i2iFunding Personal Loan is a new Indian loan platform. Which provides instant personal loan facility to the needy. It is known for low interest rates. Where you are charged only 2% to 4% interest monthly. If you are worried about frequent personal loan rejections, then you must try i2iFunding Personal Loan. Its complete information is given below step by step in this blog.

Benefits of i2iFunding Personal Loan

i2iFunding Personal Loan offers a comprehensive range of benefits designed to cater to diverse financial needs. With loan amounts ranging from ₹25,000 to ₹10 lakh and flexible repayment tenures spanning from 3 months to 36 months, borrowers have the flexibility to choose a loan that suits their requirements. The application process is quick and entirely online, ensuring convenience and minimal paperwork.

One of the standout features of i2iFunding is its competitive interest rates starting from 10.99% per annum, which helps borrowers save on borrowing costs. The platform is transparent, displaying all costs upfront, and ensures security with robust encryption methods for data protection. Additionally, i2iFunding does not charge any prepayment penalties, allowing borrowers to repay their loans early without any extra cost.

Moreover, timely repayment of i2iFunding loans can contribute to improving the borrower’s credit score. The platform serves a diverse range of borrowers including salaried individuals, self-employed individuals, and retired individuals, making it accessible to a wide audience seeking reliable and affordable financing solutions.

| Loan Amount | From ₹1,000 to ₹50,000 |

| Tenure | 1 to 6 months |

| Application Process | Simple online process Minimum documentation |

| Disbursal | Quick loan disbursal |

| Interest Rates | 2% to 4% |

| Others | No prepayment penalty Higher loan approval rate Low processing fee & Hassle-free process No security or collateral required to avail the loan Disbursal directly in bank account |

Eligibility Criteria Salaried

- Age Group: 21+ years

- Income Range: ₹3 lakhs per annum

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Salary certificate, Recent salary slip, Employment letter, etc.

You must be a resident of India

i2iFunding Personal Loan Application Process

Please keep the following documents and details handy to start the process

- Your Aadhaar card

- PAN card

- Bank account statement and

- Latest 3 month’s salary account statement (PDF/Netbanking)

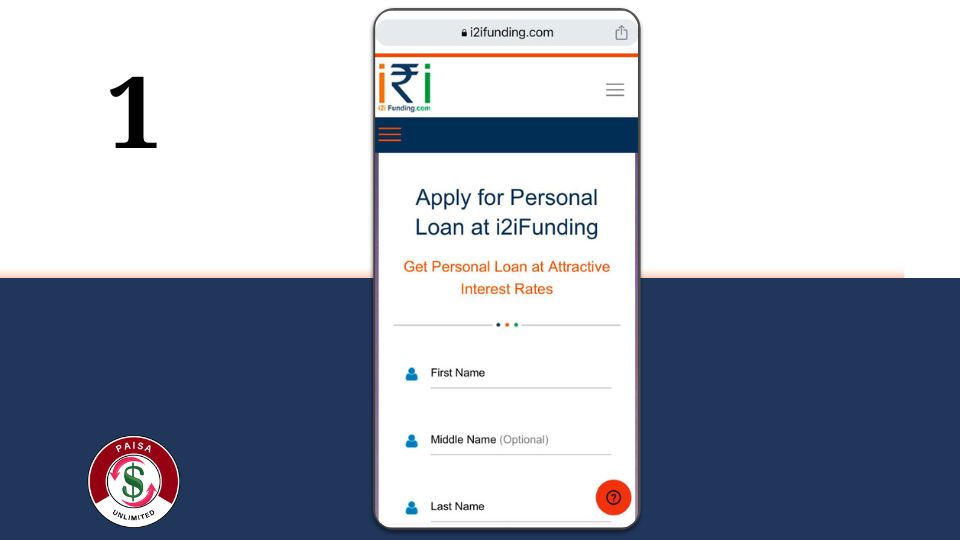

01: Let’s start!

