IDFC FIRST Bank Credit Card offers a range of benefits designed to enhance your spending experience. Enjoy attractive rewards on every purchase, along with generous cashback offers and discounts on dining, shopping, and travel. The card provides interest-free cash withdrawals for up to 48 days and no annual fees, making it cost-effective.

Cardholders benefit from flexible EMI options and contactless payment technology for added convenience. Additionally, the card includes complimentary insurance coverage and 24/7 customer support, ensuring peace of mind and assistance whenever needed. With IDFC FIRST Bank Credit Card, you enjoy a blend of rewards, savings, and security.

IDFC FIRST Bank Credit Card Benefits

Benefits OF IDFC First Bank Credit Card On Shopping

- 6X rewards on online purchases 50+ In-app discounts*

- 5% cashback on first EMI done within 90 days

- 3X rewards on offline & rental spends

Movies & Dine-in

- Avail discounts from 25%-50% on movies

- Up to 20% OFF on dining in at 1500+ restaurants

Others Benefits

- Complimentary lounge & golf access on premium cards*

- Earn rewards that never expire

- Zero over-limit fees, zero add-on charges

- Interest-free cash withdrawal from ATMs

- Lifetime FREE Credit Card

- Personal Accident cover and Zero Lost

- Card Liability

Special Benefits

- No Fee – Joining fee

- No Fee – Annual fee

- Credit Limit – Upto 5 Lakhs

Eligibility Criteria Salaried

- Age Group: 25 Years & above

- Income Range: ₹30,000+

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

Eligibility Criteria Self-employed

- Age Group: 27 years and above

- Income Range: ITR>5 Lakhs with mandate

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card

- Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet

Other Eligibility Criteria

- You must be a resident of India

- You should have an existing Credit Card

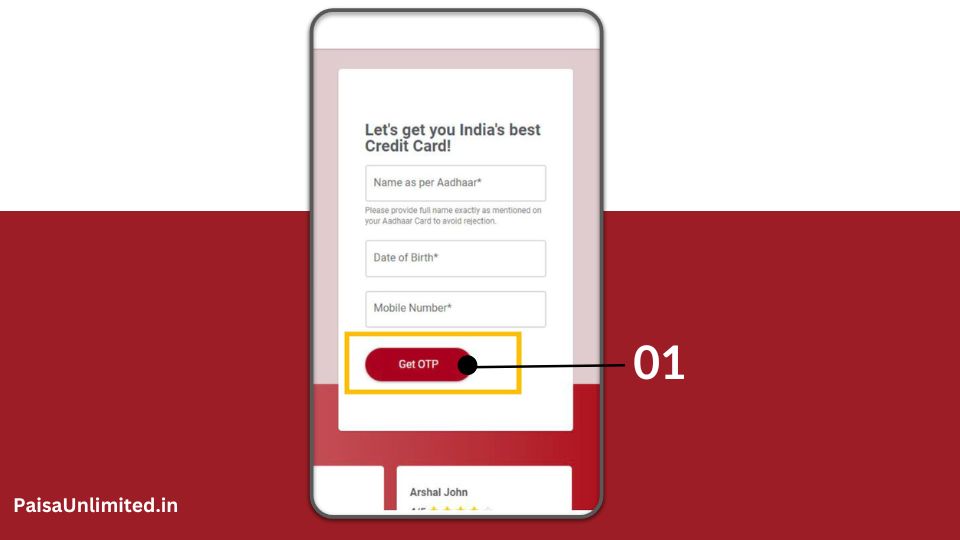

Application Process Of IDFC First Bank Credit Card

01: Enter your details and click on ‘Get OTP’ (Apply Link)

