Bajaj Finserv RBL Bank SuperCard is a very popular credit card in the country. Which provides its customers the facility to use money at the time of need. It has millions of users in the country. If you also want to apply for Bajaj Finserv RBL Bank SuperCard and want to get information related to it, then read the blog till the end.

| Joining fee | ₹999 (NIL on first year free card) |

| Annual fee | ₹999 + GST |

| Spend Based Waiver | ₹1,00,000 |

Benefits of Bajaj Finserv RBL Bank SuperCard

- Movies: 1+1 on BookMyShow on any day of the month

- Travel: 2 complimentary domestic lounge access in a year

- Rewards : 12 reward points per ₹100 spent online + spends made on Bajaj app & Get 1 reward point for every ₹100 you spend on your favourites

- Fuel : Fuel surcharge waiver of up to ₹100 per month

Others:

- 5% cashback on down payment made at any Bajaj Finance partner store

- Unlimited interest-free withdrawal of your available cash limit from all ATMs in India up to your billing date; maximum period of 50 Days

- Hassle-free conversion of shopping spends to easy EMIs. Minimum spend of ₹2,500

- Emergency cash advance (loan) at 1.16% PM up to 3 months

Eligibility Criteria Salaried

- Age Group: 21 – 60 years

- Income Range: ₹15,000+

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card

- Income Proof: Salary certificate, Recent salary slip, Employment letter

Eligibility Criteria Self-employed

- Age Group: 21 to 65 years

- Income Range: You must have a regular source of income

Documents Required:

Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence

Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card

Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet

You must be a resident of India & Credit Score should be 720+

Credit Card Application Process

Visit the Bajaj Finserv RBL Bank SuperCard website by clicking on the link and start the application journey. Keep the following details handy to start the process

●Your PAN card

●Aadhaar card and

●Bank account details

01: You need to apply using mobile number

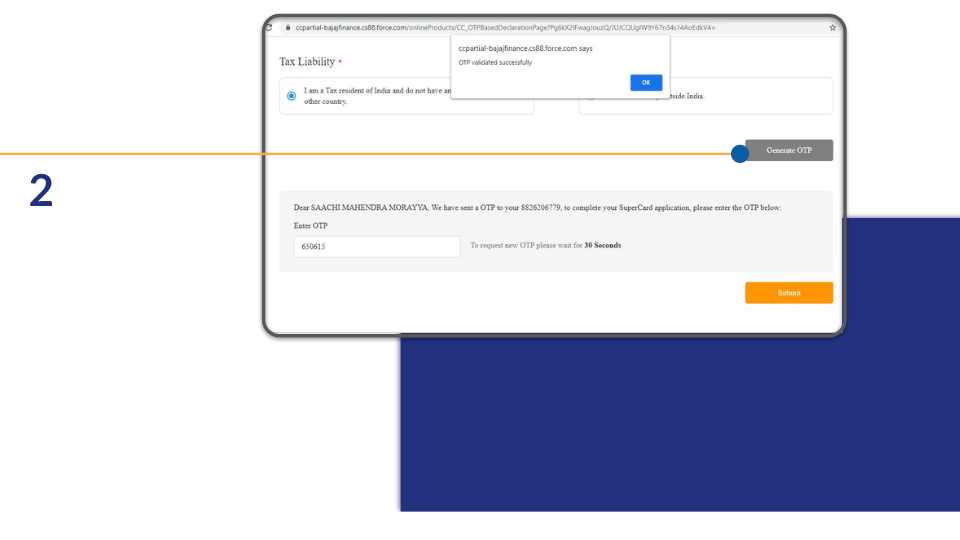

02: Confirm the tax liability status and click on ‘Generate OTP’

Enter the OTP sent to your mobile number and click on ‘Submit’

