CASHe offers instant loans through its user-friendly mobile application in 2024. Borrowers can apply for loans up to ₹2 lakh with minimal documentation and no collateral. Enjoy quick approval and disbursal of funds directly into your bank account. CASHe’s competitive interest rates and flexible repayment options make it a convenient choice for meeting short-term financial needs.

Benefits of CASHE Instant Loan

- Loan Amount : 1000 to ₹4 lakh

- Tenure : From 90 days to 540 days

- Application Process : 100% Online No paperwork is required

- Interest Rates : 24% to 30% p.a.

Others

- One approval for multiple loans Loyalty rewards program

- Personalized loans

- 24*7 chat support

Eligibility Criteria Salaried

- Age Group: 21 – 55 years

- Income Range: ₹12,000+

Documents Required:

- Identity proof: Any one of the documents – PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Aadhaar card, passport, Voter ID Card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

Other Eligibility Criteria

- You must be a resident of India

- CIBIL score must be 575+

How to Apply For Loan in 2024

Please keep the following documents and details handy to start the process

- Your PAN card

- Aadhaar card and

- Last 3 months bank statement with salary credits

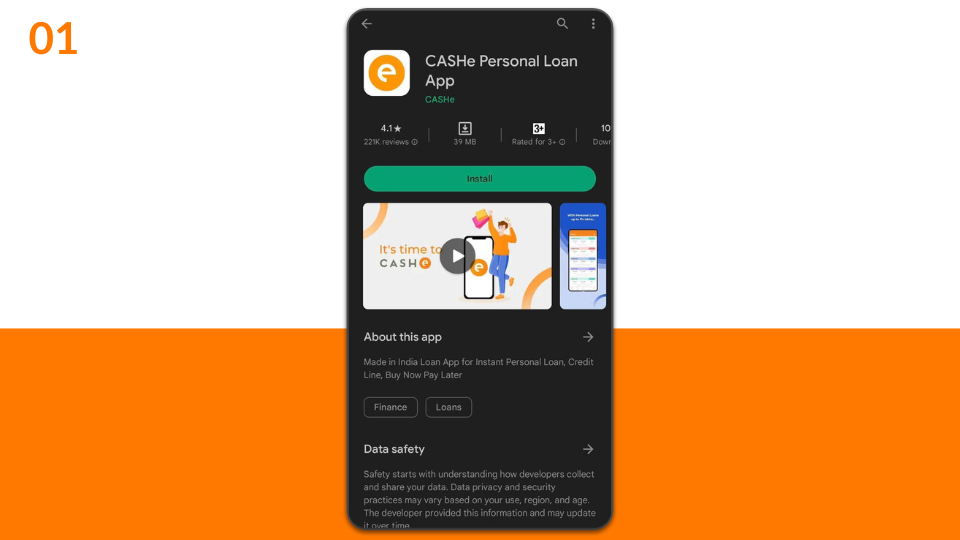

01. Let’s start!

Visit the CASHe app from the Google Play Store by clicking on the link and start the application journey

02: First part of the application is to sign up using your mobile number

- Click on ‘Apply Now’ and give all permissions to the app

- You can sign in with google/Facebook/LinkedIn

- Enter your mobile number and click on ‘Proceed’

- Enter the OTP sent to the mobile number and click on ‘Verify OTP’