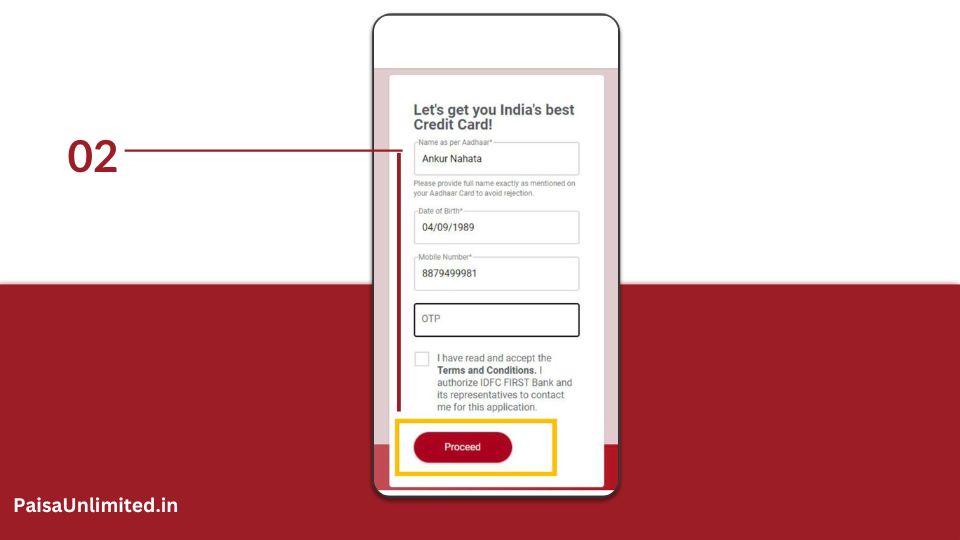

02: Enter the OTP, accept T&C and click on ‘Proceed’