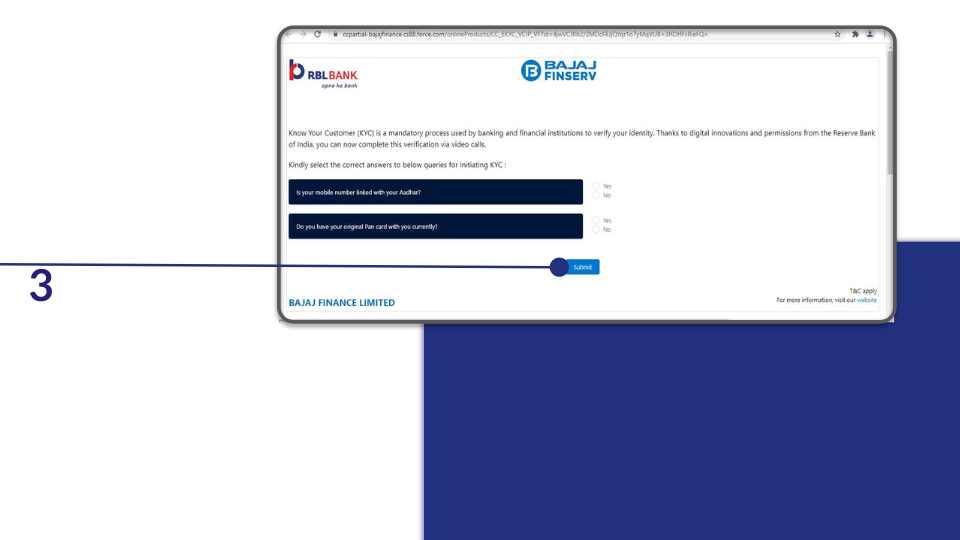

03: Answer a few questions to start the KYC process

Note: If your mobile number is not linked with Aadhaar, you need to go through biometric authentication

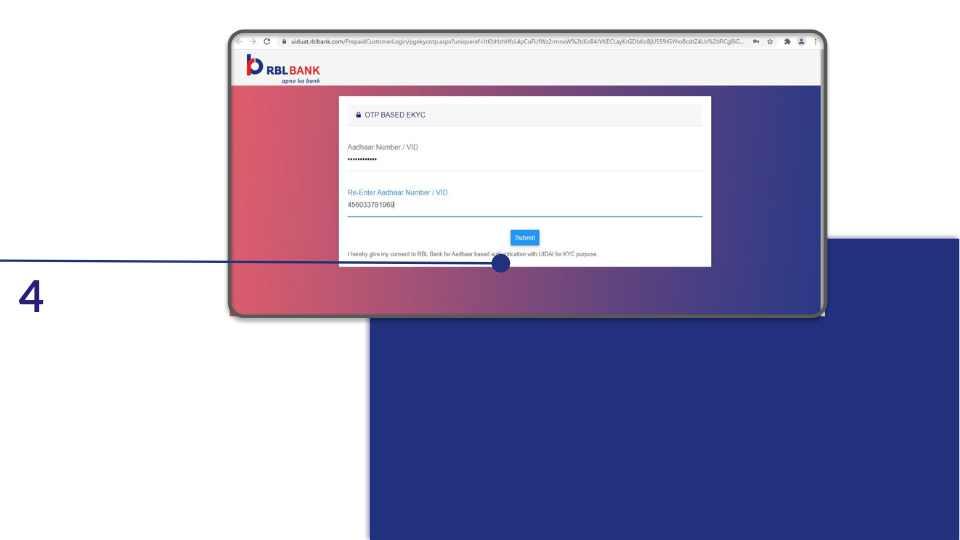

04: Enter your Aadhaar number or Virtual ID and click on ‘Submit’