Visit the i2iFunding Personal Loan website by clicking on the link and start the application journey

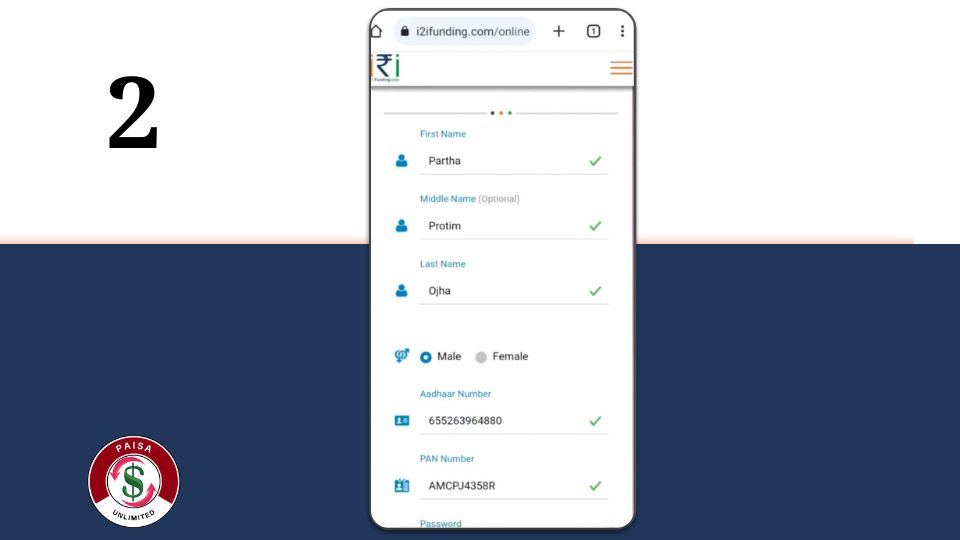

02: Enter your full name, gender, Aadhaar number, PAN number, etc., and verify through OTP Accept the terms & conditions and click on ‘Submit’

03: Enter your loan details, personal details, employment details, financial details, past CIBIL details and click on ‘Next’

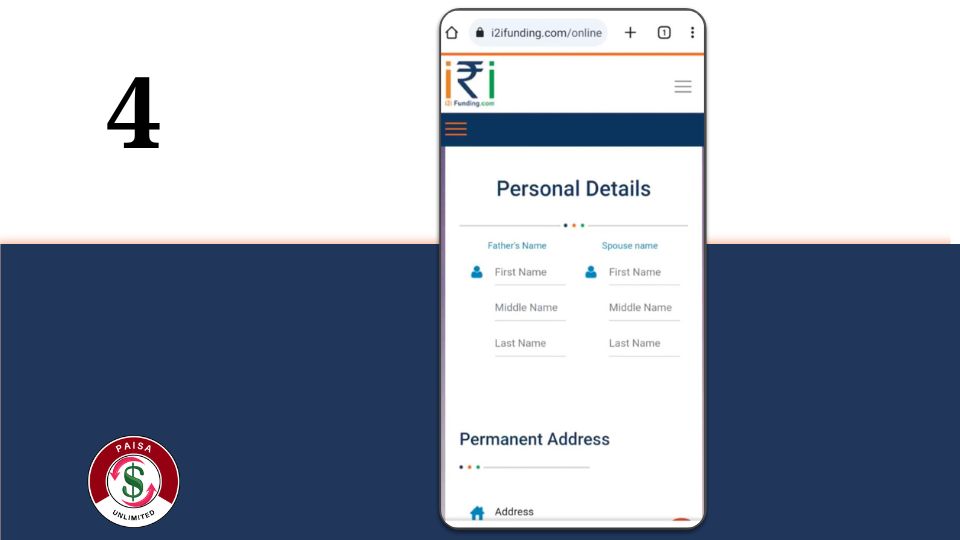

04: Enter your personal details such as your full name, permanent address, current address and proceed