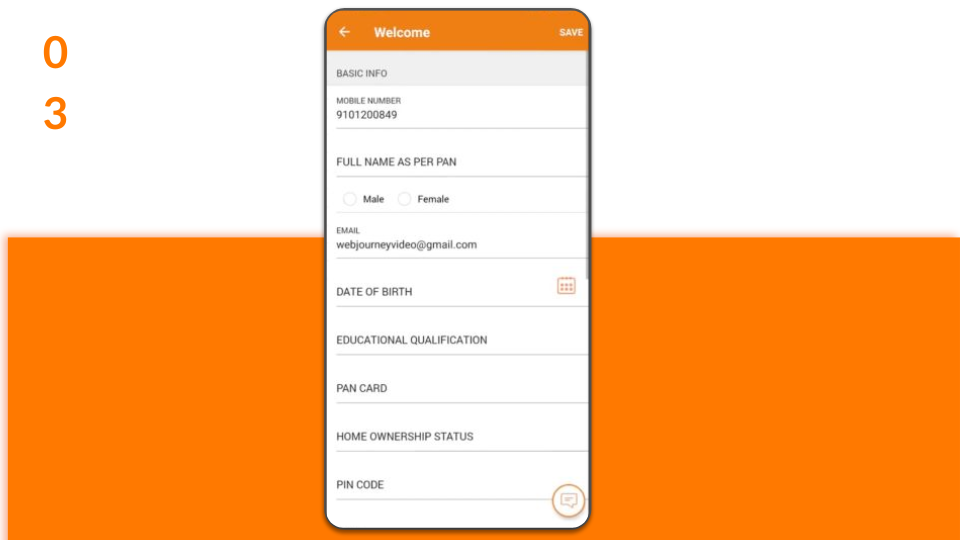

03: Completing your profile

- Enter basic details such as your full name as per PAN, gender, date of birth, etc.

- Enter professional details such as employment type, employer name, designation, etc., and click on ‘Save’

- Based on the information provided, the eligible loan amount will be displayed on the screen

