Kissht Personal Loan offers personal loans up to Rs 4 lakh to its customers for a tenure of 6-24 months. The loan application process is 100% online and paperless. Complete information related to Kissht Personal Loan has been given to you in this blog, read till the end!

Benefits of Kissht Personal Loan

| Loan Amount | Credit line up to ₹2 lakhs |

| Tenure | 6 to 24 months |

| Application Process | 100% digital KYC No paperwork Minimal documentation Fast & easy process |

| Disbursal | Quick disbursal |

| Interest Rates | 14% to 20% p.a |

| Others | Only PAN and Aadhaar card required Easy repayment over 24 months |

Eligibility Criteria Salaried

- Age Group: 21 – 58 years

- Income Range: ₹30,000+

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Salary certificate, Recent salary slip, Employment letter, etc.

Other Eligibility Criteria

- You must be a resident of India

- CIBIL score must be 700+

Application Process For Loan

01: Please keep the following documents and details handy to start the process

- Your PAN card

- Aadhaar card

02: Let’s start!

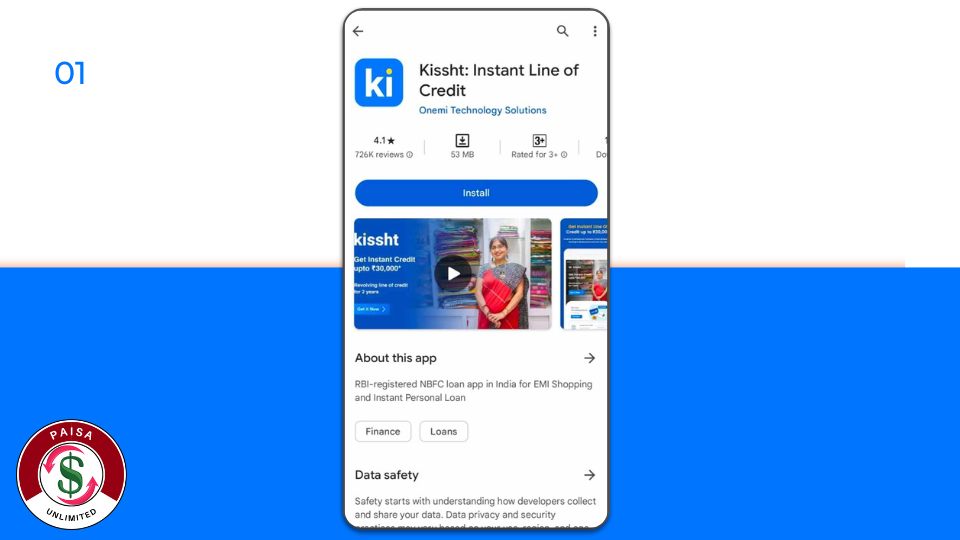

Download the Kissht Personal Loan app from the Google Play Store and start the application journey.

- Open the app and click on ‘Apply Now’

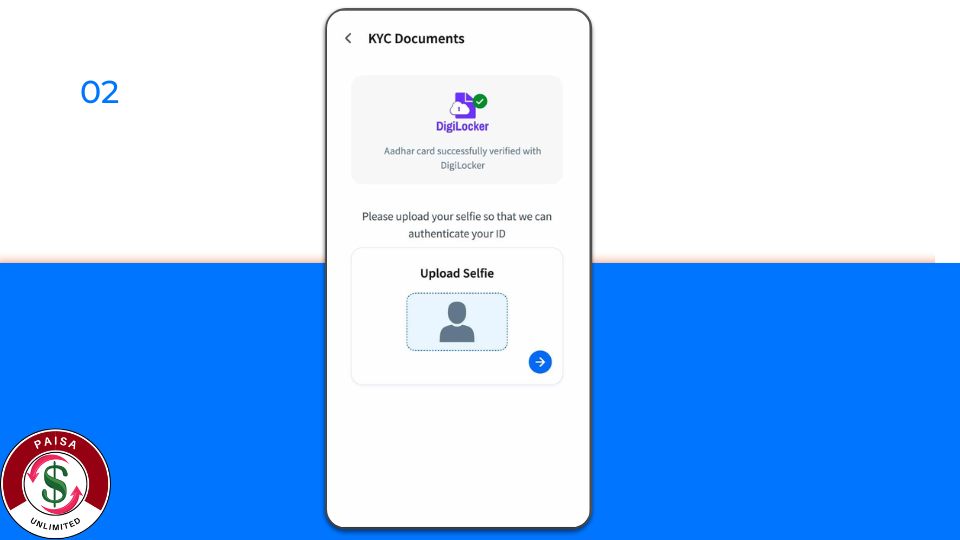

- Complete the verification of your KYC documents using DigiLocker and enter the OTP sent to your

- Aadhaar registered mobile number

- Upload your selfie and continue

- Enter your PAN number and proceed

- Enter your personal details such as your father’s full name, marital status, employment status, etc.

