Prefr Instant Loan provides its customers with the facility of instant loan ranging from Rs 25 thousand to Rs 3 lakh. Which is given for a period of 3 months to 3 years. Taking a loan online has become even more convenient due to the 100% online process for Prefr Instant Loan and also being completely paperless.

Benefits of Prefr Instant Loan

| Loan Amount | 25,000 to ₹3 lakh |

| Tenure | 3 to 36 months |

| Application Process | 100% digital process Minimal documentation No paperwork Fast & easy process |

| Disbursal | Quick loan disbursal |

| Interest Rates | 18% p.a. onwards |

| Others | No collateral required Low processing fee Fast & flexible |

Eligibility Criteria Salaried

- Age Group: 22 – 55 years

- Income Range: ₹18,000+

Documents Required:

- Identity proof: Any one of the documents – PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Aadhaar card, passport, Voter ID Card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

Eligibility Criteria For Employee

- Age Group: 22 – 55 years

- Income Range: ₹20,000+

Documents Required:

- Identity proof: Any one of the documents – PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Aadhaar card, passport, Voter ID Card

- Business Proof: Proof of Business Existence, Certificate of Incorporation, Certificate of Registration with Appropriate Registration Body

- Income Proof: ITR of Past 2 years, Certified Profit and Loss Statement

Customer must be an Indian resident

Application Process Of Prefr Loan

Please keep the following documents and details handy to start the process

- Your PAN card

- Aadhaar card

- Bank account details

- Last 3 month’s bank statement with salary

- credits or business proof

Let’s start!

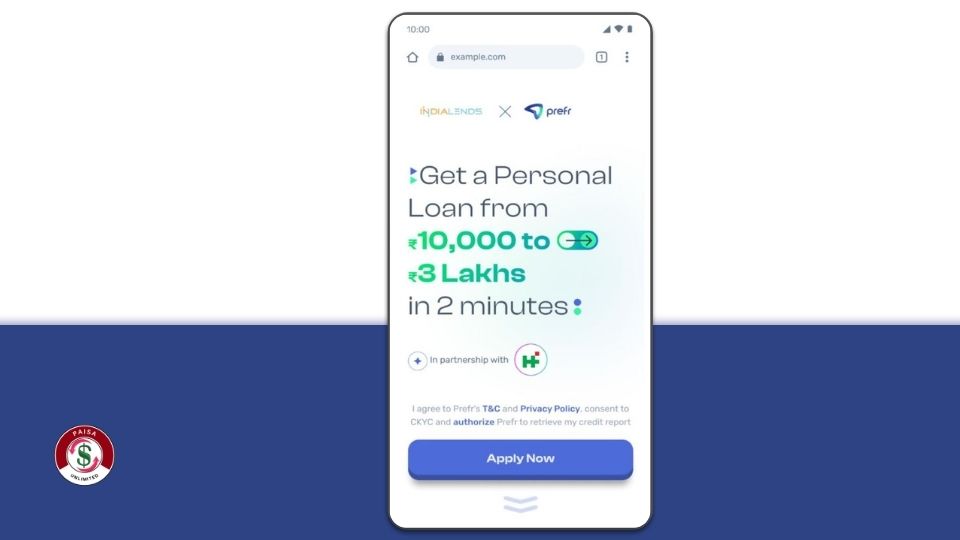

Visit the Prefr website by clicking on the link and start the application journey.

01: Mobile number authentication:

- Click on ‘Apply Now’, enter your mobile number and click on ‘Send OTP’