- Answer the questions and set MPIN for the app and proceed

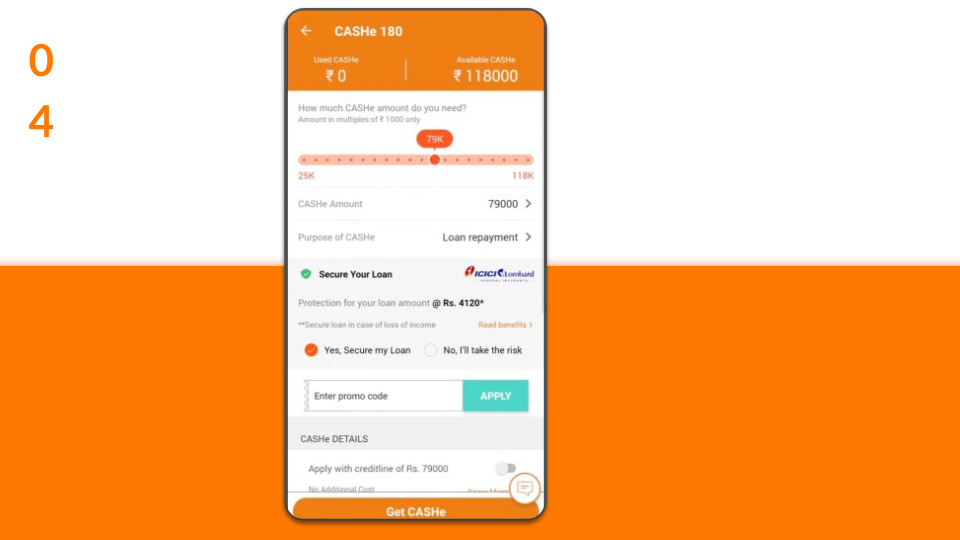

04: Choose your loan amount

- Enter your required loan amount and proceed

- Note: Fill all the pending details and complete your profile

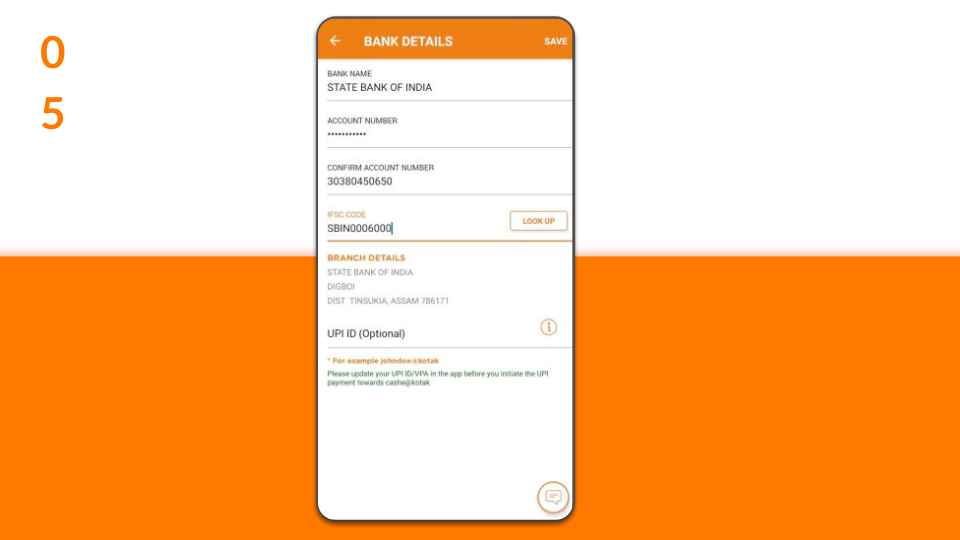

05: Add your bank account details

- Select your bank, enter your Account number, IFSC code and click on ‘Save’

- Upload and submit the required documents

- The best offer will be shown on the screen, click on ‘Get Loan’

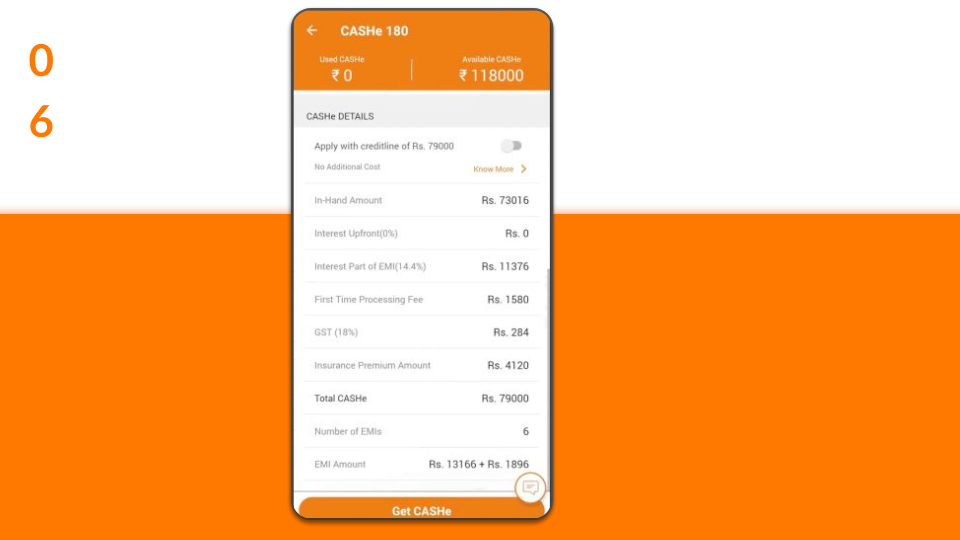

06: Set your credit limit

- Select any one as you wish and click ‘Apply Now’

- Select the loan amount, loan purpose and click on ‘Get CASHe’

- Enter all the required details, accept the terms & conditions and proceed

- Check and confirm the loan details

Best Loan Application in India Overview 2024

| Apply Link | Apply Here |

| Helpline Number | +91 80975 53191 |

| Support Email | support@cashe.co.in |

| Official Website | Visit Here |

You May Interested

- Nira Finance Instant Loan Apply Online 2024

- Fibe Loan App – Instant Loan Application in 2024

- Money View Personal Loan Apply Online 2024

FAQ-

What documents are required for applying for a Instant Loan from CASHe?

To get approved for credit with CASHe, upload your PAN card, latest salary slip, Aadhaar Card, and proof of permanent address (e.g., Passport/Driving Licence/Voter ID/Utility Bill). Also, provide your latest bank statement showing salary credits.

How fast will I get my loan?

Your loan is generally transferred instantly as soon as all your documents are verified. In order to process your loan quickly, we advise you to upload the necessary documents in the necessary formats and make sure they are clear and legible.

How do I repay the Loan availed from CASHe?

For repayments, CASHe accepts payments only through NEFT, IMPS, or UPI. Enter your CASHe CLN # as the account number and choose “Bhanix Finance and Investment Ltd” as the account name. Ensure the IFSC code is KKBK0000958. Contact support@cashe.co.in for further assistance or clarification.