To get an Axis Bank Credit Card in 2024, visit the Axis Bank website or branch to explore various card options. Complete the online application form with necessary details and submit the required documents, including ID proof, address proof, and income proof. Eligibility criteria include age, income, and credit score. Upon approval, your credit card will be dispatched to your address, providing access to a range of benefits and rewards.

Benefits of Axis Bank Credit Card

Shopping Benefits

- Free Amazon Voucher of ₹500 with Airtel Axis bank credit card

- Get Decathlon Voucher of ₹750 with Axis Aura credit card

- Free Amazon voucher of ₹2000 with Axis Select credit card

Travel Benefits

- Travel voucher worth ₹5000 with Axis Privilege credit card

- Complimentary flight tickets with Axis

- Vistara credit card

- 5X EDGE Miles on travel with Axis

- Atlas credit card

Dine-In Benefits

- 40% OFF on Swiggy with Axis MY Zone credit card

- Free Zomato Pro 3 month membership

- with Axis Neo credit card

- 4% Cashback on Swiggy & Zomato with

- Axis Ace credit card

Other Benefits OF Axis Bank Credit Card in 2024

- 100% online process, takes -5 mins Zero-interest EMIs

- Discount on movie tickets

- Waiver on fuel surcharges

- Access to airport lounges

- Discounts on hotel bookings & dine-in orders

Important Terms & Conditions

- Benefits, offers & discounts vary as per the card variant/type

- Credit limit varies as per your credit score

Axis Bank Credit Card Eligibility Criteria For Salaried

- Age Group: 18 to 70 years

- Income Range: ₹25,000+

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Salary certificate, Recent salary slip, Employment letter

Axis Bank Credit Card Eligibility Criteria For Self-employed

- Age Group: 18 to 70 years

- Income Range: You must have a regular source of income

Documents Required:

- Identity proof: Any one of the documents – Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID

- Address proof: Any one of the documents – Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet

Other Eligibility Criteria

- You must be an Indian resident

- Credit Score should be 720+

- You must be new to Axis Bank Credit Card

Application Process Of Axis Bank Credit Card

It’s really simple! You just need the following documents before you start:

- Your Aadhaar Card and PAN Card

- Latest Payslip/Bank statement/Form 16/IT

- return copy as proof of income

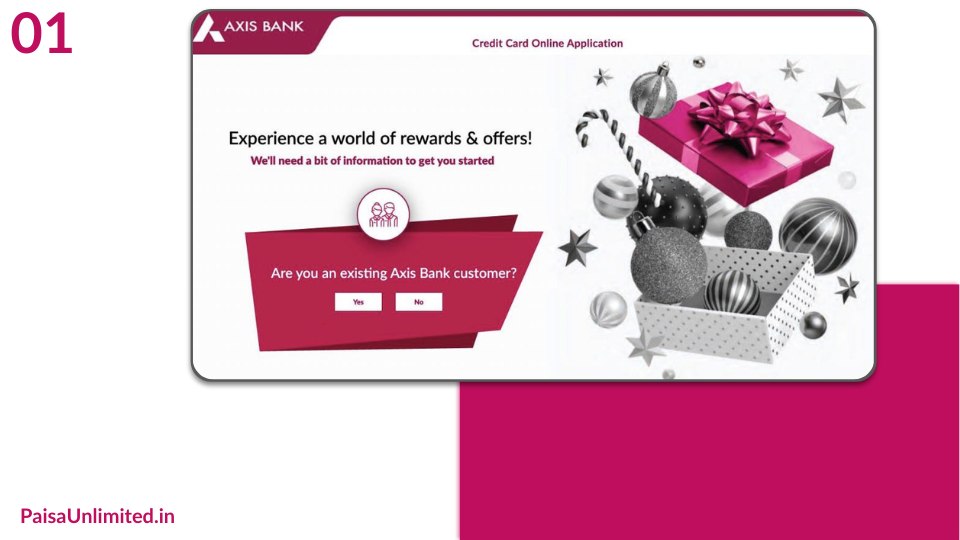

Step: 01 Start the application process by selecting whether you are an existing user of Axis Bank or a completely new user. Existing users are not eligible for the application.

Step: 02 Enter your mobile number, DOB/ PAN card and click ‘Next’

Step: 03 Verify your mobile number with the OTP and proceed

Step: 04 Enter your personal details such as your PAN number, name on the card, mother’s maiden name, etc., and proceed

Step: 05 Fill in your professional details and click ‘Next’

Step: 06 Select your card and click on ‘Submit’

Step : 07 Now your application is successfully submitted as your application ID is generated.

Which Credit Card is best in Axis Bank?

Axis Bank offers a variety of credit cards that suit a variety of individual needs and also offers cashback, rewards and discounts on select brands. However, the best card among these will be chosen according to your spending habits & patterns.

For example, if you are a Flipkart loyalist and want all-rounder benefits like dining and complimentary lounge access, the Axis Bank Flipkart Credit Card is a good choice. However, if you are looking for rewards that are limited to Flipkart, SuperCoins is the one to offer.

Additionally, you can get Axis Bank MyZone Credit Card if you are looking for entertainment benefits or Axis Bank Ace Credit Card if you want a credit card with direct cashback benefits.

Additionally, if you want a card with all-rounder fuel benefits then you can get the Indian Oil Axis Bank Credit Card and if you are looking for a travel credit card the Axis Bank & Vistara co-branded credit cards.

Note: Some users will receive a vKYC link in the application that is active for 72 hours. Remaining users will receive a call from an Axis Bank executive for an offline meet and verification of details along with documentation if required.

Axis Bank Credit Card Overview 2024

| Apply Link | Apply Now |

| Axis Bank Credit Card Help Line Number | 800 – 103- 5577 (toll Free) |

| Axis Bank Credit Card Email Support | pno@axisbank.com |

| Official Website | Axis Bank |

Releted Post

- How Do I Apply For an IndusInd Bank Credit Card

- Money View Personal Loan Apply Online 2024

- How To Apply For IDFC Firts Bank Credit Card in 2024 Step By Step Process

Help & Support FAQs

What is Axis Credit Card limit?

Axis Bank Credit Cards come along with a credit limit and cash withdrawal limit. While the credit limit depends on various factors such as credit score, debt-to-income ratio, other credit cards issued in your name and your income, the cash limit offered on Axis cards is usually 20-40% of your credit limit.

Interest Rate of Axis Bank Credit Card ?

3.60% per month