- Enter the OTP sent to your mobile number and proceed

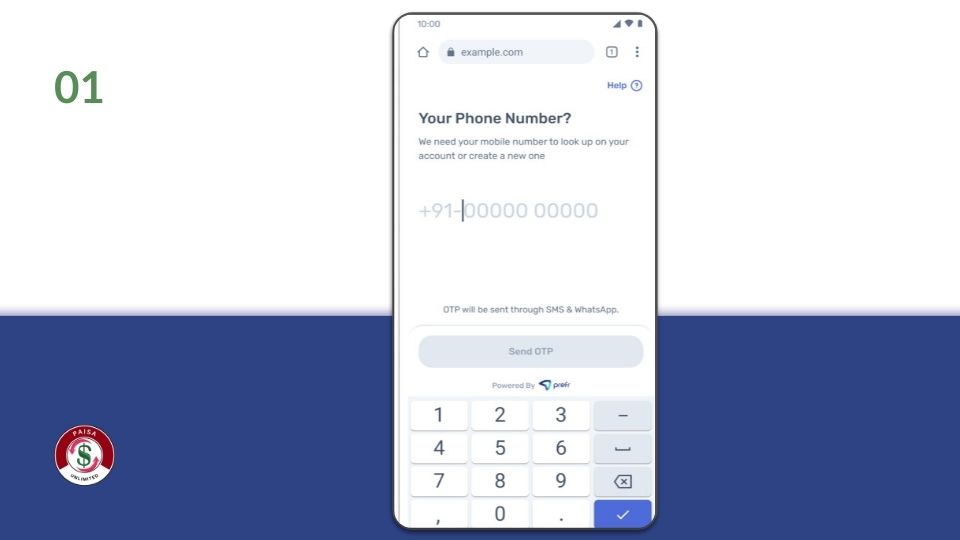

02: Fill your details:

- Enter your details such as full name, date of birth, desired loan amount, select employment type, etc., and click on ‘Proceed’ (image 1)

- Enter your personal details such as gender, PAN number, Pincode, personal email ID and click on ‘Get Offer’ (image 2)