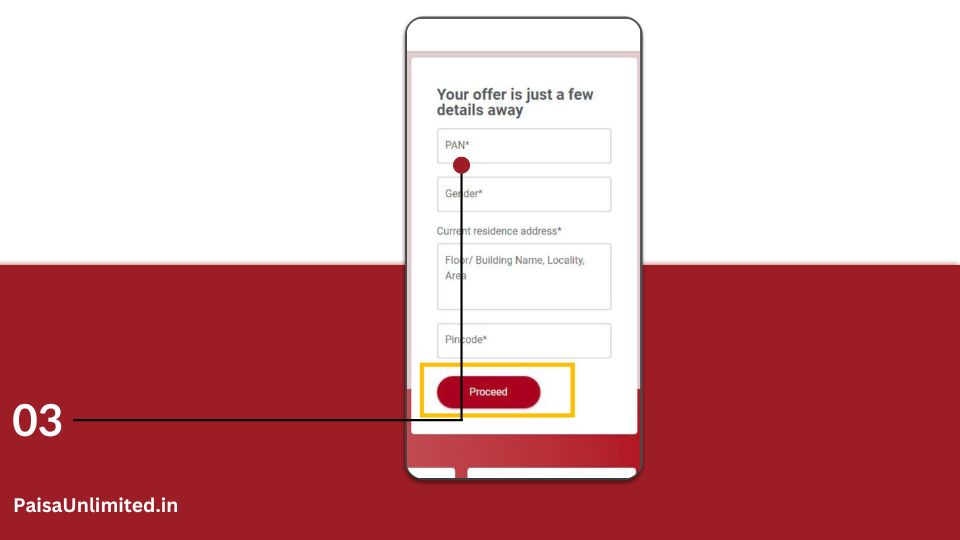

03: Enter the PAN number, gender, address details and proceed

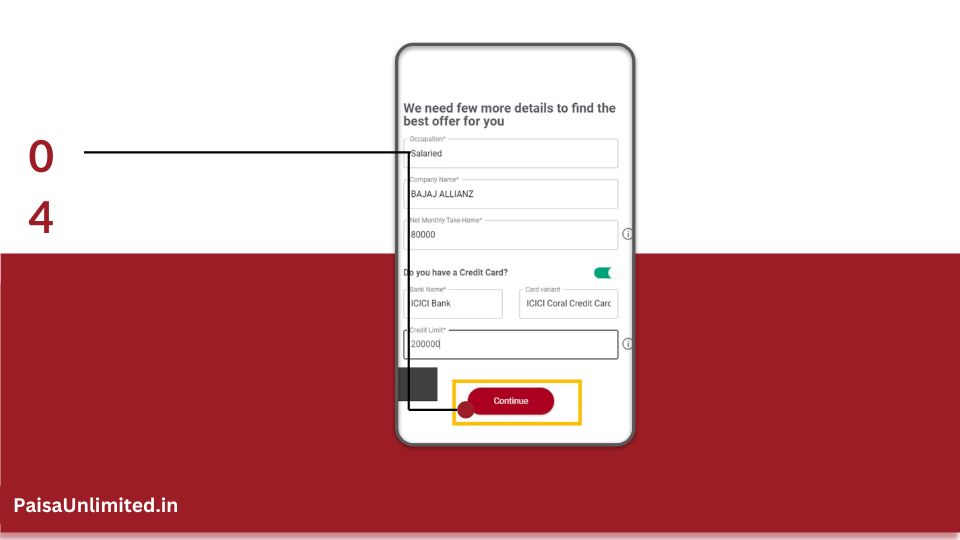

04: Enter few more details such as occupation, company name, etc. and click on ‘Continue’

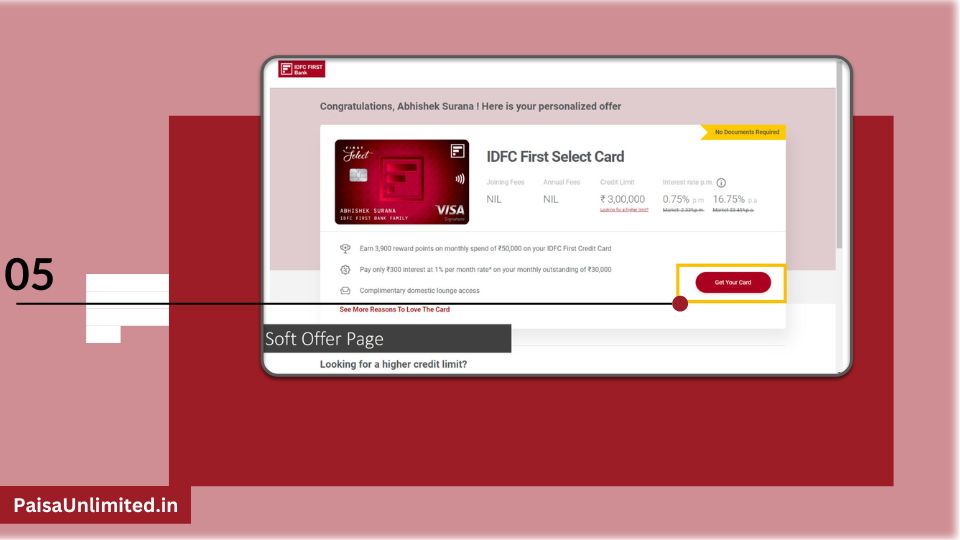

05: The best offer is shown on the screen if a customer is eligible for a credit card. Click on ‘Get your card’

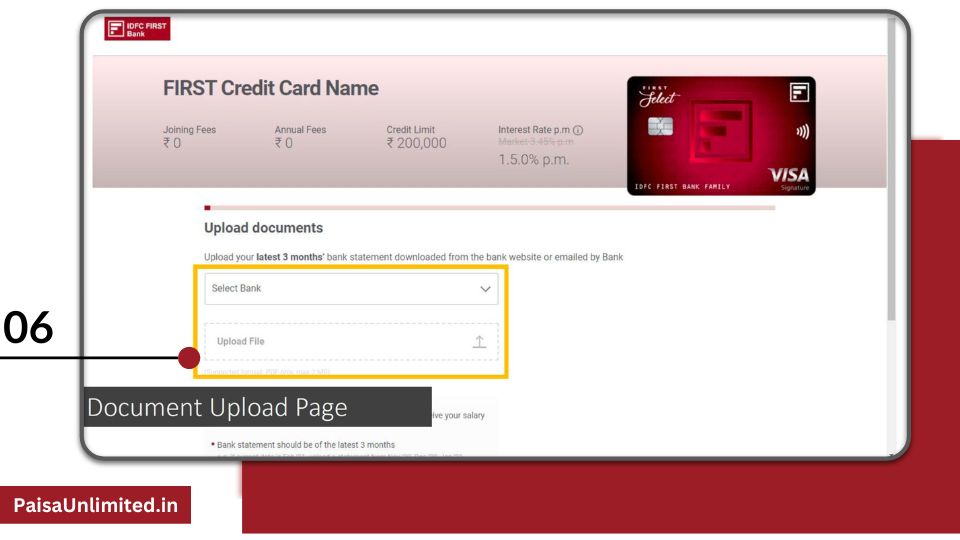

06: Select a bank, upload a bank statement and click on ‘Proceed’ (Note: Document upload basis offer chosen: Bank Statement- Salary Account, Latest ITR or Credit Card Statement)

