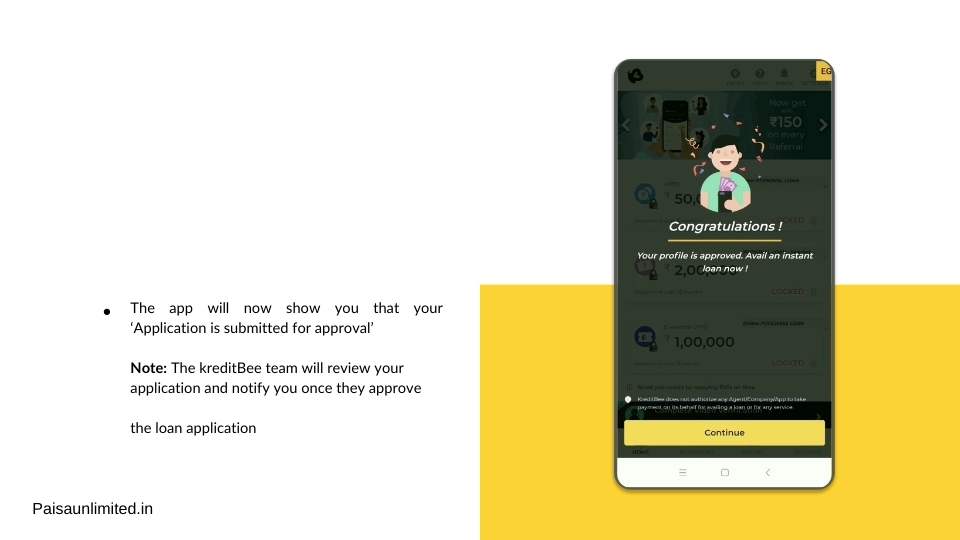

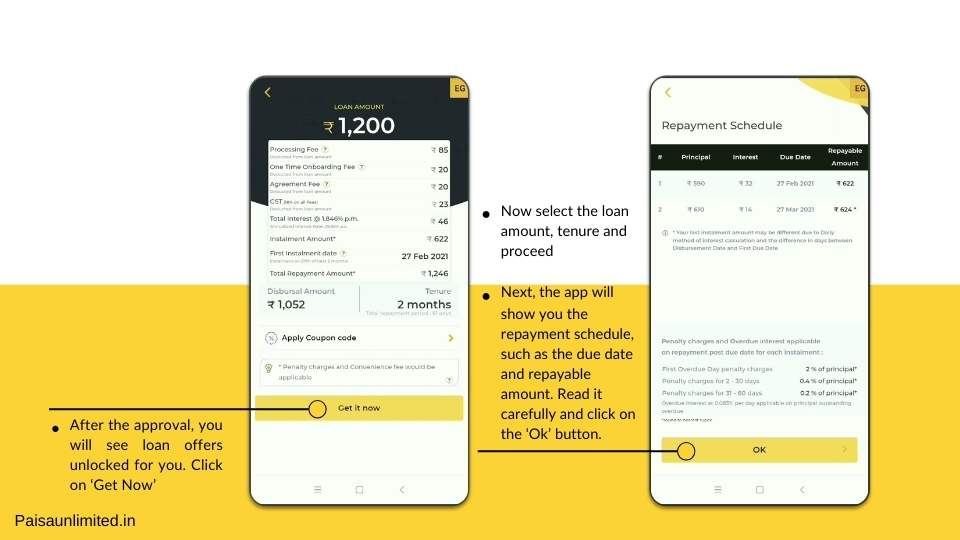

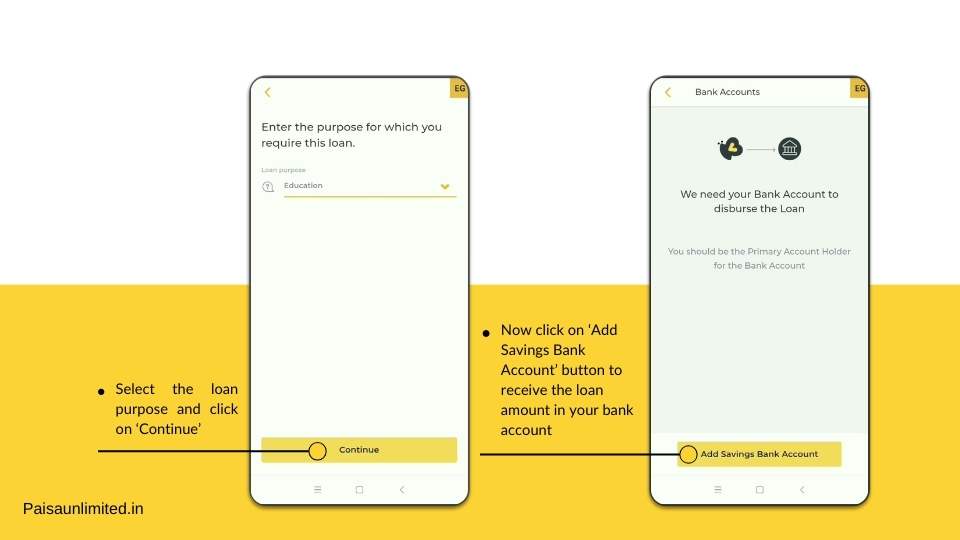

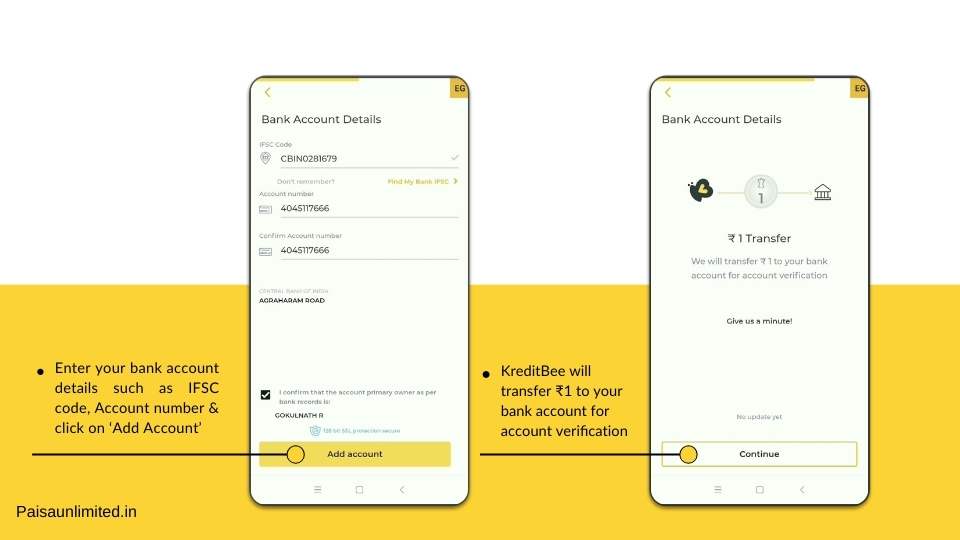

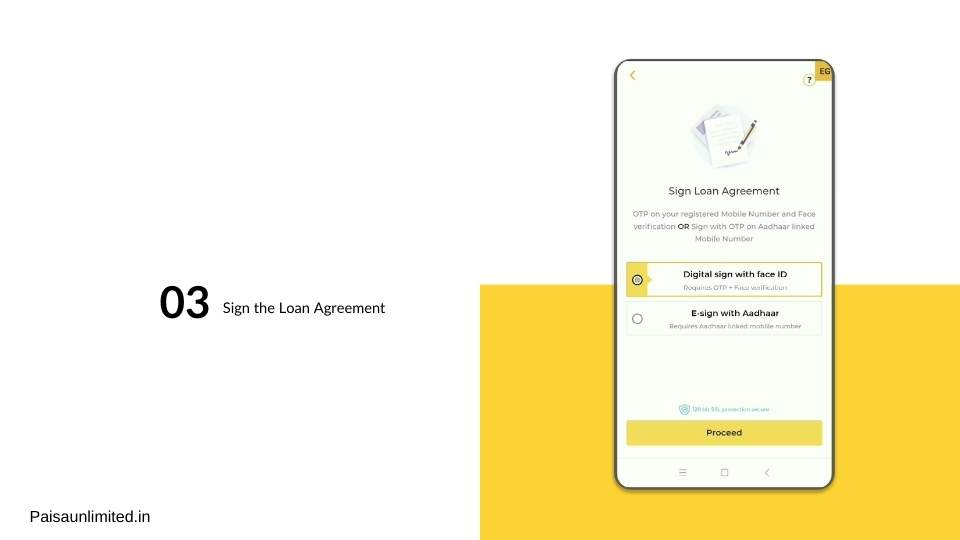

How To Apply For Loan on KreditBee App in 2024

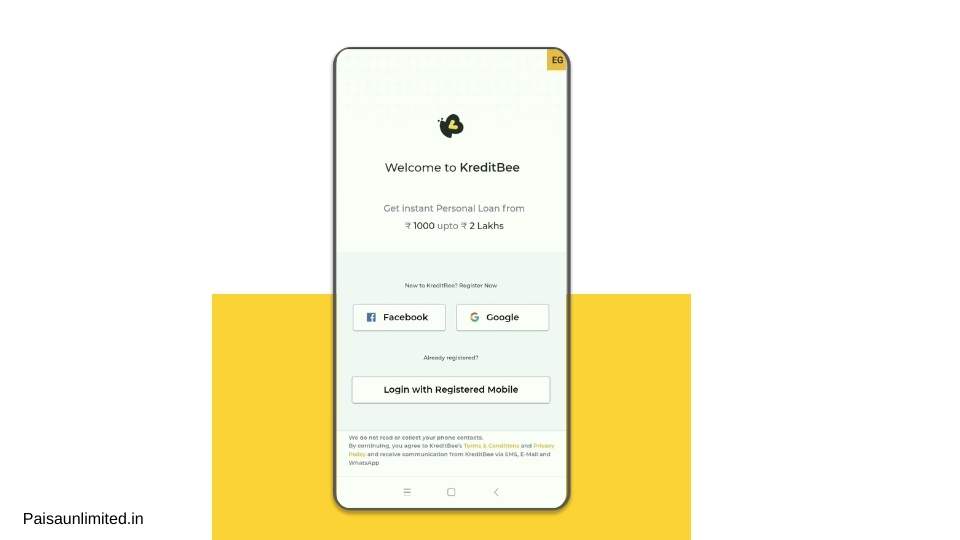

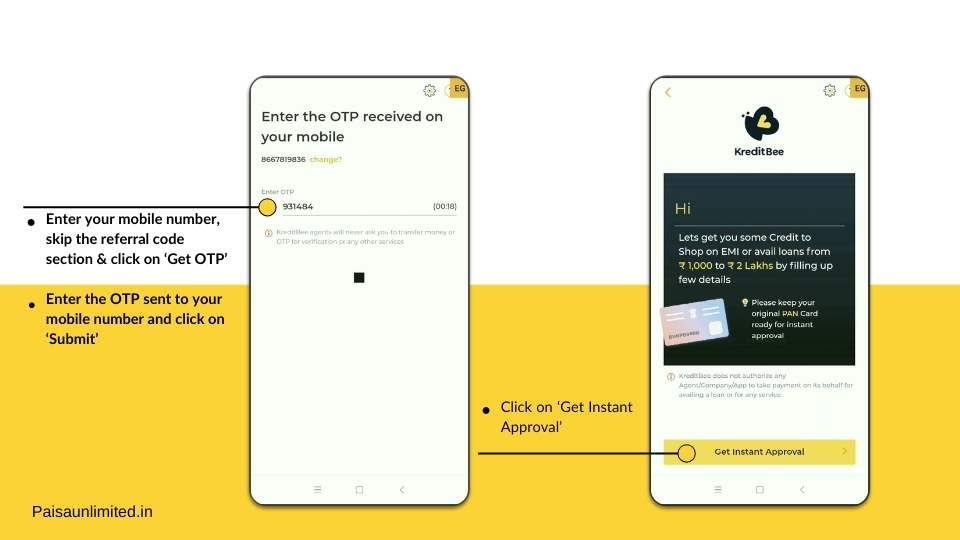

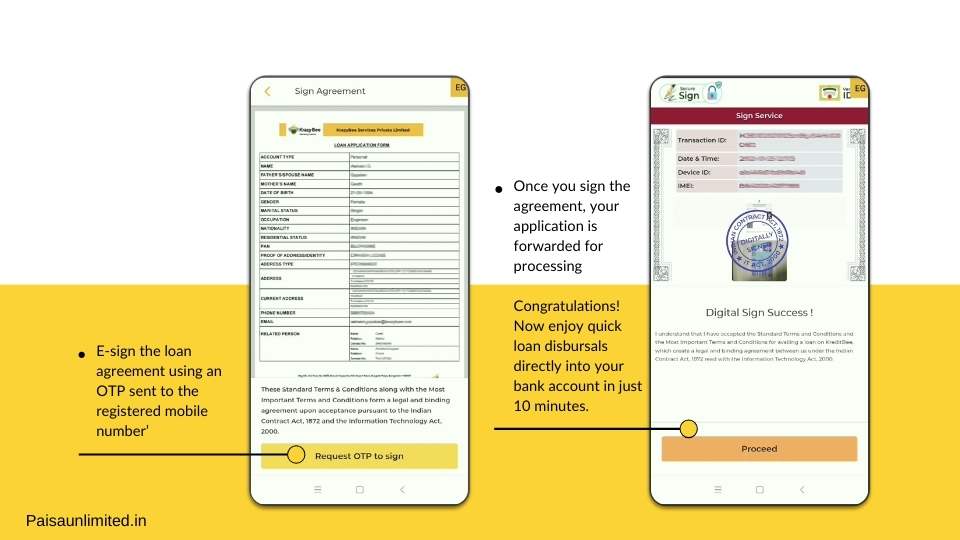

Visit the KreditBee app from the Google Play Store by clicking on the link and start the application journey.

- Sign up using mobile number:

- Login and give all the necessary permissions to the app.

- by accepting the terms and conditions and click ‘I, Agree’.

KreditBee Loan App Overview

| Apply Link | Apply Here |

| Help Line Number | 080-4429 2200 |