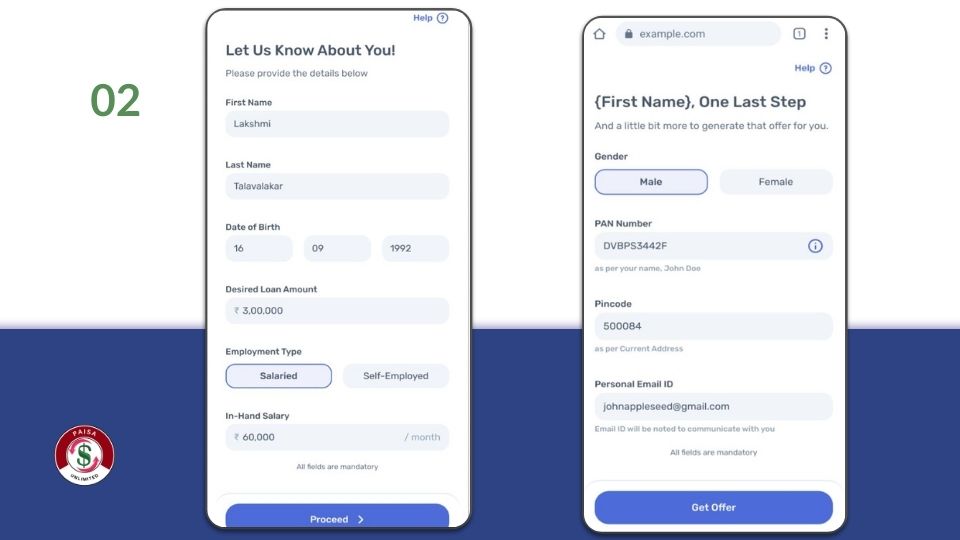

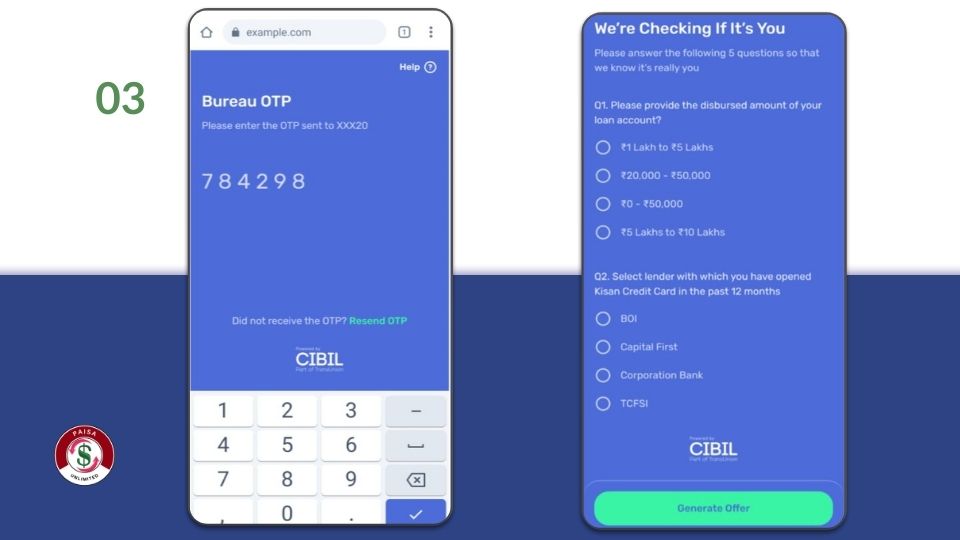

03: Credit bureau authentication:

- After completing your application details, you will go through credit bureau authentication.

- An OTP will be sent for authentication, enterthe OTP and proceed

- For additional authentication, you have to answer some bureau-related questions and click on ‘Generate Offer’

- For additional authentication, you have to answer some bureau-related questions and click on ‘Generate Offer’

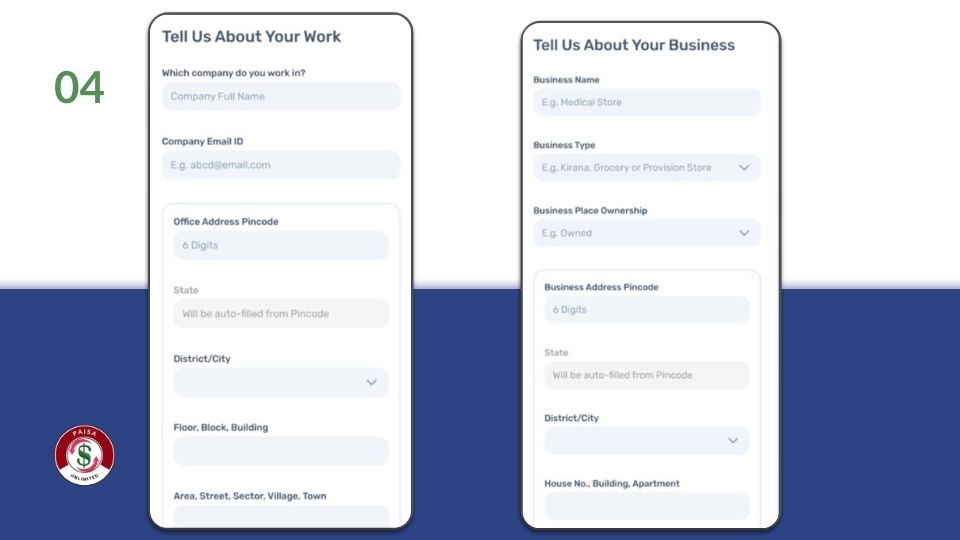

04: Choose your loan offer:

- Provide your work details based on the type of employment

- a) If you are salaried, enter your company details such as company name, company email ID and office address

- b) If you are self-employed, enter your business details such as business name, business type, business place ownership and business address

- Click on ‘Proceed To KYC’