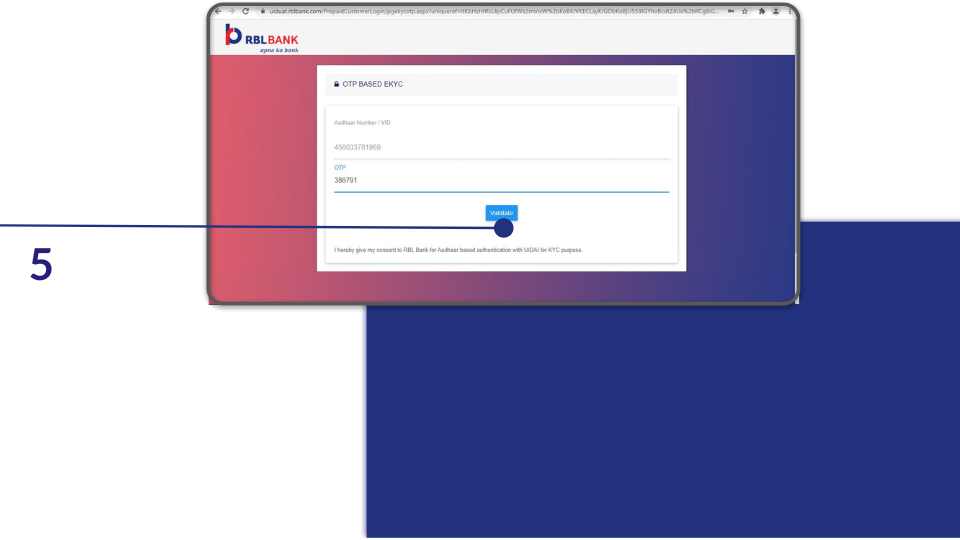

05: Enter the OTP sent to your registered mobile number and click on “Validate” to complete EKYC process

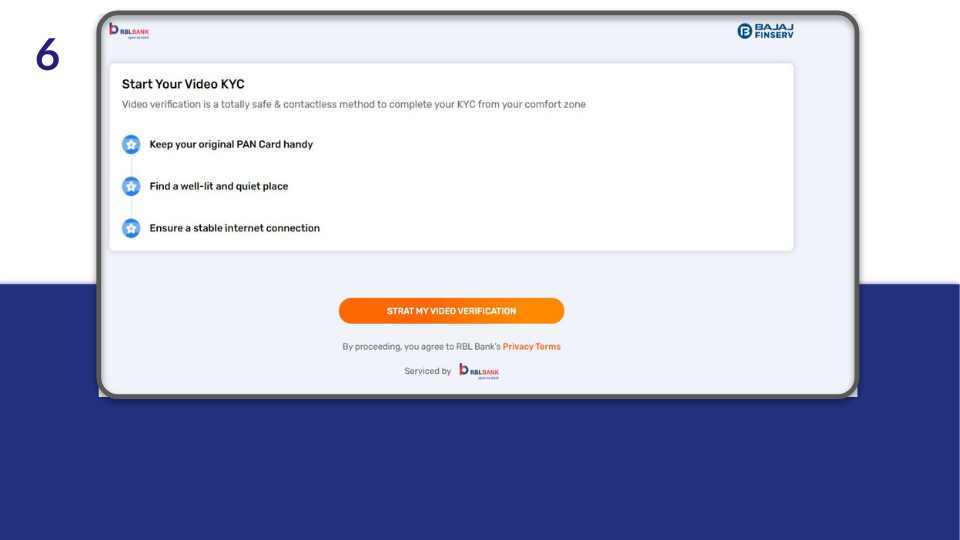

After successful completion of KYC, you will get video KYC link

06: Click on ‘Start My Video Verification’ and complete the Video KYC process

Bajaj Finserv RBL Bank SuperCard Overview 2024

| Apply Link | Apply Here |

| Bajaj Finserv RBL Bank SuperCard Helpline Number | 022 7119 0900 |

| Support Email | supercardservice@rblbank.com |

| Official Website | Visit |

Conclusion : In 2024, the Bajaj Finserv RBL Bank SuperCard application process offers a seamless and efficient experience for potential cardholders. Applicants can apply online or at a Bajaj Finserv branch, providing necessary documents such as identity proof, address proof, and income proof.

The SuperCard combines the features of a credit card and a loan, providing access to instant credit, EMIs, and rewards. With quick approval and flexible repayment options, including interest-free periods, the SuperCard is ideal for managing various expenses.

Related Posts –

- Get AU Small Finance Bank Credit Card In 2024

- How To Apply For Free HSBC Credit Card In 2024

- How To Apply For Kotak Mahindra Bank Credit Card in 2024

FAQ-

Where can I use my Bajaj Finserv RBL Bank SuperCard?

You can use your Bajaj Finserv RBL Bank SuperCard to shop online or offline. Apart from this, you can use it to withdraw cash from any ATM without paying interest for up to fifty days.

What happens if I only pay the minimum due amount?

Paying the minimum due amount on your credit card allows you to avoid a penalty charge on the card. However, the outstanding balance gets carried forward to next month’s bill, leaving you with a larger amount to pay off. It also attracts interest on the due amount.

How do I reach Bajaj Team to activate my Bajaj Finserv RBL Bank SuperCard or know more about my card?

WhatsApp Banking. Say ‘Hi RBL’ on 8433598888 from your registered mobile number.

Call at 022 7119 0900

Write at supercardservice@rblbank.com