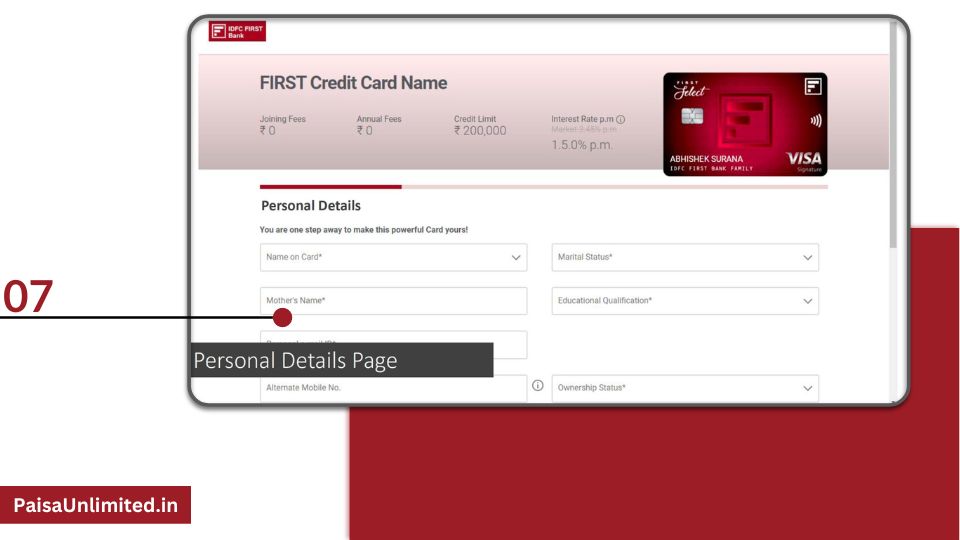

07: Enter the personal details such as name, marital status, etc., and click on ‘Proceed’

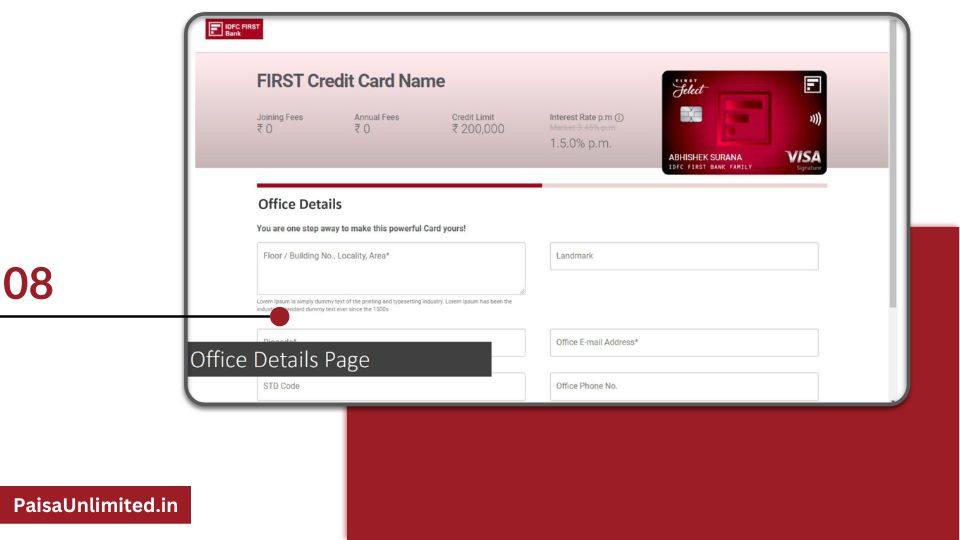

08: Enter office details such as address, phone number, etc., select card preferences and click on ‘Proceed’