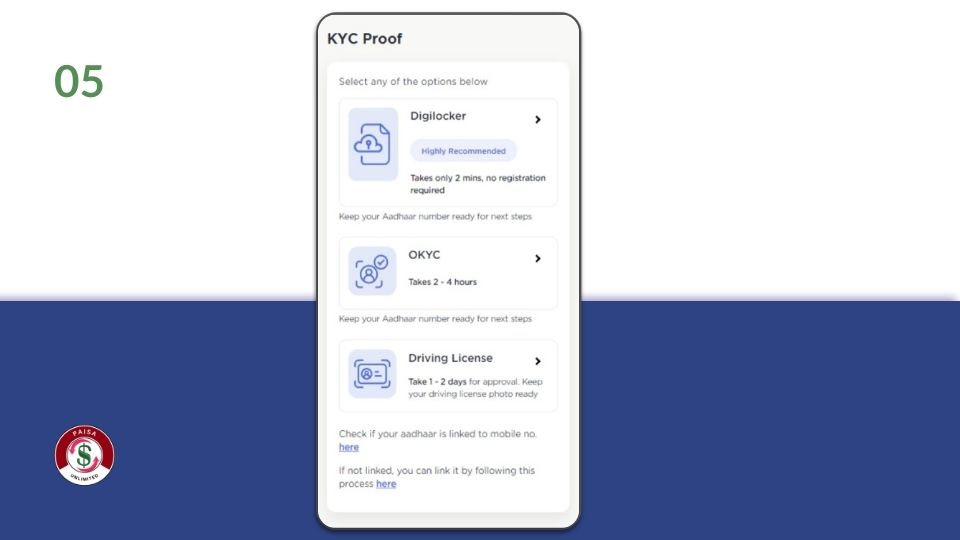

05: The final step is to complete your KYC:

Upload the required documents and complete KYC

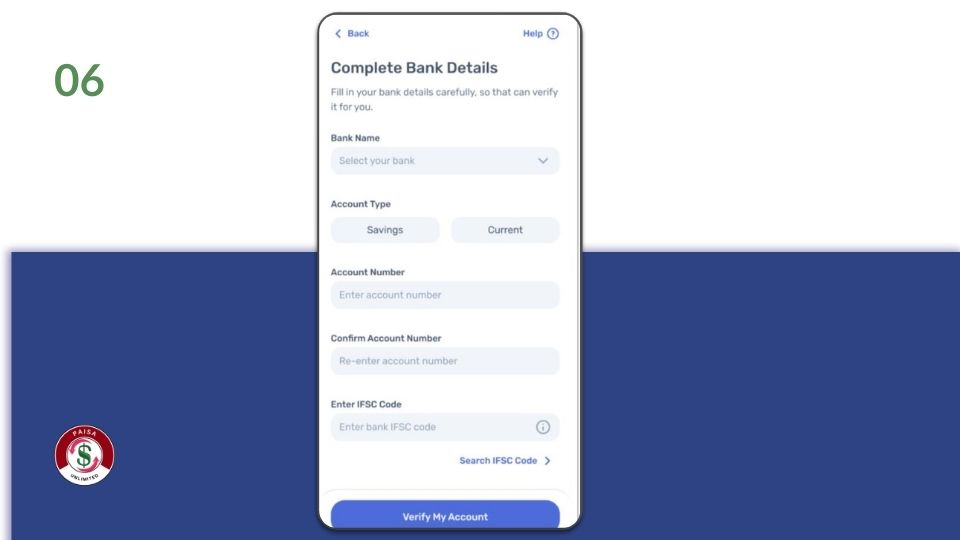

06: Add your bank account details such as bank name, account number, IFSC code, etc., and verify