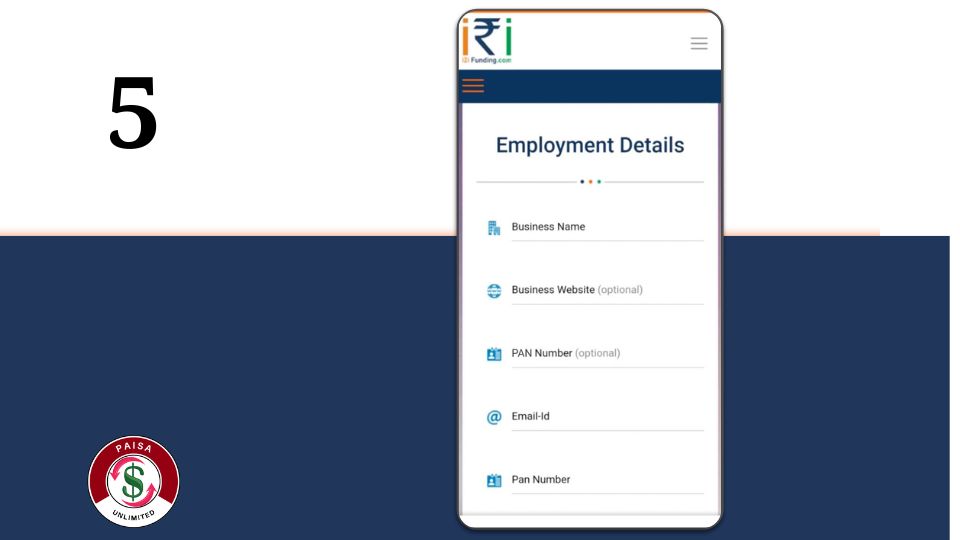

05: Enter your employment details, office address and click ‘Next’ Now Enter your education details and proceed

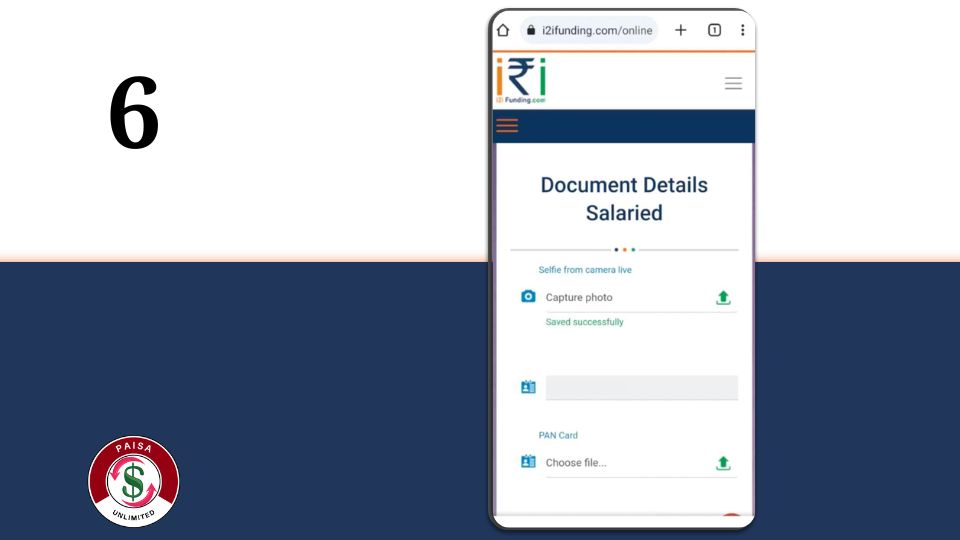

06: Upload the required documents, tick the checkboxes and click on ‘Submit’

Now, i2iFunding team will contact you for further processing

| Apply Link | Apply Here |

| I2IFunding Loan Helpline Number | +91-923 093 3820 |

| Email Support | loan@i2ifunding.com |

| Official Website Link | Official Website |

The application requires minimal documentation, making it convenient and hassle-free. Once submitted, i2iFunding conducts a swift review and verification process. Upon approval, funds are disbursed directly into the borrower’s bank account within a short period, typically within a few days.

i2iFunding prioritizes transparency and security, ensuring that personal and financial information is safeguarded using advanced encryption methods. The platform provides a user-friendly interface and responsive customer support to guide applicants through the entire process.

Overall, i2iFunding stands out for its competitive interest rates, flexible repayment options, and commitment to providing a seamless borrowing experience, making it a preferred choice for individuals seeking reliable and accessible personal loans in 2024.

Related Posts-

- Zype Personal Loan Application Process In 2024

- How to Apply For Loan On Prefr App in 2024

- mPokket Instant Loan – Best Loan App For Students in 2024

- Low Interest Rate Personal Loan in India 204 – Kissht Personal Loan

FAQ-

How much is the processing fee?

Processing fee for this loan is 4% to 10% of the loan amount

How can I connect with i2iFunding Personal Loan customer care?

You can contact i2iFunding customer care for any query related to personal loan

Phone number: +91-923 093 3820

Email: loan@i2ifunding.com