AU small finance bank credit card: Au Small Finance offers you many types of cards.Their benefits are also different. In this blog you will get Complete information about AU Small Finance Bank SwipeUp Credit Card. Which includes all the necessary documents, rewards interest rate and the process of applying for AU Small Finance Bank SwipeUp Credit Card.

Benefits of AU Small Finance Bank SwipeUp Credit Card

Zero membership fee, Higher reward points Value-added Features in comparison to your existing other bank credit card Higher credit limit, Higher cashbacks

Eligibility Criteria Salaried

- Age Group: 21 Years and above

- Income Range: ₹20,000+

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card or any other government-approved ID

- Income Proof: Salary certificate, Recent salary slip, Employment letter, etc.

Eligibility Criteria Self-employed

- Age Group: 25 years and above

- Income Range: You must have a regular source of income

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card or any other government-approved ID

- Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc.

Eligibility Criteria

- You must be an Indian resident

- You should have an existing other bank’s credit card

- Credit Score should be 720+

How to Apply For AU Small Bank Credit Card in 2024

01: Visit the AU Bank SwipeUp website by clicking on the link and start the application journey.

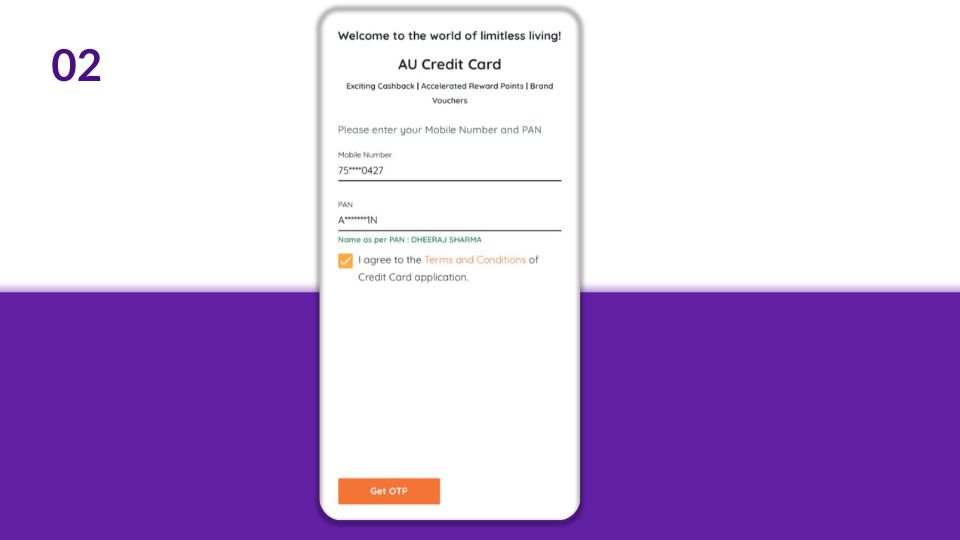

02: Enter your mobile number, PAN number, accept the terms & conditions and click on ‘Get OTP’ Enter the OTP sent to your mobile number and verify

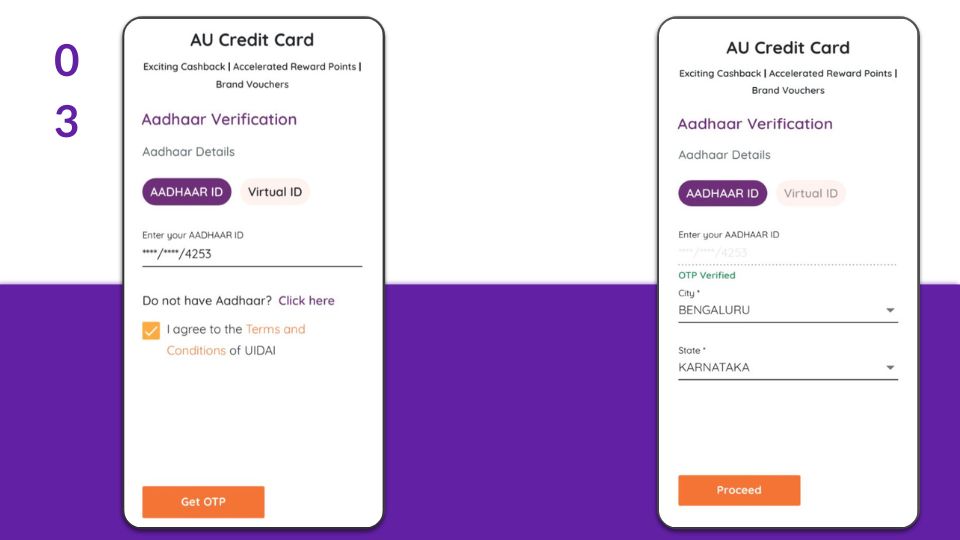

03: Enter the Aadhaar ID / Virtual ID, accept the terms & conditions and click on ‘Get OTP’ (image 1)

Enter the OTP sent to your Aadhaar-registered mobile number & verify. Enter your city, state and proceed (image 2)