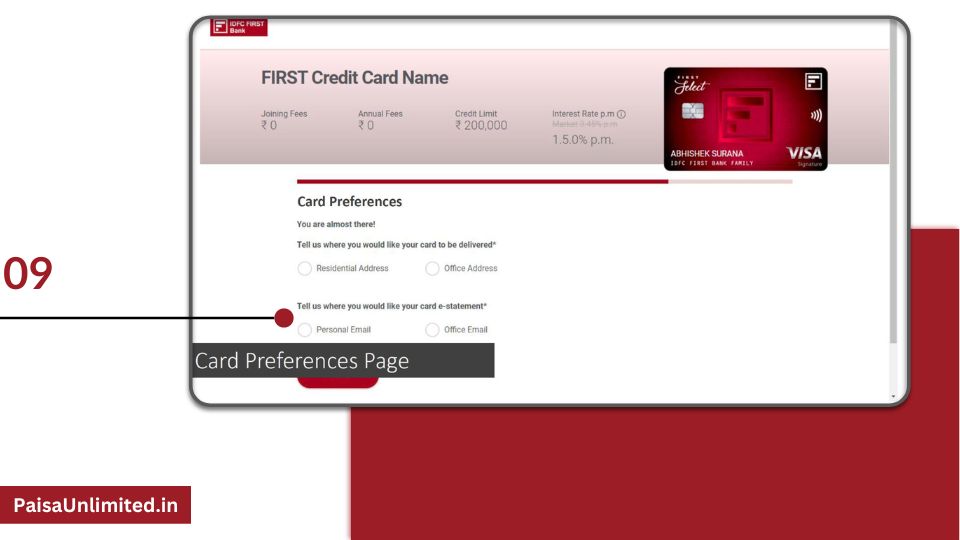

09: Add Card preference details

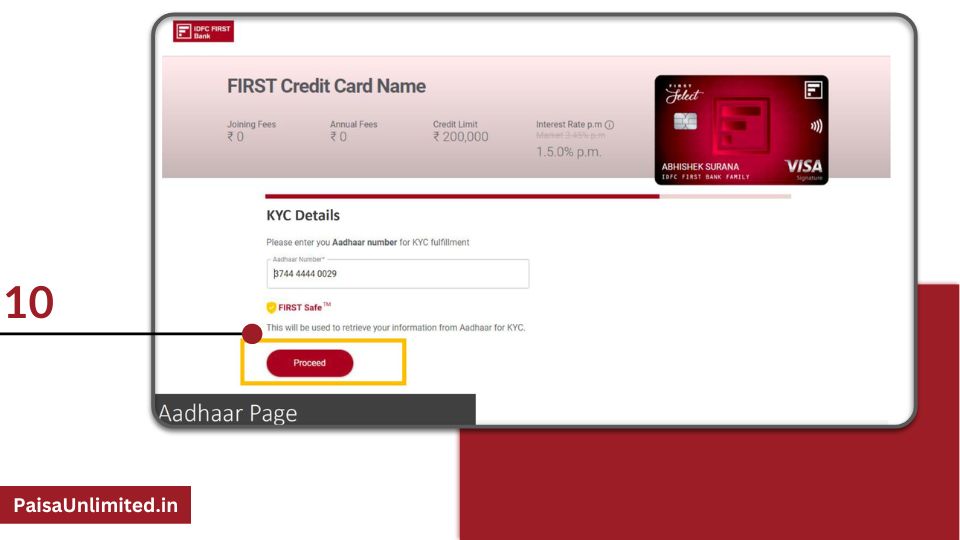

10: Enter KYC details such as Aadhaar number and click on ‘Proceed’