| Support | help@kreditbee.in |

| Official Website | Visit Here |

Fine More Loan Applications Click Here

Conclusion : The KreditBee Loan App revolutionizes the borrowing experience with its user-friendly interface and swift processing. Offering loan amounts from ₹1,000 to ₹4 lakh with flexible tenures between 64 days and 24 months, it caters to a wide range of financial needs. The entirely online application process, requiring minimal documentation, eliminates the hassle of paperwork.

One of the app’s standout features is the rapid disbursal time, ensuring funds are transferred to your bank account within just 10 minutes. With competitive interest rates from 15% to 29.95% per annum, easy repayment options, no collateral requirements, and the ability to make purchases on EMI, KreditBee provides a comprehensive and efficient solution for urgent financial needs.

FAQ-

-

How quickly can I get a loan from KreditBee?

KreditBee strives for speed! Once your application is approved, you can expect the funds to be disbursed to your account within a few hours, ensuring you get the financial support you need without delay.

-

What sets KreditBee apart from other loan providers?

KreditBee stands out with its hassle-free application process, minimal documentation, and quick approval. We prioritize your convenience, providing a seamless and user-friendly experience for those seeking reliable financial assistance.

-

Are there any hidden charges with KreditBee loans?

Transparency is our priority. KreditBee ensures clarity in all transactions. You’ll find no hidden charges—what you see is what you get. We believe in building trust through openness and honesty.

-

Can I apply for a loan with a low credit score?

Yes! KreditBee understands that credit scores don’t define you. We consider various factors during the evaluation process, offering opportunities for individuals with varying credit histories to access the financial support they need.

-

What repayment options does KreditBee provide?

KreditBee offers flexible repayment plans to suit your financial circumstances. You can choose from multiple repayment options, making it convenient for you to manage and repay your loan without added stress. We believe in empowering you with choices.