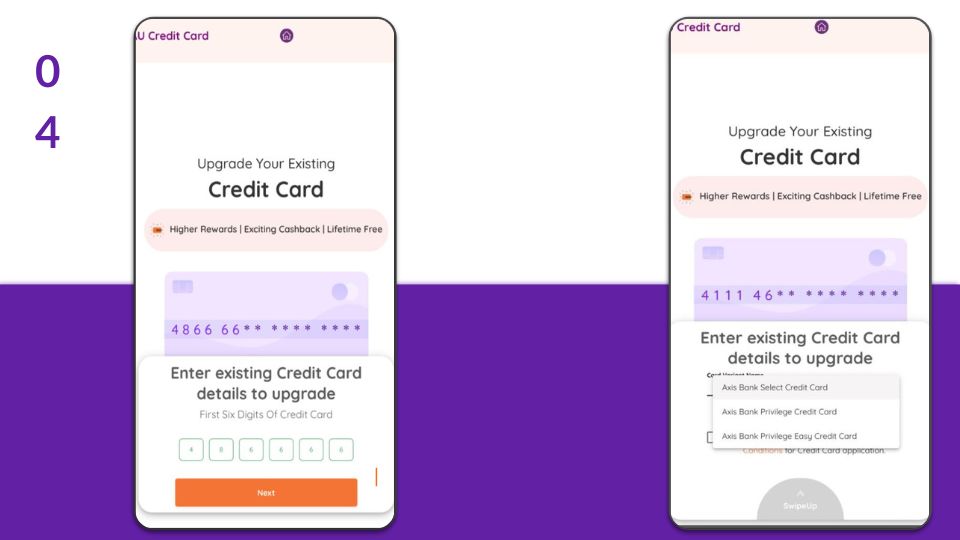

04: Enter the first 6 digits of your existing (other bank’s) credit card to upgrade, select the existing credit card bank name & click ‘Next’ (image 1)

AU Bank compares your existing credit card features and provides you with a variety of AU credit cards with higher reward points, cashbacks, credit limit and zero membership fee (image 2)

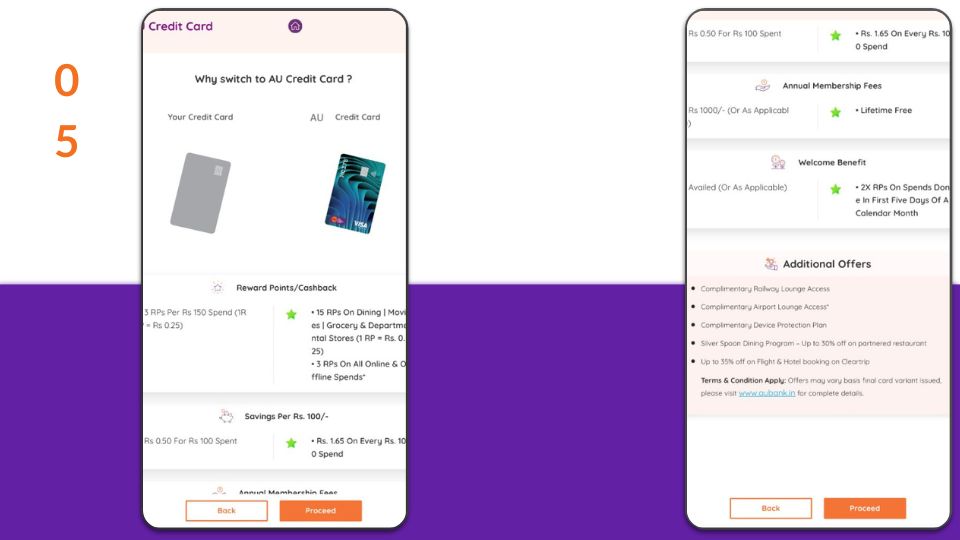

05: Select the credit card variant you would like to proceed with

Final Step : Upload the documents if required and complete the Video KYC Now the application has been successfully submitted and will be updated within 3 working days

AU Small Finance Bank Credit Card Overview 2024

| Apply Link | Apply Here |

| Helpline Number | 1800 26 66677 |

| Support Email | customercare@aubank.in |

| Official Website | Visit Here |

Conclusion : In 2024, getting an AU Small Finance Bank Credit Card is a seamless process with attractive benefits. The application can be done online or at branches, with a range of cards to choose from. Enjoy benefits like cashback, rewards, and exclusive offers. With competitive interest rates and robust customer support, AU Small Finance Bank Credit Cards are a valuable addition for managing finances effectively.

You May Interested

How To Apply For Free HSBC Credit Card In 2024

How To Apply For Kotak Mahindra Bank Credit Card in 2024

How To Get Axis Bank Credit Card in 2024

FAQ-

What is AU Small Finance Bank SwipeUp Platform?

SwipeUp platform is a unique offering of AU Small Finance Bank that offers an upgraded credit card to other bank credit card holders. Through this platform, you will get an assured upgraded AU Credit Card against other bank’s existing credit card matching your current upgraded lifestyle.

Why choose AU Small Finance Bank SwipeUp Platform?

When you choose AU Small Finance Bank SwipeUp Platform, you enjoy a card with more features & benefits like higher reward points and cashbacks, in addition to the higher credit limit offered by your existing credit card.

Why do I need to upgrade my credit card?

You need a credit card that offers benefits that best suit your current lifestyle needs. As you progress, your lifestyle needs to change and upgrading your credit card can continue to provide benefits that meet your evolving needs.

How can I connect with AU Small Finance Bank

SwipeUp credit card customer care?

If you have any queries, you can contact customer care 1800 26 66677