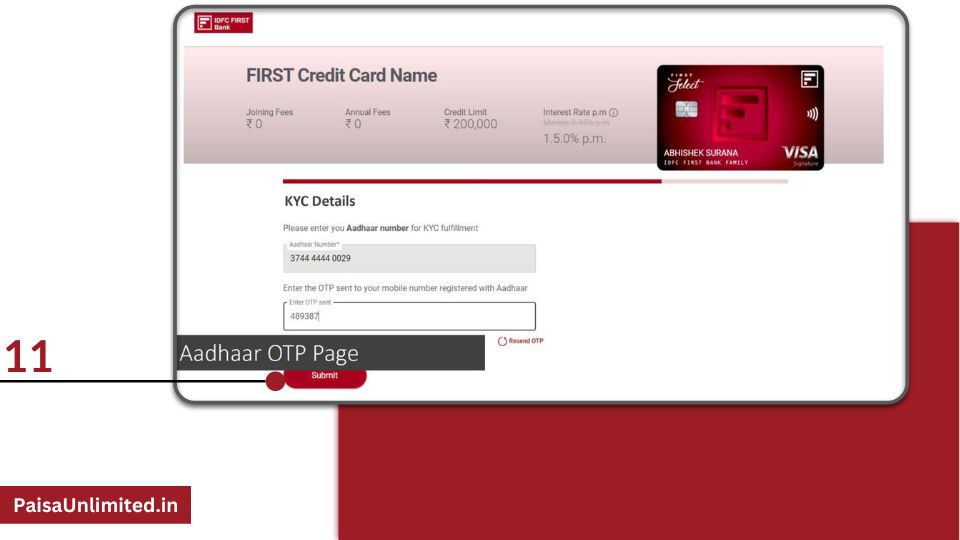

11: the OTP sent to the registered Aadhaar mobile number and click on ‘Submit’