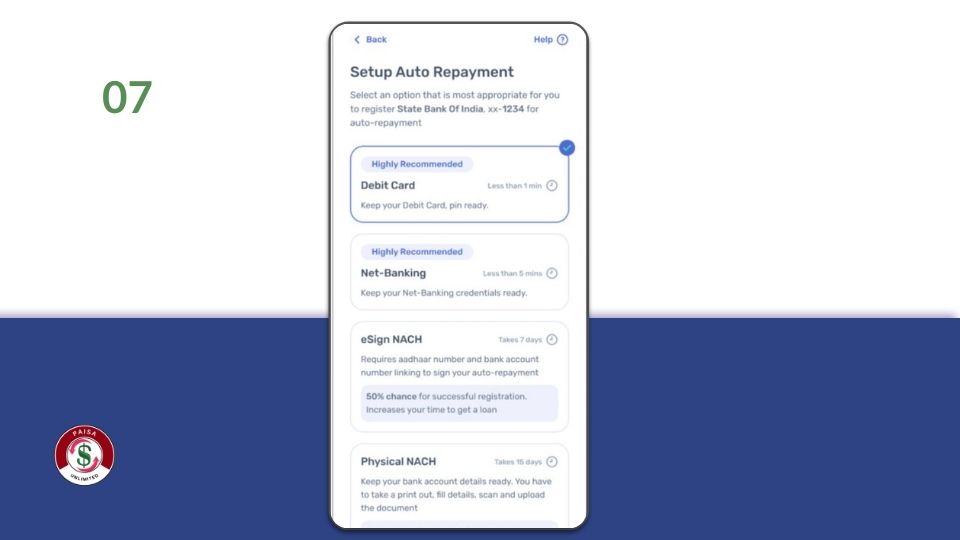

07: Set up auto EMI repayment

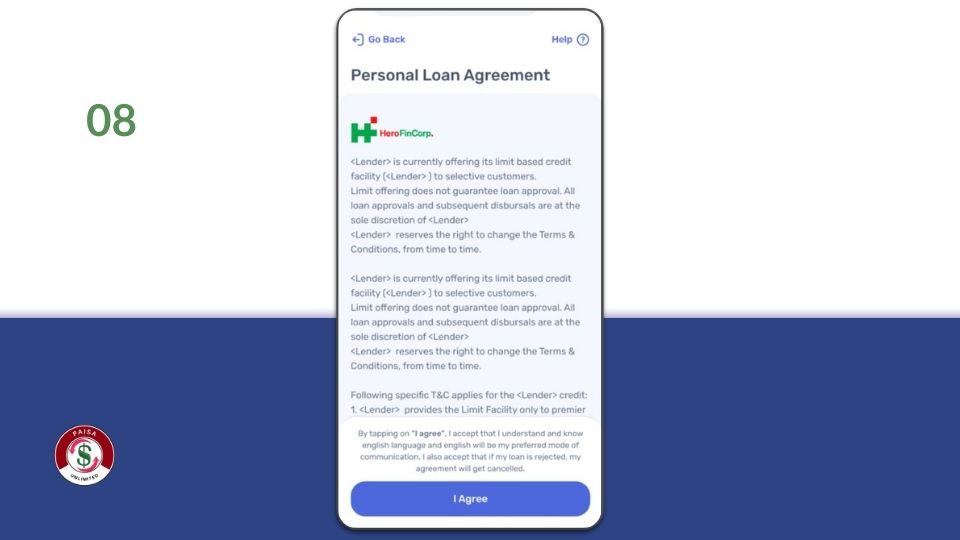

08: Read the loan agreement and click on ‘I Agree’ Prefr team will review your loan application and disburse the loan within 24 hours

Prefr Instant Loan Application Overview 2024

| Apply Link | Apply Here |

| Prefr Loan Helpline Number | 1800-102-4145 |

| Support Email | wecare@prefr.com |

| Official Website | Prefr |

conclusion : In 2024, applying for a loan on the Prefr App is simple and convenient. Users can complete the entire process online with minimal documentation. Prefr offers competitive interest rates and flexible repayment options, ensuring a hassle-free borrowing experience. With quick approval and disbursal of funds directly to your bank account, Prefr App is an excellent choice for those seeking quick financial assistance.

Related Posts

mPokket Instant Loan – Best Loan App For Students in 2024

Low Interest Rate Personal Loan in India 204 – Kissht Personal Loan

CASHe Instant Loan Application in 2024

FAQ-

What documents are required to get a personal loan

from Prefr?

List of documents -1.PAN Card

2.Aadhaar Card

3.3 months bank statement in PDF format

4.Business proof

I don’t have a credit(CIBIL) score. Will I get a loan?

Yes, Prefr will use your banking data to generate an offer for you.

How long will it take to get Prefr Personal Loan?

Prefr personal loan will be disbursed in your bank account within 24 hours

How can I contact prefr customer care?

You can send an email to wecare@prefr.com

Prefr Loan Fake or Real ?

If you have all required documents and Complete Eligibility Criteria than you can get loan from it. its mean its Real