03: Give consent for CKYC and continue

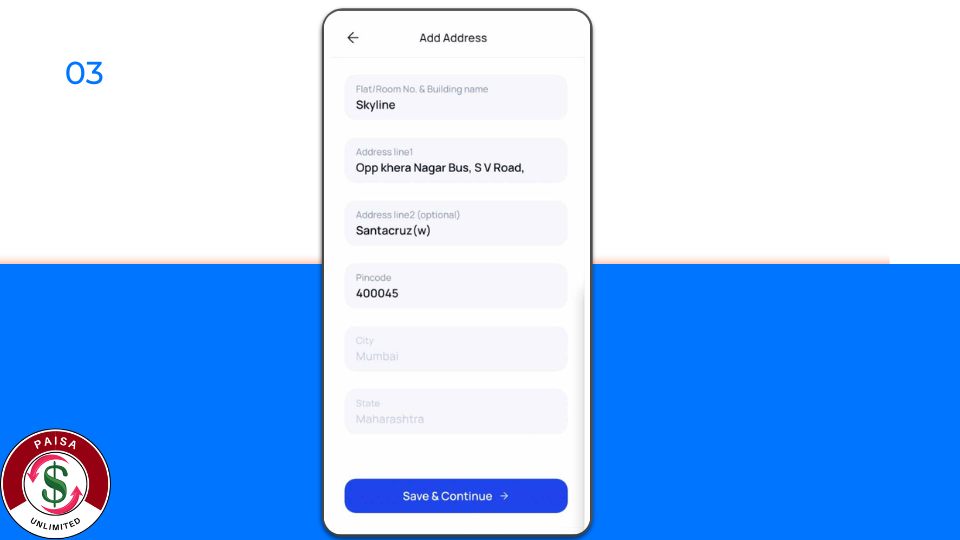

- Enter your address details and click ‘Save & Continue’

- Confirm your communication address

- Now you can see your approved credit limit displayed on the screen, click on ‘Proceed’

- Link your salary account and verify your income to upgrade your credit limit

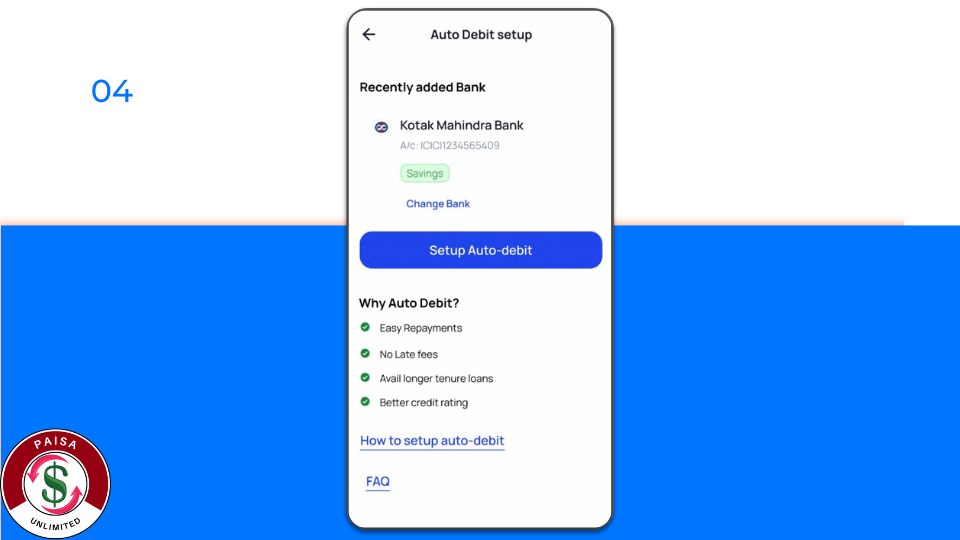

04: Select your bank name and verify

- Add your bank account details such as IFSC code, bank account number, account holder name, etc., and confirm

- Set up auto debit for your personal loan

- After the verification, the cash will be transferred to your bank account within few hours

Kissht Personal Loan Overview

| Apply Link | Apply Here |

| Helpline Number | 022 62820570 / 02248914921 |

| Support Email | care@kissht.com |

| Official Website | Visit Now |

You May Interested

- CASHe Instant Loan Application in 2024

- Nira Finance Instant Loan Apply Online 2024

- Fibe Loan App – Instant Loan Application in 2024

FAQ-

Can I apply for the loan process with a photocopy of my PAN Card instead of the original?

You can submit the photocopy of your PAN Card to Kissht who will do their best to ensure that your loan gets sanctioned. All you have to do is self-attest the photocopy of your PAN card, provide your signature and then upload it on the Kissht app.

Can I skip paying the processing fee and request Kissht to deduct it from my loan amount at the time of loan disbursement?

No, the processing fee has to be paid upfront and we cannot deduct the same from your loan amount. You don’t have to worry about losing the processing fee in case of loan cancellation as Kissht refunds 100% of the processing fee in case of loan cancellation before approval.

How can I contact Kissht Personal Loan customer care?

You can contact Kissht’s customer care for any query related to personal loan

Phone number: 022 62820570 / 02248914921 from 9:30 AM to 6:30 PM

Email: care@kissht.com

You can also use WhatsApp chat to reach us at 022 48913631

Is Kissht Finance registered with RBI?

Kissht is an RBI-registered NBFC and is a clean, transparent organization.