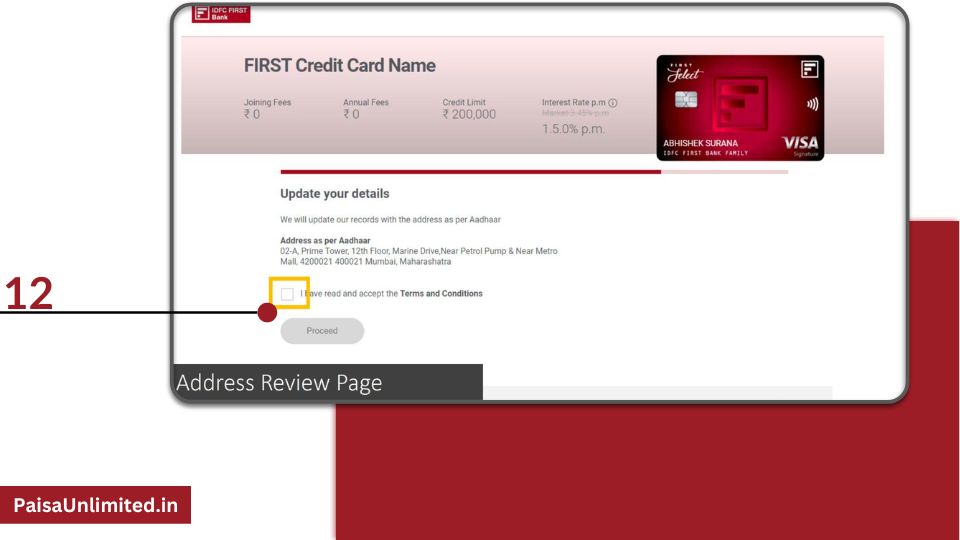

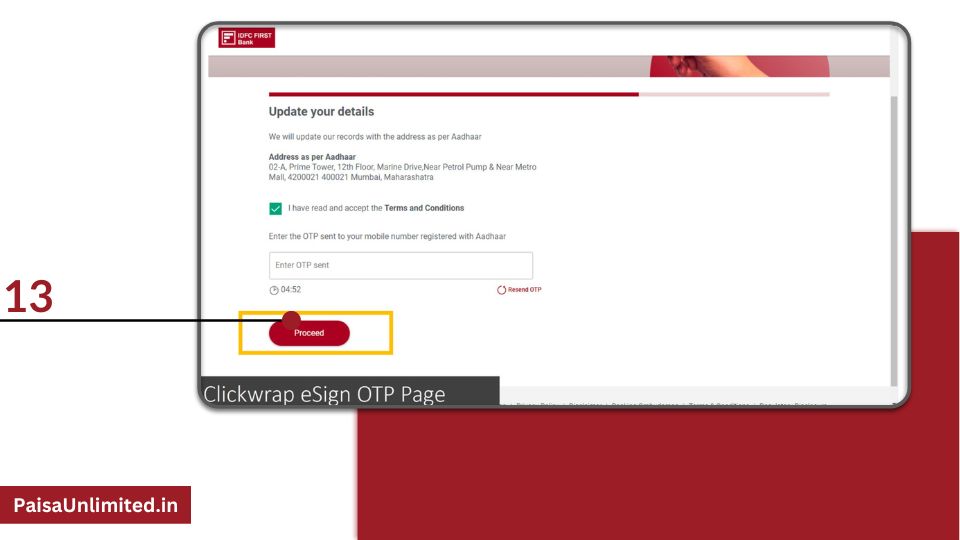

12: Accept the terms and conditions, enter the OTP and click on ‘Proceed’

12: Enter OTP sent on Aadhaar registered Mobile Number

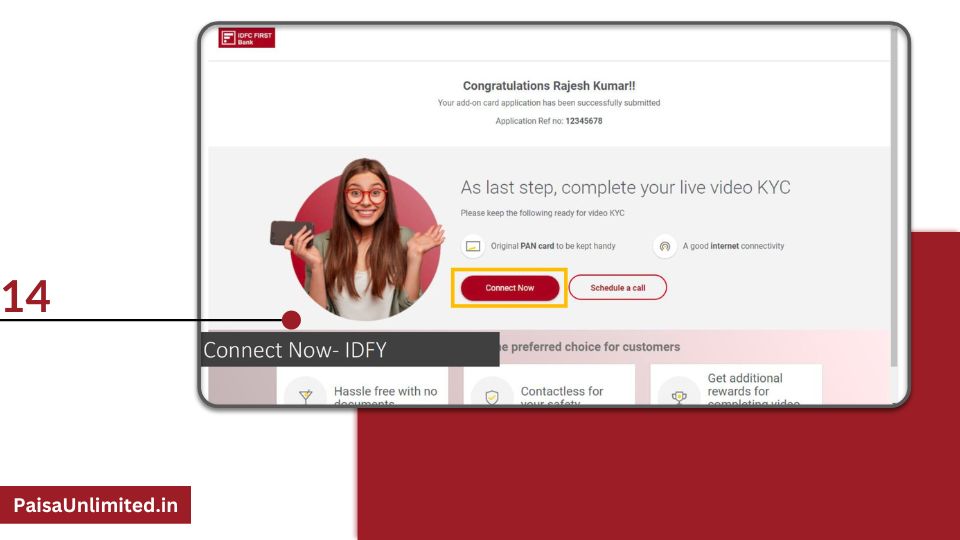

14: Complete live video KYC by connect now or schedule a call

Congratulations!: Enjoy the Benefits of IDFC FIRST Bank Credit Card.

IDFC Bank Credit Card 2024 Overview

| Apply Link | Apply Now |

| IDFC Credit Card Customer Care Number | 1800 10 888 |

| IDFC Credit Card Email Support | customer.care@idfcfirstbank.com |

| Official Website | Visit Here |

Releted Post

- How Do I Apply For an IndusInd Bank Credit Card

- Money View Personal Loan Apply Online 2024

- How To Apply For IDFC Firts Bank Credit Card in 2024 Step By Step Process

FAQ-

-

Is there a Joining/Membership fee for IDFC FIRST Bank Credit Cards?

No joining or membership fee is applicable on any of the IDFC FIRST Bank credit cards.

-

is there an expiry date on the reward points accrued on my card?

No, the reward points earned on your IDFC FIRST Bank Credit Card do not have an expiry date

-

What are the current offers available on IDFC FIRST

Bank credit cards?IDFC FIRST Bank Bank Credit Cards are loaded with a host of benefits, offers & features. Some of them are listed below and applicable according to the card variant available with you:

Lifestyle benefits: Discounts on shopping, dining & movies, complimentary round of golf every month, etc.

Travel benefits: Complimentary airport lounge access

Other benefits: Various online discounts on the app, discounts on health and wellness outlets, etc.